Related Research Articles

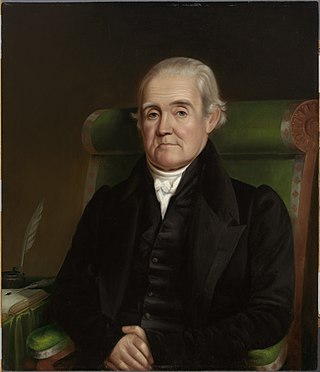

Noah Webster was an American lexicographer, textbook pioneer, English-language spelling reformer, political writer,editor, and author. He has been called the "Father of American Scholarship and Education". His "Blue-Backed Speller" books taught generations of American children how to spell and read. Webster's name has become synonymous with "dictionary" in the United States, especially the modern Merriam-Webster dictionary that was first published in 1828 as An American Dictionary of the English Language.

A dozen is a grouping of twelve.

A lien is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation. The owner of the property, who grants the lien, is referred to as the lienee and the person who has the benefit of the lien is referred to as the lienor or lien holder.

Casualty insurance is a defined term which broadly encompasses insurance not directly concerned with life insurance, health insurance, or property insurance.

Title insurance is a form of indemnity insurance, predominantly found in the United States and Canada, that insures against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans. Unlike some land registration systems in countries outside the United States, US states' recorders of deeds generally do not guarantee indefeasible title to those recorded titles. Title insurance will defend against a lawsuit attacking the title or reimburse the insured for the actual monetary loss incurred up to the dollar amount of insurance provided by the policy.

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

Home insurance, also commonly called homeowner's insurance, is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insurance protections, which can include losses occurring to one's home, its contents, loss of use, or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory.

A duvet, usually called a comforter or (down-filled) quilt in American English, and a doona in Australian English, is a type of bedding consisting of a soft flat bag filled with either down, feathers, wool, cotton, silk, or a synthetic alternative, and is typically protected with a removable cover, analogous to a pillow and pillow case. The term duvet is mainly British, especially in reference to the bedding; rarely used in US English, it often refers to the cover. Sleepers often use a duvet without a top bed sheet, as the duvet cover can readily be removed and laundered as often as the bottom sheet.

Bedding, also called bedclothes or bed linen, is the materials laid above the mattress of a bed for hygiene, warmth, protection of the mattress, and decorative effect. Bedding is the removable and washable portion of a human sleeping environment. Multiple sets of bedding for each bed are often washed in rotation and/or changed seasonally to improve sleep comfort at varying room temperatures. Most standardized measurements for bedding are rectangular, but there are also some square-shaped sizes, which allows the user to put on bedding without having to consider its lengthwise orientation.

A blanket mortage, or blanket loan, is a type of mortgage used to fund the purchase of more than one piece of real property. Blanket loans are popular with builders and developers who buy large tracts of land, then subdivide them to create many individual parcels to be gradually sold one at a time. Rather than securing a new mortgage each time a portion of the development is sold, the borrower uses the blanket loan to buy them all. Once a parcel is sold, a portion of the mortgage is released, with the rest of the mortgage remaining intact.

Real estate economics is the application of economic techniques to real estate markets. It aims to describe and predict economic patterns of supply and demand. The closely related field of housing economics is narrower in scope, concentrating on residential real estate markets, while the research on real estate trends focuses on the business and structural changes affecting the industry. Both draw on partial equilibrium analysis, urban economics, spatial economics, basic and extensive research, surveys, and finance.

A bindle is the bag, sack, or carrying device stereotypically used by the American sub-culture of hobos. The bindle is colloquially known as the blanket stick, particularly within the Northeastern hobo community.

A fidelity bond or fidelity guarantee is a form of insurance protection that covers policyholders for losses that they incur as a result of fraudulent acts by specified individuals. It usually insures a business for losses caused by the dishonest acts of its employees.

Mortgage life insurance is a form of insurance specifically designed to protect a repayment mortgage. If the policyholder were to die while the mortgage life insurance was in force, the policy would pay out a capital sum that will be just sufficient to repay the outstanding mortgage.

This article gives descriptions of mortgage terminology in the United Kingdom.

The Home Mortgage Disclosure Act is a United States federal law that requires certain financial institutions to provide mortgage data to the public. Congress enacted HMDA in 1975.

A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word mortgage is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form of a collateral for a benefit (loan)".

Mortgage discrimination or mortgage lending discrimination is the practice of banks, governments or other lending institutions denying loans to one or more groups of people primarily on the basis of race, ethnic origin, sex or religion.

Landlords' insurance is an insurance policy that covers a property owner from financial losses connected with rental properties. The policy covers the building, with the option of insuring any contents that belong to the landlord that are inside. Landlords' insurance is often referred to as buy-to-let insurance, however buy-to-let insurance is a type of landlords' insurance. It is important to distinguish between buy-to-let insurance which generally covers one property that has been purchased with a buy-to-let mortgage, and multi-property insurance, which covers two or more properties. Each of these types of landlords' insurance covers different things. Landlord insurance is separate from landlords' emergency cover.

Collateral Protection Insurance, or CPI, insures property held as collateral for loans made by lending institutions. CPI, also known as force-placed insurance and lender placed insurance, may be classified as single-interest insurance if it protects the interest of the lender, a single party, or as dual-interest insurance coverage if it protects the interest of both the lender and the borrower.

References

- ↑ "Blanket mortgage". Webster's Revised Unabridged Dictionary . Springfield, MA: G. & C. Merriam. 1913. OCLC 800618302 . Retrieved 17 October 2024.