Called to Common Mission (CCM) is an agreement between The Episcopal Church (ECUSA) and the Evangelical Lutheran Church in America (ELCA) in the United States, establishing full communion between them. It was ratified by the ELCA in 1999, the ECUSA in 2000, after the narrow failure of a previous agreement. Its principal author on the Episcopal side was theological professor J. Robert Wright. Under the agreement, they recognize the validity of each other's baptisms and ordinations. The agreement provided that the ELCA would accept the historical episcopate and the "threefold ministry" of Bishop - Priest - Deacon with respect to ministers of communicant churches serving ELCA congregations. This provision was opposed by some in the ELCA, which after its founding merger in 1988, held a lengthy study of the ministry which was undertaken with divided opinions. In response to concerns about the meaning of the CCM, synod bishops in the ELCA drafted the Tucson resolution which presented the official ELCA position. It made clear that there is no requirement to ordain deacons or accept their ministry. It also provided assurance that the ELCA did not and was not required by CCM to change its own theological stance.

In finance, default is failure to meet the legal obligations of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt.

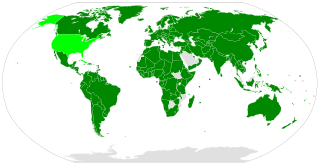

The International Covenant on Civil and Political Rights (ICCPR) is a multilateral treaty adopted by the United Nations General Assembly. Resolution 2200A (XXI) on 16 December 1966, and in force from 23 March 1976 in accordance with Article 49 of the covenant. Article 49 allowed that the covenant will enter into force three months after the date of the deposit of the thirty-fifth instrument of ratification or accession. The covenant commits its parties to respect the civil and political rights of individuals, including the right to life, freedom of religion, freedom of speech, freedom of assembly, electoral rights and rights to due process and a fair trial. As of August 2017, the Covenant has 172 parties and six more signatories without ratification.

Ratification is a principal's approval of an act of its agent that lacked the authority to bind the principal legally. Ratification defines the international act in which a state indicates its consent to be bound to a treaty if the parties intended to show their consent by such an act. In the case of bilateral treaties, ratification is usually accomplished by exchanging the requisite instruments, and in the case of multilateral treaties, the usual procedure is for the depositary to collect the ratifications of all states, keeping all parties informed of the situation.

A repurchase agreement, also known as a repo, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and buys them back shortly afterwards, usually the following day, at a slightly higher price.

Hypothecation is the practice where a debtor pledges collateral to secure a debt or as a condition precedent to the debt, or a third party pledges collateral for the debtor. A letter of hypothecation is the usual instrument for carrying out the pledge.

Total return swap, or TRS, or total rate of return swap, or TRORS, or Cash Settled Equity Swap is a financial contract that transfers both the credit risk and market risk of an underlying asset.

A syndicated loan is one that is provided by a group of lenders and is structured, arranged, and administered by one or several commercial banks or investment banks known as lead arrangers.

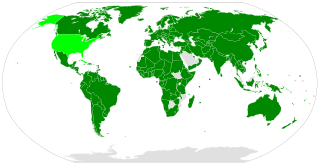

The International Covenant on Economic, Social and Cultural Rights (ICESCR) is a multilateral treaty adopted by the United Nations General Assembly on 16 December 1966 through GA. Resolution 2200A (XXI), and came in force from 3 January 1976. It commits its parties to work toward the granting of economic, social, and cultural rights (ESCR) to the Non-Self-Governing and Trust Territories and individuals, including labour rights and the right to health, the right to education, and the right to an adequate standard of living. As of September 2018, the Covenant has 169 parties. A further four countries, including the United States, have signed but not ratified the Covenant.

Guarantee is a legal term more comprehensive and of higher import than either warranty or "security". It most commonly designates a private transaction by means of which one person, to obtain some trust, confidence or credit for another, engages to be answerable for him. It may also designate a treaty through which claims, rights or possessions are secured. It is to be differentiated from the colloquial "personal guarantee" in that a Guarantee is a legal concept which produces an economic effect. A personal guarantee by contrast is often used to refer to a promise made by an individual which is supported by, or assured through, the word of the individual. In the same way, a guarantee produces a legal effect wherein one party affirms the promise of another by promising to themselves pay if default occurs.

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan. The collateral serves as a lender's protection against a borrower's default and so can be used to offset the loan if the borrower fails to pay the principal and interest satisfactorily under the terms of the lending agreement.

