The economy of Denmark is a modern market economy with comfortable living standards, a high level of government services and transfers, and a high dependence on foreign trade. The economy is dominated by the service sector with 80% of all jobs, whereas about 11% of all employees work in manufacturing and 2% in agriculture. Nominal gross national income per capita was the tenth-highest in the world at $55,220 in 2017. Correcting for purchasing power, per capita income was Int$52,390 or 16th-highest globally. Income distribution is relatively equal, but inequality has increased somewhat during the last decades, however, due to both a larger spread in gross incomes and various economic policy measures. In 2017 Denmark had the seventh-lowest Gini coefficient of the 28 European Union countries. With 5,789,957 inhabitants, Denmark has the 39th largest national economy in the world measured by nominal gross domestic product (GDP) and 60th largest in the world measured by purchasing power parity (PPP).

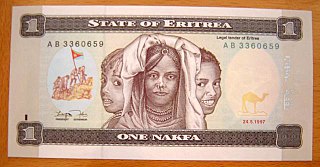

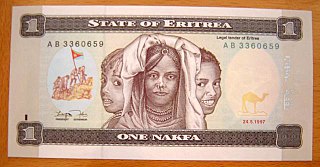

The Economy of Eritrea has experienced considerable growth in recent years, indicated by an improvement in Gross domestic product (GDP) in October 2012 of 7.5 percent over 2011. However, worker remittances from abroad are estimated to account for 32 percent of gross domestic product. Eritrea has an extensive amount of resources such as copper, gold, granite, marble, and potash. The Eritrean economy has undergone extreme changes due to the War of Independence.

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a period of time, often annually. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore using a basis of GDP per capita at purchasing power parity (PPP) is arguably more useful when comparing differences in living standards between nations.

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. For households and individuals, "income is the sum of all the wages, salaries, profits, interest payments, rents, and other forms of earnings received in a given period of time."

The Agricultural Adjustment Act (AAA) was a United States federal law of the New Deal era designed to boost agricultural prices by reducing surpluses. The Government bought livestock for slaughter and paid farmers subsidies not to plant on part of their land. The money for these subsidies was generated through an exclusive tax on companies which processed farm products. The Act created a new agency, the Agricultural Adjustment Administration, an agency of the U.S. Department of Agriculture, to oversee the distribution of the subsidies. The Agriculture Marketing Act, which established the Federal Farm Board in 1929, was seen as a strong precursor to this act. The AAA, along with other New Deal programs, represented the federal government's first substantial effort to address economic welfare in the United States.

In the United States, a conservation easement is a power invested in a qualified private land conservation organization or government to constrain, as to a specified land area, the exercise of rights otherwise held by a landowner so as to achieve certain conservation purposes. It is an interest in real property established by agreement between a landowner and land trust or unit of government. The conservation easement "runs with the land", meaning it is applicable to both present and future owners of the land. As with other real property interests, the grant of conservation easement is recorded in the local land records; the grant becomes a part of the chain of title for the property.

This aims to be a complete article list of economics topics:

In accounting, an economic item's historical cost is the original nominal monetary value of that item. Historical cost accounting involves reporting assets and liabilities at their historical costs, which are not updated for changes in the items' values. Consequently, the amounts reported for these balance sheet items often differ from their current economic or market values.

An agricultural subsidy, is a government incentive paid to agribusinesses, agricultural organizations and farms to supplement their income, manage the supply of agricultural commodities, and influence the cost and supply of such commodities. Examples of such commodities include: wheat, feed grains, cotton, milk, rice, peanuts, sugar, tobacco, oilseeds such as soybeans and meat products such as beef, pork, and lamb and mutton.

A family farm is generally understood to be a farm owned and/or operated by a family; it is sometimes considered to be an estate passed down by inheritance. Family farm businesses can take many forms, as most farm families have structured their farm businesses as corporations, limited liability corporations, and trusts, for liability, tax, and business purposes. It is a common misconception that all farms with these business structures are not family farms, when in actuality that is not true. In the United States for example, a 2014 USDA report shows that family farms operate 90 percent of the nation’s farmland, and account for 85 percent of the country’s agricultural production value.

