The Secretary of the Treasury is the head of the United States Department of the Treasury which is concerned with financial and monetary matters, and, until 2003, also included several federal law enforcement agencies. This position in the federal government of the United States is analogous to the Minister of Finance in many other countries. The Secretary of the Treasury is a member of the President's Cabinet, and is nominated by the President of the United States. Nominees for Secretary of the Treasury undergo a confirmation hearing before the United States Senate Committee on Finance before being voted on by the United States Senate.

The Department of the Treasury (USDT) is an executive department and the treasury of the United States federal government. Established by an Act of Congress in 1789 to manage government revenue, the Treasury prints all paper currency and mints all coins in circulation through the Bureau of Engraving and Printing and the United States Mint, respectively; collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy.

The National Banking Acts of 1863 and 1864 were two United States federal banking acts that established a system of national banks, and created the United States National Banking System. They encouraged development of a national currency backed by bank holdings of U.S. Treasury securities and established the Office of the Comptroller of the Currency as part of the United States Department of the Treasury and a system of nationally chartered banks. The Act shaped today's national banking system and its support of a uniform U.S. banking policy.

The Federal Reserve Act is an Act of Congress that created the Federal Reserve System, and which created the authority to issue Federal Reserve Notes as legal tender. The Act was signed into law by President Woodrow Wilson.

Monetary policy concerns the actions of a central bank or other regulatory authorities that determine the size and rate of growth of the money supply. For example, in the United States, the Federal Reserve is in charge of monetary policy, and implements it primarily by performing operations that influence short-term interest rates.

The Glass–Steagall legislation describes four provisions of the United States Banking Act of 1933 separating commercial and investment banking. The article 1933 Banking Act describes the entire law, including the legislative history of the provisions covered here.

Banking in the United States began in the late 1790s along with the country's founding and has developed into highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services namely private banking, asset management, and deposit security.

Her Majesty's Treasury, sometimes referred to as the Exchequer, or more informally the Treasury, is the British government department responsible for developing and executing the government's public finance policy and economic policy. The Treasury maintains the Online System for Central Accounting and Reporting (OSCAR), the replacement for the Combined Online Information System (COINS), which itemises departmental spending under thousands of category headings, and from which the Whole of Government Accounts (WGA) annual financial statements are produced.

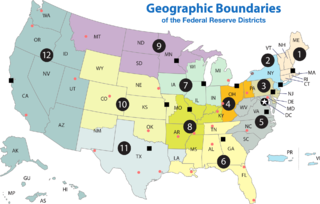

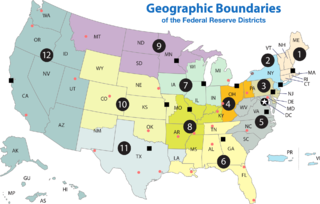

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows:

Federal Reserve Notes, also United States banknotes or U.S. banknotes, are the banknotes currently used in the United States of America. Denominated in United States dollars, Federal Reserve Notes are printed by the United States Bureau of Engraving and Printing on paper made by Crane & Co. of Dalton, Massachusetts. Federal Reserve Notes are the only type of U.S. banknote currently produced. Federal Reserve Notes are authorized by Section 16 of the Federal Reserve Act of 1913 and are issued to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The notes are then put into circulation by the Federal Reserve Banks, at which point they become liabilities of the Federal Reserve Banks and obligations of the United States.

As money became a commodity, the money market became a component of the financial market for assets involved in short-term borrowing, lending, buying and selling with original maturities of one year or less. Trading in money markets is done over the counter and is wholesale.

In banking, the term national bank carries several meanings:

The Australian pound was the currency of Australia from 1910 until 14 February 1966, when it was replaced by the Australian dollar. As with other £sd currencies, it was subdivided into 20 shillings, each of 12 pence.

The Office of the Comptroller of the Currency (OCC) is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to charter, regulate, and supervise all national banks and thrift institutions and the federally licensed branches and agencies of foreign banks in the United States. The Comptroller of the Currency is Joseph Otting.

This history of central banking in the United States encompasses various bank regulations, from early "wildcat" practices through the present Federal Reserve System.

The main elements of Japan's financial system are much the same as those of other major industrialized nations: a commercial banking system, which accepts deposits, extends loans to businesses, and deals in foreign exchange; specialized government-owned financial institutions, which fund various sectors of the domestic economy; securities companies, which provide brokerage services, underwrite corporate and government securities, and deal in securities markets; capital markets, which offer the means to finance public and private debt and to sell residual corporate ownership; and money markets, which offer banks a source of liquidity and provide the Bank of Japan with a tool to implement monetary policy.

This article is about the history of the United States Federal Reserve System from its creation to the present.

This article details the history of banking in the United States. Banking in the United States is regulated by both the federal and state governments.