A nonprofit organization (NPO) or non-profit organization, also known as a non-business entity, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrary with an entity that operates as a business aiming to generate a profit for its owners. A nonprofit is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. An array of organizations are nonprofit, including some political organizations, schools, business associations, churches, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without securing tax-exempt status.

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

Bouncy Castle is a collection of APIs used in cryptography. It includes APIs for both the Java and the C# programming languages. The APIs are supported by a registered Australian charitable organization: Legion of the Bouncy Castle Inc.

The National Committee for Quality Assurance (NCQA) is an independent 501(c)(3) nonprofit organization in the United States that works to improve health care quality through the administration of evidence-based standards, measures, programs, and accreditation. The National Committee for Quality Assurance operates on a formula of measure, analyze, and improve and it aims to build consensus across the industry by working with policymakers, employers, doctors, and patients, as well as health plans.

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

The Pulmonary Hypertension Association (PHA) is a 501(c)(3) nonprofit organization that provides support, education, advocacy, and awareness association for pulmonary hypertension. It provides information to the public about the illness and acts as a support group for those with the disease, providing medical provider location services and emotional support for those suffering from the illness.

The National Register of Health Service Psychologists is the largest credentialing organization for psychologists in the United States. Founded in 1974, the National Register was created to identify qualified Health Service Providers. Today, the National Register certifies 11,000 licensed psychologists as health service providers and reviews credentials for doctoral students. The National Register is a 501c3 nonprofit organization based in Washington DC.

Free Press is a United States advocacy group that is part of the media reform or media democracy movement. Their mission includes, "saving Net Neutrality, achieving affordable internet access for all, uplifting the voices of people of color in the media, challenging old and new media gatekeepers to serve the public interest, ending unwarranted surveillance, defending press freedom and reimagining local journalism." The group is a major supporter of net neutrality.

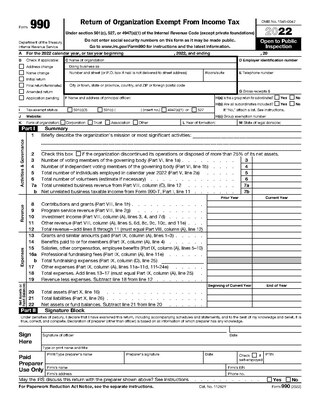

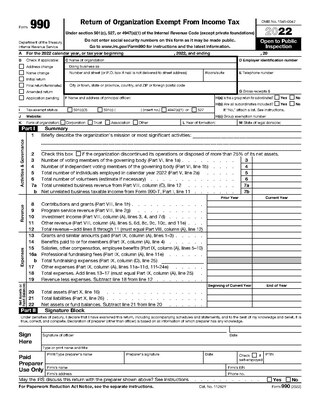

Form 990 is a United States Internal Revenue Service (IRS) form that provides the public with financial information about a nonprofit organization. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Certain nonprofits have more comprehensive reporting requirements, such as hospitals and other healthcare organizations.

Candid is an information service specializing in reporting on U.S. nonprofit companies. In 2016, its database provided information on 2.5 million organizations. It is the product of the February 2019 merger of GuideStar with Foundation Center.

Regan v. Taxation with Representation of Washington, 461 U.S. 540 (1983), was a case in which the United States Supreme Court upheld lobbying restrictions imposed on tax-exempt non-profit corporations.

Nonpartisanism in the United States is organized under United States Internal Revenue Code that qualifies certain non-profit organizations for tax-exempt status because they refrain from engaging in certain political activities prohibited for them. The designation "nonpartisan" usually reflects a claim made by organizations about themselves, or by commentators, and not an official category per American law. Rather, certain types of nonprofit organizations are under varying requirements to refrain from election-related political activities, or may be taxed to the extent they engage in electoral politics, so the word affirms a legal requirement. In this context, "nonpartisan" means that the organization, by US tax law, is prohibited from supporting or opposing political candidates, parties, and in some cases other votes like propositions, directly or indirectly, but does not mean that the organization cannot take positions on political issues.

Cloud Foundry is an open source, multi-cloud application platform as a service (PaaS) governed by the Cloud Foundry Foundation, a 501(c)(6) organization.

Volunteer grants are charitable gifts given to non-profit organizations by corporations in recognition of volunteer work being done by a company's employees. This practice is widespread in the United States.

Salsa Labs, Inc. is a Bethesda, Maryland-based software as a service (SaaS) company that provides donor management, digital marketing, online fundraising, online advocacy, and peer-to-peer fundraising tools to more than 3,000 nonprofit organizations in North America and around the world.

In 2013, the United States Internal Revenue Service (IRS), under the Obama administration, revealed that it had selected political groups applying for tax-exempt status for intensive scrutiny based on their names or political themes. This led to wide condemnation of the agency and triggered several investigations, including a Federal Bureau of Investigation (FBI) criminal probe ordered by United States Attorney General Eric Holder. Conservatives claimed that they were specifically targeted by the IRS, but an exhaustive report released by the Treasury Department's Inspector General in 2017 found that from 2004 to 2013, the IRS used both conservative and liberal keywords to choose targets for further scrutiny.

Equality Hawaii was a statewide political advocacy organization in Hawaii that advocated for lesbian, gay, bisexual, and transgender (LGBT) rights, including same-sex marriage.

Google for Education is a service from Google that provides independently customizable versions of several Google products using a domain name provided by the customer. It features several Web applications with similar functionality to traditional office suites, including Gmail, Hangouts, Meet, Google Calendar, Drive, Docs, Sheets, Slides, Groups, News, Play, Sites, and Vault. The products also tie into the use of Chromebooks which can be added to the Google Workspace Domain of the educational establishment.

Every Voice is an American nonprofit, progressive liberal political advocacy organization. The organization was formed in 2014 upon the merger of the Public Campaign Action Fund, a 501(c)(4) group, and the Friends of Democracy. Every Voice, along with its affiliated Super PAC, Every Voice Action, advocates for campaign finance reform in the United States via public financing of political campaigns and limitations on political donations. The organization's president, David Donnelly, has said "We fully embrace the irony of working through a Super PAC to fight the influence of Super PACs."

A 501(h) election or Conable election is a procedure in United States tax law that allows a 501(c)(3) non-profit organization to participate in lobbying limited only by the financial expenditure on that lobbying, regardless of its overall extent. This allows organizations taking the 501(h) election to potentially perform a large amount of lobbying if it is done using volunteer labor or through inexpensive means. The 501(h) election is available to most types of 501(c)(3) organizations that are not churches or private foundations. It was introduced by Representative Barber Conable as part of the Tax Reform Act of 1976 and codified as 26 U.S.C. § 501(h), and the corresponding Internal Revenue Service (IRS) regulations were finalized in 1990.