In probability theory, Novikov's condition is the sufficient condition for a stochastic process which takes the form of the Radon–Nikodym derivative in Girsanov's theorem to be a martingale. If satisfied together with other conditions, Girsanov's theorem may be applied to a Brownian motion stochastic process to change from the original measure to the new measure defined by the Radon–Nikodym derivative.

Probability theory is the branch of mathematics concerned with probability. Although there are several different probability interpretations, probability theory treats the concept in a rigorous mathematical manner by expressing it through a set of axioms. Typically these axioms formalise probability in terms of a probability space, which assigns a measure taking values between 0 and 1, termed the probability measure, to a set of outcomes called the sample space. Any specified subset of these outcomes is called an event.

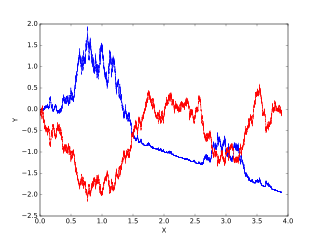

In probability theory and related fields, a stochastic or random process is a mathematical object usually defined as a collection of random variables. Historically, the random variables were associated with or indexed by a set of numbers, usually viewed as points in time, giving the interpretation of a stochastic process representing numerical values of some system randomly changing over time, such as the growth of a bacterial population, an electrical current fluctuating due to thermal noise, or the movement of a gas molecule. Stochastic processes are widely used as mathematical models of systems and phenomena that appear to vary in a random manner. They have applications in many disciplines including sciences such as biology, chemistry, ecology, neuroscience, and physics as well as technology and engineering fields such as image processing, signal processing, information theory, computer science, cryptography and telecommunications. Furthermore, seemingly random changes in financial markets have motivated the extensive use of stochastic processes in finance.

In probability theory, a martingale is a sequence of random variables for which, at a particular time, the conditional expectation of the next value in the sequence, given all prior values, is equal to the present value.

This condition was suggested and proved by Alexander Novikov. There are other results which may be used to show that the Radon–Nikodym derivative is a martingale, such as the more general criterion Kazamaki's condition, however Novikov's condition is the most well-known result.

Alexander Novikov is a professor of mathematics at the Department of Mathematical Sciences, University of Technology Sydney.

In mathematics Kazamaki's condition gives a sufficient criterion ensuring that the Doléans-Dade exponential of a local martingale is a true martingale. This is particularly important if Girsanov's theorem is to be applied to perform a change of measure. Kazamaki's condition is more general than Novikov's condition.

Assume that is a real valued adapted process on the probability space and is an adapted Brownian motion: [1] :334

Brownian motion or pedesis is the random motion of particles suspended in a fluid resulting from their collision with the fast-moving molecules in the fluid.

If the condition

is fulfilled then the process

is a martingale under the probability measure and the filtration . Here denotes the Doléans-Dade exponential.

In mathematics, a filtration is an indexed set of subobjects of a given algebraic structure , with the index running over some index set that is a totally ordered set, subject to the condition that

In stochastic calculus, the Doléans-Dade exponential, Doléans exponential, or stochastic exponential, of a semimartingale X is defined to be the solution to the stochastic differential equation dYt = Yt dXt with initial condition Y0 = 1. The concept is named after Catherine Doléans-Dade. It is sometimes denoted by Ɛ(X). In the case where X is differentiable, then Y is given by the differential equation dY/dt = Y dX/dt to which the solution is Y = exp(X − X0). Alternatively, if Xt = σBt + μt for a Brownian motion B, then the Doléans-Dade exponential is a geometric Brownian motion. For any continuous semimartingale X, applying Itō's lemma with ƒ(Y) = log(Y) gives