This article may rely excessively on sources too closely associated with the subject, potentially preventing the article from being verifiable and neutral.(April 2015) (Learn how and when to remove this template message) |

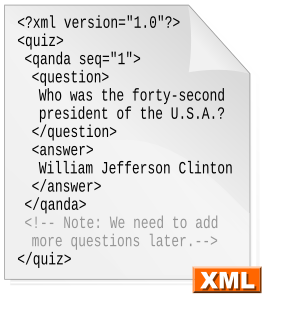

Transaction Workflow Innovation Standards Team (Twist) is a not-for-profit industry standards group. It does not charge anything for involvement. The main goal of Twist is to create non-proprietary XML message standards for the financial services industry. To this end it provides a message format validation service.

In computer science, data validation is the process of ensuring data have undergone data cleansing to ensure they have data quality, that is, that they are both correct and useful. It uses routines, often called "validation rules" "validation constraints" or "check routines", that check for correctness, meaningfulness, and security of data that are input to the system. The rules may be implemented through the automated facilities of a data dictionary, or by the inclusion of explicit application program validation logic.

Contents

Its focus on financial transaction processing covers the aspects of:

- Payments and collections (on invoices to suppliers and from customers)

- Cash management (cash flow, position keeping across accounts and timing)

- Working capital finance (short term investment of spare cash to make gains)

- Wholesale financial market access (raising capital through stocks and bonds)

A market is one of the many varieties of systems, institutions, procedures, social relations and infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services in exchange for money from buyers. It can be said that a market is the process by which the prices of goods and services are established. Markets facilitate trade and enable the distribution and resource allocation in a society. Markets allow any trade-able item to be evaluated and priced. A market emerges more or less spontaneously or may be constructed deliberately by human interaction in order to enable the exchange of rights of services and goods. Markets generally supplant gift economies and are often held in place through rules and customs, such as a booth fee, competitive pricing, and source of goods for sale.

The focus of these combined standards is to create and improve straight-through processing (STP). As any STP system of systems will invariably involve many market participants such standards are essential for success. Twist provides a check-list for ensuring STP is implemented in accordance with its standards. The word ‘standards’ is used rather than protocols as Twist endeavours to also define business process best practices. Such practices are typically implemented in a workflow, or business process management system (BPMS). Considerable emphasis is placed on how to handle exceptions so that as much traffic can be handled automatically with as little as possible going to manual intervention. One major standard introduced by TWIST is the Bank Services Billing Standard (BSB).

Straight-through processing (STP) is a method used by financial companies to speed up the transaction process and allow the transaction to be processed without manual intervention (straight-through).

Business process management (BPM) is a discipline in operations management in which people use various methods to discover, model, analyze, measure, improve, optimize, and automate business processes. BPM focuses on improving corporate performance by managing business processes. Any combination of methods used to manage a company's business processes is BPM. Processes can be structured and repeatable or unstructured and variable. Though not required, enabling technologies are often used with BPM.

Large multinational corporations want to streamline their banking practices. To do this, they need all of their bank billing electronically, and in a common format.