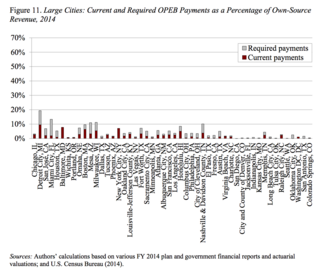

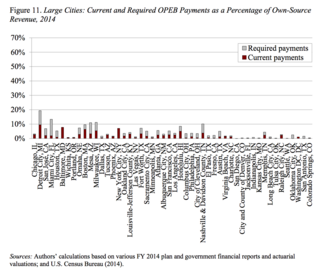

GASB 45, or GASB Statement 45, is an accounting and financial reporting provision requiring government employers to measure and report the liabilities associated with other (than pension) postemployment benefits (or OPEB). Reported OPEBs may include post-retirement medical, pharmacy, dental, vision, life, long-term disability and long-term care benefits that are not associated with a pension plan. Government employers required to comply with GASB 45 include all states, towns, education boards, water districts, mosquito districts, public schools and all other government entities that offer OPEB and report under GASB.

Accounting or accountancy is the measurement, processing, and communication of financial information about economic entities such as businesses and corporations. The modern field was established by the Italian mathematician Luca Pacioli in 1494. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of users, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used as synonyms.

A government is the system or group of people governing an organized community, often a state.

In financial accounting, a liability is defined as the future sacrifices of economic benefits that the entity is obliged to make to other entities as a result of past transactions or other past events, the settlement of which may result in the transfer or use of assets, provision of services or other yielding of economic benefits in the future.

GASB 45 was instigated by the Governmental Accounting Standards Board (GASB) in July 2004 because of the growing concern over the potential magnitude of government employer obligations for post-employment benefits. GASB 45 will:

The Governmental Accounting Standards Board (GASB) is the source of generally accepted accounting principles (GAAP) used by state and local governments in the United States. As with most of the entities involved in creating GAAP in the United States, it is a private, non-governmental organization.

- Recognize the cost of OPEB benefits in the period when services are received.

- Provide information about the actuarial liabilities for the promised benefits.

- Provide information useful in assessing potential demands on future cash flows.

GASB 45 applies to the financial statements issued by government employers that offer OPEB and that are subject to GASB accounting standards. GASB 45 does not apply to private employers or trusts that are established in order to pre-fund OPEB benefits and for trusts that are used as conduits to pay OPEB benefits.

Generally Accepted Accounting Principles is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the latter differ considerably from GAAP and progress has been slow and uncertain. More recently, the SEC has acknowledged that there is no longer a push to move more U.S companies to IFRS so the two sets of standards will "continue to coexist" for the foreseeable future.

Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in insurance, finance and other industries and professions. Actuaries are professionals trained in this discipline. In many countries, actuaries must demonstrate their competence by passing a series of rigorous professional examinations.

The Canada Pension Plan is a contributory, earnings-related social insurance program. It forms one of the two major components of Canada's public retirement income system, the other component being Old Age Security (OAS). Other parts of Canada's retirement system are private pensions, either employer-sponsored or from tax-deferred individual savings. As of September 2017, the CPP Investment Board manages over C$328.2 billion in investment assets for the Canada Pension Plan on behalf of 20 million Canadians. CPPIB is one of the world's biggest pension funds.

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal United States tax and labor law that establishes minimum standards for pension plans in private industry. It contains rules on the federal income tax effects of transactions associated with employee benefit plans. ERISA was enacted to protect the interests of employee benefit plan participants and their beneficiaries by:

A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Federal tax aspects of retirement plans in the United States are based on provisions of the Internal Revenue Code and the plans are regulated by the Department of Labor under the provisions of the Employee Retirement Income Security Act (ERISA).

A cash balance plan is a defined benefit retirement plan that maintains hypothetical individual employee accounts like a defined contribution plan. The hypothetical nature of the individual accounts was crucial in the early adoption of such plans because it enabled conversion of traditional plans without declaring a plan termination.

Government financial statements are annual financial statements or reports for the year. The financial statements, in contrast to budget, present the revenue collected and amounts spent. The government financial statements usually include a statement of activities, a balance sheet and often some type of reconciliation. Cash flow statements are often included to show the sources of the revenue and the destination of the expenses.

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a fund consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

Other postemployment benefits is a term used in the United States to describe the benefits that an employee begins to receive at the start of their retirement. These benefits do not include the pension paid to the retired employee. "Other postemployment benefits" were originally intended to be an important source of supplemental coverage for people on Medicare. Typically this means that if employees retire before the age of 65 they can remain on their employer's health plan. Upon turning 65 they leave their employers plan for Medicare but still receive additional benefits from their employer. These benefits may include health insurance and dental, vision, prescription, or other healthcare benefits provided to eligible retirees and their beneficiaries. They also may include life insurance, disability insurance, long-term care insurance, and other benefits.