A collateral contract is usually a single term contract, made in consideration of the party for whose benefit the contract operates agreeing to enter into the principal or main contract, which sets out additional terms relating to the same subject matter as the main contract. The collateral contract co-exists side by side. For example, a collateral contract is formed when one party pays the other party a certain sum for entry into another contract. A collateral contract may be between one of the parties and a third party.

In contract law, an integration clause, merger clause, is a clause in a written contract which declares that contract to be the complete and final agreement between the parties. It is often placed at or towards the end of the contract. Any pre-contractual material which the parties wish to be incorporated into the contract need to be assembled with it or explicitly referred to in the contractual documentation.

In finance, a currency swap is an interest rate derivative (IRD). In particular it is a linear IRD and one of the most liquid, benchmark products spanning multiple currencies simultaneously. It has pricing associations with interest rate swaps (IRSs), foreign exchange (FX) rates, and FX swaps (FXSs).

A warranty deed is a type of deed where the grantor (seller) guarantees that he or she holds clear title to a piece of real estate and has a right to sell it to the grantee (buyer), is in contrast to a quitclaim deed, where the seller does not guarantee that he or she holds title to a piece of real estate. A general warranty deed protects the grantee against title defects arising at any point in time, extending back to the property's origins. A special warranty deed protects the grantee only against title defects arising from the actions or omissions of the grantor.

In finance, securities lending or stock lending refers to the lending of securities by one party to another. The terms of the loan will be governed by a "Securities Lending Agreement", which requires that the borrower provides the lender with collateral, in the form of cash or non-cash securities, of value equal to or greater than the loaned securities plus agreed-upon margin. Non-cash refers to the subset of collateral that is not pure cash, including equities, government bonds, convertible bonds, corporate bonds, and other products. The agreement is a contract enforceable under relevant law, which is often specified in the agreement.

A security interest is a legal right granted by a debtor to a creditor over the debtor's property which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations. One of the most common examples of a security interest is a mortgage: When person, by the action of an expressed conveyance, pledges by a promise to pay a certain sum of money, with certain conditions, on a said date or dates for a said period, that action on the page with wet ink applied on the part of the one wishing the exchange creates the original funds and negotiable Instrument. That action of pledging conveys a promise binding upon the mortgagee which creates a face value upon the Instrument of the amount of currency being asked for in exchange. It is therein in good faith offered to the Bank in exchange for local currency from the Bank to buy a house. The particular country's Bank Acts usually requires the Banks to deliver such fund bearing negotiable instruments to the Countries Main Bank such as is the case in Canada. This creates a security interest in the land the house sits on for the Bank and they file a caveat at land titles on the house as evidence of that security interest. If the mortgagee fails to pay defaulting in his promise to repay the exchange, the bank then applies to the court to for-close on your property to eventually sell the house and apply the proceeds to the outstanding exchange.

The Second Optional Protocol to the International Covenant on Civil and Political Rights, aiming at the abolition of the death penalty is a side agreement to the International Covenant on Civil and Political Rights. It was created on 15 December 1989 and entered into force on 11 July 1991. As of September 2018, the Optional Protocol has 86 states parties. In addition, Angola has signed, but not ratified the Protocol.

Privity is a doctrine in English contract law that covers the relationship between parties to a contract and other parties or agents. At its most basic level, the rule is that a contract can neither give rights to, nor impose obligations on, anyone who is not a party to the original agreement, i.e. a "third party". Historically, third parties could enforce the terms of a contract, as evidenced in Provender v Wood, but the law changed in a series of cases in the 19th and early 20th centuries, the most well known of which are Tweddle v Atkinson in 1861 and Dunlop Pneumatic Tyre v Selfridge and Co Ltd in 1915.

Financial law is the law and regulation of the insurance, derivatives, commercial banking, capital markets and investment management sectors. Understanding Financial law is crucial to appreciating the creation and formation of banking and financial regulation, as well as the legal framework for finance generally. Financial law forms a substantial portion of commercial law, and notably a substantial proportion of the global economy, and legal billables are dependent on sound and clear legal policy pertaining to financial transactions. Understanding the legal implications of transactions and structures such as an indemnity, or overdraft is crucial to appreciating their effect in financial transactions. This is the core of Financial law. Thus, Financial law draws a narrower distinction than commercial or corporate law by focusing primarily on financial transactions, the financial market, and its participants; for example, the sale of goods may be part of commercial law but is not financial law. Financial law may be understood as being formed of three overarching methods, or pillars of law formation and categorised into five transaction silos which form the various financial positions prevalent in finance.

![]()