A cash crop or profit crop is an agricultural crop which is grown to sell for profit. It is typically purchased by parties separate from a farm. The term is used to differentiate marketed crops from subsistence crops, which are those fed to the producer's own livestock or grown as food for the producer's family. In earlier times cash crops were usually only a small part of a farm's total yield, while today, especially in developed countries, almost all crops are mainly grown for revenue. In the least developed countries, cash crops are usually crops which attract demand in more developed nations, and hence have some export value.

Agricultural economics is an applied field of economics concerned with the application of economic theory in optimizing the production and distribution of food and fiber. Agricultural economics began as a branch of economics that specifically dealt with land usage, it focused on maximizing the crop yield while maintaining a good soil ecosystem. Throughout the 20th century the discipline expanded and the current scope of the discipline is much broader. Agricultural economics today includes a variety of applied areas, having considerable overlap with conventional economics. Agricultural economists have made substantial contributions to research in economics, econometrics, development economics, and environmental economics. Agricultural economics influences food policy, agricultural policy, and environmental policy.

Agriculture in Russia survived a severe transition decline in the early 1990s as it struggled to transform from a command economy to a market-oriented system. Following the breakup of the Soviet Union in 1991, large collective and state farms – the backbone of Soviet agriculture – had to contend with the sudden loss of state-guaranteed marketing and supply channels and a changing legal environment that created pressure for reorganization and restructuring. In less than ten years, livestock inventories declined by half, pulling down demand for feed grains, and the area planted to grains dropped by 25%.

Tajikistan is a highly agrarian country, with its rural population at more than 70% and agriculture accounting for 60% of employment and around 30% of GDP. As is typical of economies dependent on agriculture, Tajikistan has low income per capita: back in the Soviet period (1990) Tajikistan was the poorest republic with a staggering 45% of its population in the lowest income “septile”. In 2006 Tajikistan still had the lowest income per capita among the Commonwealth of Independent States (CIS) countries: $1,410 compared with nearly $12,000 for Russia. The low income and the high agrarian profile justify and drive the efforts for agricultural reform since 1991 in the hope of improving the population’s well being.

The following outline is provided as an overview of and topical guide to economics:

The Consumer support estimate (CSE) is an OECD indicator of the annual monetary value of gross transfers to (from) consumers of agricultural commodities, measured at the farm gate level, arising from policy measures which support agriculture, regardless of their nature, objectives or impacts on consumption of farm products. The CSE can be expressed in monetary terms; as a ratio to the value of consumption expenditure valued at farm gate prices, including budgetary support to consumers ; or as a ratio to the value of consumption expenditure valued at world market prices, without budgetary support to consumers.

The total support estimate (TSE) is an Organisation for Economic Co-operation and Development (OECD) indicator of the annual monetary value of all gross transfers from taxpayers and consumers arising from policy measures that support agriculture, net of the associated budgetary receipts, regardless of their objectives and impacts on farm production and income, or consumption of farm products. The TSE can be expressed in monetary terms or as a percentage of the gross domestic product. In addition to the TSE, other measures used to compare levels of support to agriculture across counties include the producer support estimate (PSE), consumer support estimate (CSE), and general services support estimate (GSSE).

The producer support estimate (PSE) is an indicator of the annual monetary value of gross transfers from consumers and taxpayers to agricultural producers, measured at the farm gate level, arising from policy measures that support agriculture, regardless of their nature, objectives or impacts on farm production or income. Examples include market price support, and payments based on output, area planted, animal numbers, inputs, or farm income. PSEs, which are updated and published annually by the Organisation for Economic Co-operation and Development, can be expressed in monetary terms: as a ratio to the value of gross farm receipts valued at farm gate prices, including budgetary support ; or, as a ratio to the value of gross farm receipts valued at world market prices, without budgetary support.

In United States agricultural policy, net farm income refers to the return to farm operators for their labor, management and capital, after all production expenses have been paid. It includes net income from farm production as well as net income attributed to the rental value of farm dwellings, the value of commodities consumed on the farm, depreciation, and inventory changes.

The General Services Support Estimate (GSSE) is an Organisation for Economic Co-operation and Development (OECD) indicator of the annual monetary value of gross transfers of general services provided to agriculture collectively, arising from policy measures that support agriculture, regardless of their nature, objectives and impacts on farm production, income, or consumption of farm products. Examples include research and development, education, infrastructure, and marketing and promotion programs. The GSSE can be expressed in monetary terms or as a percentage of the total support to agriculture.