The Pension Protection Act of 2006, 120 Stat. 780, was signed into law by U.S. President George W. Bush on August 17, 2006.

IAS 19 or International Accounting Standard Nineteen rule concerning employee benefits under the IFRS rules set by the International Accounting Standards Board. In this case, "employee benefits" includes wages and salaries as well as pensions, life insurance, and other perquisites.

An Individual Pension Plan or IPP is a Canadian retirement savings vehicle. An IPP is a one-person maximum Defined Benefit Pension Plan which allows the plan member to accrue retirement income on a tax-deferred basis. As such, an IPP must conform to the Canadian Income Tax Act (ITA) and regulations (ITR) as well as the requirements of the Canada Revenue Agency (CRA) with respect to defined benefit pension plans. It is possible for an IPP to be a combination plan offering both Defined Benefits and Defined Contribution pensions

A Comprehensive Annual Financial Report (CAFR) is a set of U.S. government financial statements comprising the financial report of a state, municipal or other governmental entity that complies with the accounting requirements promulgated by the Governmental Accounting Standards Board (GASB). GASB provides standards for the content of a CAFR in its annually updated publication Codification of Governmental Accounting and Financial Reporting Standards. The U.S. Federal Government adheres to standards determined by the Federal Accounting Standards Advisory Board (FASAB).

Milliman, formerly Milliman & Robertson, is a large international, independent actuarial and consulting firm, with revenues of $838 million in 2014. Founded in Seattle in 1947, by Wendell Milliman and Stuart A. Robertson, the firm operates 59 offices worldwide with over 3,000 employees, including more than 1,300 consultants and actuaries. Milliman is owned and managed by approximately 350 principals. Milliman's primary business includes consulting practices in employee benefits, healthcare, investment, life insurance and financial services, and property and casualty insurance. Clients include a spectrum of business, financial, government, union, education, and nonprofit organizations. The firm also provides data analysis, predictive analytics, and big data services.

Pension administration in the United States is the act of performing various types of yearly service on an organizational retirement plan, such as a 401(k), profit sharing plan, defined benefit plan, or cash balance plan. Increasingly these plan types are also being implemented in combination arrangements for greater contribution potential, such as the pairing of a cash balance plan with some variety of 401(k). The basic purpose of Pension Administration is to ensure that an organizational retirement plan does not discriminate against the lower level employees while also ensuring that the plan is not used as an abusive tax shelter. Stress tests include the average benefits test, Average Deferral Percentage, and minimum coverage. Yearly pension administration work involves filing a Form 5500 with the Internal Revenue Service. There are several professional designations available to those who perform this work, such as those offered by the National Institute of Pension Administrators and the American Society of Pension Professionals and Actuaries. Pension Administration firms more often than not rely on financial brokers for their business prospects, although they do have other referral sources. Some pension administration firms carry out the financial advisory work within an internal unit of their own company, as well as accepting referrals from an independent broker network. Examples of firms with which these brokers are associated are Raymond James, Edward Jones Investments and Morgan Stanley. The brokers may be employees of these firms or independent contractors. The plan assets of the organizational retirement plans in question sometimes reside on a trading platform controlled by the administration firm. But more often than not the assets are held by large financial institutions who provide a variety of investment options for plan participants. Examples of large firms in this market space are Principal Financial Group, John Hancock Insurance, ING Group and Mass Mutual, although there are many others. Plans which contain over one-hundred participants must perform an independent audit each year, necessitating yearly coordination with representatives of a public accounting firm. In cases where a defined benefit plan is being managed the pension administration firm must employ an actuary to certify the plan's present and future benefit liabilities and compliance with minimum funding standards set by the IRS. Pension administration firms with a large block of defined benefit plans often employ an actuary directly. But they may also retain the actuary as an independent contractor, and this is almost certain to be the arrangement in cases where the pension administration firm only works on a small collection of defined benefit plans. The actuary completes contribution calculations for the plan and provides a Schedule SB so that the yearly Form 5500 may be completed. Without this Schedule the yearly filing for a defined benefit plan would be incomplete. In addition to the Internal Revenue Service, organizational retirement plan operation and maintenance falls under the regulation of the United States Department of Labor.

A defined benefit pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum on retirement that is predetermined by a formula based on the employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provided defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

Jeremy Edward Gold was an American actuary and economist. He was noted—famous in some circles, infamous in others—for his advocacy of the application of financial economics to pension actuarial practice and his criticism of actuarial standards and professionalism.