Employment is a relationship between two parties, usually based on a contract where work is paid for, where one party, which may be a corporation, for profit, not-for-profit organization, co-operative or other entity is the employer and the other is the employee. Employees work in return for payment, which may be in the form of an hourly wage, by piecework or an annual salary, depending on the type of work an employee does or which sector she or he is working in. Employees in some fields or sectors may receive gratuities, bonus payment or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits can include health insurance, housing, disability insurance or use of a gym. Employment is typically governed by employment laws, regulations or legal contracts.

The H-1B is a visa in the United States under the Immigration and Nationality Act, section 101(a)(15)(H) that allows U.S. employers to temporarily employ foreign workers in specialty occupations. A specialty occupation requires the application of specialized knowledge and a bachelor's degree or the equivalent of work experience. Laws limit the number of H-1B visas that are issued each year.

A salary is a form of payment from an employer to an employee, which may be specified in an employment contract. It is contrasted with piece wages, where each job, hour or other unit is paid separately, rather than on a periodic basis. From the point of view of running a business, salary can also be viewed as the cost of acquiring and retaining human resources for running operations, and is then termed personnel expense or salary expense. In accounting, salaries are recorded in payroll accounts.

The National Minimum Wage Act 1998 creates a minimum wage across the United Kingdom, which from 1 April 2018 was £7.83 per hour for workers aged over 25, £7.38 per hour for workers aged 21 to 24, and £5.90 per hour for workers aged 18 to 20.

An H-2A visa allows a foreign national entry into the United States for temporary or seasonal agricultural work. There are several requirements of the employer in regard to this visa. The H-2A temporary agricultural program establishes a means for agricultural employers who anticipate a shortage of domestic workers to bring non-immigrant foreign workers to the U.S. to perform agricultural labor or services of a temporary or seasonal nature. In 2015 there were approximately 140,000 total temporary agricultural workers under this visa program. Terms of work can be as short as a month or two or as long as 10 months in most cases, although there are some special procedures that allow workers to stay longer than 10 months. All of these workers are covered by U.S. wage laws, workers' compensation and other standards; additionally, temporary workers and their employers are subject to the employer and/or individual mandates under the Affordable Care Act. Because of concern that guest workers might be unfairly exploited the U.S. Department of Labor Wage and Hour Division is especially vigilant in auditing and inspecting H-2A employers. H-2A employers are the only group of employers who are required to pay inbound and outbound transportation, free housing, and provide meals for their workers. H-2A agricultural employers are among the most heavily regulated and monitored employers in the United States. Unlike other guest worker programs, there is no cap on the number of H-2A visas allocated each year.

A guest worker program allows foreign workers to temporarily reside and work in a host country until a next round of workers is readily available to switch. Guest workers typically perform low or semi-skilled agricultural, industrial, or domestic labor in countries with workforce shortages, and they return home once their contract has expired.

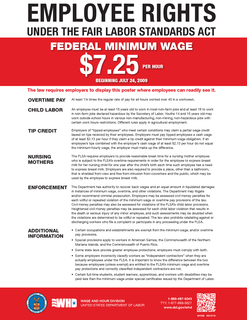

The minimum wage in the United States is set by US labor law and a range of state and local laws. Employers generally have to pay workers the highest minimum wage prescribed by federal, state, and local law. Since July 24, 2009, the federal government has mandated a nationwide minimum wage of $7.25 per hour. As of January 2018, there were 29 states with a minimum wage higher than the federal minimum. From 2017 to 2018, eight states increased their minimum wage levels through automatic adjustments, while increases in eleven other states occurred through referendum or legislative action.

The Fair Labor Standards Act of 1938 29 U.S.C. § 203 (FLSA) is a United States labor law that creates the right to a minimum wage, and "time-and-a-half" overtime pay when people work over forty hours a week. It also prohibits most employment of minors in "oppressive child labor". It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the production of goods for commerce, unless the employer can claim an exemption from coverage.

