Related Research Articles

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a period of time, often annually. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore using a basis of GDP per capita at purchasing power parity (PPP) is arguably more useful when comparing differences in living standards between nations.

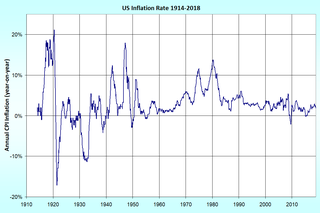

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. The measure of inflation is the inflation rate, the annualized percentage change in a general price index, usually the consumer price index, over time. The opposite of inflation is deflation.

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted national income also called as NNI at factor cost. All are specially concerned with counting the total amount of goods and services produced within the economy and by different sectors. The boundary is usually defined by geography or citizenship, and it is also defined as the total income of the nation and also restrict the goods and services that are counted. For instance, some measures count only goods & services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by imputing monetary values to them.

Purchasing power parity (PPP) is a way of measuring economic variables in different countries so that irrelevant exchange rate variations do not distort comparisons. Purchasing power exchange rates are such that it would cost exactly the same number of, for example, US dollars to buy euros and then buy a basket of goods in the market as it would cost to purchase the same goods directly with dollars. The purchasing power exchange rate used in this conversion equals the ratio of the currencies' respective purchasing powers.

This aims to be a complete article list of economics topics:

Purchasing power is the amount of goods and services that can be purchased with a unit of currency. For example, if one had taken one unit of currency to a store in the 1950s, it would have been possible to buy a greater number of items than would be the case today, indicating that the currency had a greater purchasing power in the 1950s. Currency can be either a commodity money, like gold or silver, or fiat money emitted by government sanctioned agencies.

A Consumer Price Index measures changes in the price level of market basket of consumer goods and services purchased by households.

In economics, the GDP deflator is a measure of the level of prices of all new, domestically produced, final goods and services in an economy in a year. GDP stands for gross domestic product, the total monetary value of all final goods and services produced within the territory of a country over a particular period of time.

In economics, a real value, of a good or other entity, is one which has been adjusted for inflation, enabling comparison of quantities as if prices had not changed. Changes in real terms therefore exclude the effect of inflation. In contrast with a real value, a nominal value has not been adjusted for inflation, and so changes in nominal value reflect at least in part the effect of inflation. Suppose, the nominal value of a pen is Rs 5, which has been changed to Rs 6, then the effect is less as compared to the inflated price.

In business, the difference between the sale price and the production cost of a product is the unit profit. In economics, the sum of the unit profit, the unit depreciation cost, and the unit labor cost is the unit value added. Summing value added per unit over all units sold is total value added. Total value added is equivalent to revenue less intermediate consumption. Value added is a higher portion of revenue for integrated companies, e.g., manufacturing companies, and a lower portion of revenue for less integrated companies, e.g., retail companies. Total value added is very closely approximated by compensation of employees plus earnings before taxes. The first component is a return to labor and the second component is a return to capital. In national accounts used in macroeconomics, it refers to the contribution of the factors of production, i.e., capital and labor, to raising the value of a product and corresponds to the incomes received by the owners of these factors. The national value added is shared between capital and labor, and this sharing gives rise to issues of distribution.

The personal consumption expenditure (PCE) measure is the component statistic for consumption in gross domestic product (GDP) collected by the United States Bureau of Economic Analysis (BEA). It consists of the actual and imputed expenditures of households and includes data pertaining to durable and non-durable goods and services. It is essentially a measure of goods and services targeted towards individuals and consumed by individuals.

In economics and finance, an index is a statistical measure of changes in a representative group of individual data points. These data may be derived from any number of sources, including company performance, prices, productivity, and employment. Economic indices track economic health from different perspectives. Influential global financial indices such as the Global Dow, and the NASDAQ Composite track the performance of selected large and powerful companies in order to evaluate and predict economic trends. The Dow Jones Industrial Average and the S&P 500 primarily track U.S. markets, though some legacy international companies are included. The consumer price index tracks the variation in prices for different consumer goods and services over time in a constant geographical location, and is integral to calculations used to adjust salaries, bond interest rates, and tax thresholds for inflation. The GDP Deflator Index, or real GDP, measures the level of prices of all new, domestically produced, final goods and services in an economy. Market performance indices include the labour market index/job index and proprietary stock market index investment instruments offered by brokerage houses.

Operating surplus is an accounting concept used in national accounts statistics and in corporate and government accounts. It is the balancing item of the Generation of Income Account in the UNSNA. It may be used in macro-economics as a proxy for total pre-tax profit income, although entrepreneurial income may provide a better measure of business profits. According to the 2008 SNA, it is the measure of the surplus accruing from production before deducting property income, e.g., land rent and interest.

Capitalization rate is a real estate valuation measure used to compare different real estate investments. Although there are many variations, a cap rate is often calculated as the ratio between the net operating income produced by an asset and the original capital cost or alternatively its current market value.

The United States Consumer Price Index (CPI) is a set of consumer price indices calculated by the U.S. Bureau of Labor Statistics (BLS). To be precise, the BLS routinely computes many different CPIs that are used for different purposes. Each is a time series measure of the price of consumer goods and services. The BLS publishes the CPI monthly.

A house price index (HPI) measures the price changes of residential housing as a percentage change from some specific start date. Methodologies commonly used to calculate a HPI are the hedonic regression (HR), simple moving average (SMA) and repeat-sales regression (RSR).

The Swiss Performance Index (SPI) is Switzerland's most closely followed performance index. It is a dividend-corrected index that includes almost all SIX Swiss Exchange-traded equity securities of companies domiciled in Switzerland or the Principality of Liechtenstein.

Production is a process of combining various material inputs and immaterial inputs in order to make something for consumption. It is the act of creating an output, a good or service which has value and contributes to the utility of individuals.

Productivity in economics is the ratio of what is produced to what is used in producing it. Productivity is the measure on production efficiency. A productivity model is a measurement method which is used in practice for measuring productivity. A productivity model must be able to compute Output / Input when there are many different outputs and inputs.

The prices received index is an index that measures changes in the prices received for crops and livestock. The National Agricultural Statistics Service currently publishes the index on a 1990-92 = 100 base. A ratio of the prices received index to the prices paid index on the 1990-92 base that is greater than 100% indicates that farm commodity prices have increased at a faster rate than farm input prices. When the ratio is less than 100%, farm input prices are increasing a more rapid pace than farm commodity prices. The prices received index and the prices paid index are used to calculate the parity ratio.

References

The Congressional Research Service (CRS), known as Congress's think tank, is a public policy research arm of the United States Congress. As a legislative branch agency within the Library of Congress, CRS works primarily and directly for Members of Congress, their Committees and staff on a confidential, nonpartisan basis.