This aims to be a complete list of the articles on real estate.

A real estate broker or a real estate agent is a person who represents sellers or buyers of real estate or real property. While a broker may work independently, an agent usually work under a licensed broker to represent clients. Brokers and agents are licensed by the state to negotiate sales agreements and manage the documentation required for closing real estate transactions. In North America, some brokers and agents are members of the National Association of Realtors (NAR), the largest trade association for the industry. NAR members are obligated by a code of ethics that go above and beyond state legal requirements to work in the best interest of the client. Buyers and sellers are generally advised to consult a licensed real estate professional for a written definition of an individual state's laws of agency, and many states require written disclosures to be signed by all parties outlining the duties and obligations.

Title insurance is a form of indemnity insurance predominantly found in the United States which insures against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans. The vast majority of title insurance policies are written on land within the United States. Unlike some land registration systems in countries outside the United States, US states' recorders of deeds generally do not guarantee indefeasible title to those recorded titles. Title insurance will defend against a lawsuit attacking the title or reimburse the insured for the actual monetary loss incurred up to the dollar amount of insurance provided by the policy.

Predatory lending refers to unethical practices conducted by lending organizations during a loan origination process that are unfair, deceptive, or fraudulent. While there are no legal definitions in the United States for predatory lending per se, a 2006 audit report from the office of inspector general of the Federal Deposit Insurance Corporation (FDIC) broadly defines predatory lending as "imposing unfair and abusive loan terms on borrowers", though "unfair" and "abusive" were not specifically defined. Though there are laws against some of the specific practices commonly identified as predatory, various federal agencies use the phrase as a catch-all term for many specific illegal activities in the loan industry. Predatory lending should not be confused with predatory mortgage servicing which is mortgage practices described by critics as unfair, deceptive, or fraudulent practices during the loan or mortgage servicing process, post loan origination.

A mortgage broker acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses.

A double closing is the simultaneous purchase and sale of a real estate property involving three parties: the original seller, an investor (middleman), and the final buyer.

The Truth in Lending Act (TILA) of 1968 is a United States federal law designed to promote the informed use of consumer credit, by requiring disclosures about its terms and cost to standardize the manner in which costs associated with borrowing are calculated and disclosed.

Credit is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately, but promises either to repay or return those resources at a later date. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people.

The Fair and Accurate Credit Transactions Act of 2003 is a United States federal law, passed by the United States Congress on November 22, 2003, and signed by President George W. Bush on December 4, 2003, as an amendment to the Fair Credit Reporting Act. The act allows consumers to request and obtain a free credit report once every twelve months from each of the three nationwide consumer credit reporting companies. In cooperation with the Federal Trade Commission, the three major credit reporting agencies set up the web site AnnualCreditReport.com to provide free access to annual credit reports.

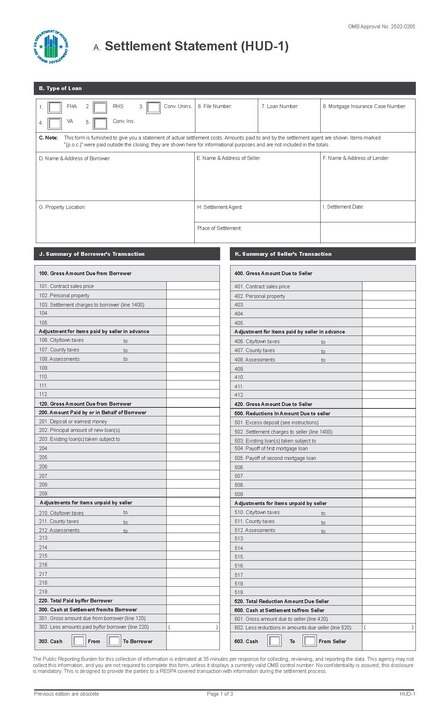

A good faith estimate, referred to as a GFE, was a standard form that had to be provided by a mortgage lender or broker in the United States to a consumer, as required by the Real Estate Settlement Procedures Act (RESPA). Since August 2015, GFE has been replaced by a loan estimate form, serving the same purpose but following slightly different guidelines set by CFPB, so as to reduce consumer confusion. A good faith estimate is a standard form intended to be used to compare different offers from different lenders or brokers. The estimate must include an itemized list of fees and costs associated with the loan and must be provided within 3 business days of applying for a loan. Since RESPA does not apply to Business Purpose Loans, no GFE is provided in those transactions.

Closing costs are fees paid at the closing of a real estate transaction. This point in time called the closing is when the title to the property is conveyed (transferred) to the buyer. Closing costs are incurred by either the buyer or the seller.

A secured loan is a loan in which the borrower pledges some asset as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan. The debt is thus secured against the collateral, and if the borrower defaults, the creditor takes possession of the asset used as collateral and may sell it to regain some or all of the amount originally loaned to the borrower. An example is the foreclosure of a home. From the creditor's perspective, that is a category of debt in which a lender has been granted a portion of the bundle of rights to specified property. If the sale of the collateral does not raise enough money to pay off the debt, the creditor can often obtain a deficiency judgment against the borrower for the remaining amount.

Mortgage fraud is a crime in which the intent is to materially misrepresent or omit information on a mortgage loan application in order to obtain a loan or to obtain a larger loan than could have been obtained had the lender or borrower known the truth.

Mortgage discrimination or mortgage lending discrimination is the practice of banks, governments or other lending institutions denying loans to one or more groups of people primarily on the basis of race, ethnic origin, sex or religion.

A real estate transaction is the process whereby rights in a unit of property is transferred between two or more parties, e.g. in case of conveyance one party being the seller(s) and the other being the buyer(s). It can often be quite complicated due to the complexity of the property rights being transferred, the amount of money being exchanged, and government regulations. Conventions and requirements also vary considerably among different countries of the world and among smaller legal entities (jurisdictions).

The Mortgage Industry Standards Maintenance Organization(MISMO) is a not-for-profit, wholly owned subsidiary of the Mortgage Bankers Association (MBA) responsible for developing standards for exchanging information and conducting business in the U.S. mortgage finance industry. It has more than 175 member organizations representing a cross-section of the residential and commercial mortgage industries.

The Dodd–Frank Wall Street Reform and Consumer Protection Act is a United States federal law that was enacted on July 21, 2010. The law overhauled financial regulation in the aftermath of the financial crisis of 2007–2008, and it made changes affecting all federal financial regulatory agencies and almost every part of the nation's financial services industry.

The Mortgage Choice Act of 2013 is a bill that would direct the Consumer Financial Protection Bureau (CFPB) to amend its regulations related to qualified mortgages to reflect new exclusions made by this bill. The CFPB released new regulations regarding the definition of a Qualified Mortgage that took effect in January 2014, a definition that this bill would modify.

In consumer lending, mortgage origination, a specialized subset of loan origination, is the process by which a lender works with a borrower to complete a mortgage transaction, resulting in a mortgage loan. A mortgage is a loan in which property or real estate is used as collateral. During this process, borrowers must submit various types of financial information and documentation to a mortgage lender, including tax returns, payment history, credit card information and bank balances. Mortgage lenders use this information to determine the type of loan and the interest rate for which the borrower is eligible. The process in the United States has become complex due to the proliferation of loan products and consumer protection regulations.