The Wage and Hour Division (WHD) of the United States Department of Labor is the federal office responsible for enforcing federal labor laws. The Division was formed with the enactment of the Fair Labor Standards Act of 1938. The Wage and Hour mission is to promote and achieve compliance with labor standards to protect and enhance the welfare of the Nation's workforce. WHD protects over 144 million workers in more than 9.8 million establishments throughout the United States and its territories. The Wage and Hour Division enforces over 13 laws, most notably the Fair Labor Standards Act and the Family Medical Leave Act. In FY18, WHD recovered $304,000,000 in back wages for over 240,000 workers.

The H-2B visa nonimmigrant program permits employers to hire foreign workers to come temporarily to the United States and perform temporary nonagricultural services or labor on a one-time, seasonal, peakload or intermittent basis.

The companionship exemption refers to federal labor regulations in the United States that exclude workers providing companionship services to the elderly or disabled from the federal minimum wage and overtime protections that apply to most other American workers.

The Labor policy in the Philippines is specified mainly by the country’s Labor Code of the Philippines and through other labor laws. They cover 38 million Filipinos who belong to the labor force and to some extent, as well as overseas workers. They aim to address Filipino workers’ legal rights and their limitations with regard to the hiring process, working conditions, benefits, policymaking on labor within the company, activities, and relations with employees.

Wage theft is the denial of wages or employee benefits rightfully owed an employee. It can be conducted by employers in various ways, among them failing to pay overtime; violating minimum-wage laws; the misclassification of employees as independent contractors, illegal deductions in pay; forcing employees to work "off the clock", or simply not paying an employee at all.

The tipped wage is base wage paid to an employee that receives a substantial portion of their compensation from tips. According to a common labor law provision referred to as a "tip credit", the employee must earn at least the state’s minimum wage when tips and wages are combined or the employer is required to increase the wage to fulfill that threshold. This ensures that all tipped employees earn at least the minimum wage: significantly more than the tipped minimum wage.

The Labor Condition Application (LCA) is an application filed by prospective employers on behalf of workers applying for work authorization for the non-immigrant statuses H-1B, H-1B1 and E-3. The application is submitted to and needs to be approved by the United States Department of Labor Employment and Training Administration (DOLETA)'s Office of Foreign Labor Certification (OFLC). The form used to submit the application is ETA Form 9035.

The American Competitiveness and Workforce Improvement Act (ACWIA) was an act passed by the government of the United States on October 21, 1998, pertaining to high-skilled immigration to the United States, particularly immigration through the H-1B visa, and helping improving the capabilities of the domestic workforce in the United States to reduce the need for foreign labor.

The term H-1B-dependent employer is used by the United States Department of Labor to describe an employer who meets a particular threshold in terms of the fraction of the workforce comprising workers in H-1B status. An employer classified as H-1B-dependent needs to include additional attestations in the Labor Condition Application used for the petition of any H-1B beneficiary being offered an annual compensation of less than $60,000 and without a master's degree. The notion was introduced by the American Competitiveness and Workforce Improvement Act (ACWIA) passed in 1998 and operationalized through the United States Department of Labor's Interim Final H-1B Rule of December 20, 2000. The regulation is found in 20 CFR 655.736 in the Code of Federal Regulations.

A public access file is a file that needs to be maintained by any United States employer hiring people in H-1B, H-1B1, or E-3 temporary nonimmigrant worker statuses. It is intended to include more background information related to the attestations made on the Labor Condition Application used for the Form I-129 and/or visa application that was used to acquire the nonimmigrant worker status. The file may be requested by any member of the public through telephone or email inquiries, that should be responded to within 3 business days. It is distinguished from a private access file that contains more sensitive and confidential employee data that must be shared with the U.S. Department of Labor if they choose to investigate. Regulations governing the public access file can be found in the Code of Federal Regulations, Title 20, or more specifically, in 20 CFR 655.760.

The H-1A visa was a visa that was previously available to foreign nationals seeking temporary employment in the United States. These visas were made available to foreign nurses coming into the United States to perform services as a registered nurse in areas with a shortage of health professionals as determined by the Department of Labor. The creation of this visa was prompted by the nursing shortage.