Related Research Articles

Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

Ballot Measure 47 was an initiative in the U.S. state of Oregon that passed in 1996, affecting the assessment of property taxes and instituting a double majority provision for tax legislation. Measure 50 was a revised version of the law, which also passed, after being referred to the voters by the 1997 state legislature.

The Oregon tax revolt is a political movement in Oregon which advocates for lower taxes. This movement is part of a larger anti-tax movement in the western United States which began with the enactment of Proposition 13 in California. The tax revolt, carried out in large part by a series of citizens' initiatives and referendums, has reshaped the debate about taxes and public services in Oregon.

Timothy Donald Eyman is an American anti-tax activist and businessman.

John Peter Ricketts is an American businessman and politician serving as the junior United States senator from Nebraska since 2023. A member of the Republican Party, he served as the 40th governor of Nebraska from 2015 to 2023.

The Idaho State Capitol in Boise is the home of the government of the U.S. state of Idaho. Although Lewiston briefly served as Idaho's capital from the formation of Idaho Territory in 1863, the territorial legislature moved it to Boise on December 24, 1864.

The 2006 New Jersey state government shutdown was the first shutdown in the history of the U.S. state of New Jersey. The shutdown occurred after the New Jersey Legislature and Governor Jon Corzine failed to agree on a state budget by the constitutional deadline. Furthermore, Corzine and the Legislature clashed on the issue of raising the state sales tax to help balance budget. Exercising his constitutional powers as governor, Corzine ordered the shutdown as a means of pressuring the Legislature to pass a budget. The shutdown began at midnight on July 1, 2006, when Corzine called for an orderly shutdown of non-essential government services, which was followed by a second round of shutdowns three days later on July 4.

Proposition 218 is an adopted initiative constitutional amendment which revolutionized local and regional government finance and taxation in California. Named the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in 1978. Proposition 218 was approved and adopted by California voters during the November 5, 1996, statewide general election.

The 2007 Texas Constitutional Amendment Election took place 6 November 2007.

The Oregon tax rebate, commonly referred to as the kicker, is a rebate calculated for both individual and corporate taxpayers in the U.S. state of Oregon when a revenue surplus exists. The Oregon Constitution mandates that the rebate be issued when the calculated revenue for a given biennium exceeds the forecast revenue by at least two percent. The law was first enacted by ballot measure in 1980, and was entered into the Oregon Constitution with the enactment of Ballot Measure 86 in 2000.

California's state elections were held November 3, 1992. Necessary primary elections were held on March 3. Up for election were all the seats of the State Assembly, 20 seats of the State Senate, and fifteen ballot measures.

Raúl Rafael Labrador is an American lawyer and politician from Idaho, currently the state's attorney general. A member of the Republican Party, he was the U.S. Representative for Idaho's 1st congressional district from 2011 to 2019 and chaired the Idaho Republican Party from 2019 to 2020. He also represented the 14B district in the state legislature from 2006 to 2010.

Massachusetts Question 3, filed under the name, the 3 percent Sales Tax Relief Act, appears on the November 2, 2010 ballot in the state of Massachusetts as an initiative. The measure, if enacted by voters, would reduce the state sales tax rate from 6.25 to 3 percent. The measure is being sponsored by the Alliance to Roll Back Taxes headed by Carla Howell. The measure would be enacted into a law 30 days after the election if approved by voters.

In California state elections, 2014 was the first year in which the top statewide offices were elected under the nonpartisan blanket primary, pursuant to Proposition 14, which passed with 53% voter approval in June 2010. Under this system, which first went into effect during the 2012 election year, all candidates will appear on the same ballot, regardless of party. In the primary, voters may vote for any candidate, regardless of their party affiliation. The top two finishers, regardless of party, then advance to face each other in the general election in November.

2015 Michigan Proposal 1, also known as the Michigan Sales Tax Increase for Transportation Amendment, was a referendum held on May 5, 2015, concerning a legislatively-referred ballot measure. The measure's approval would have caused one constitutional amendment and 10 statutes to go into effect. It is estimated that Proposal 1 would raise state revenues from sales and use taxes by $1.427 billion, fuel taxes by $463 million, truck registration fees by $50 million, and vehicle registration fees by $10.1 million in the first year. If approved, the proposal was estimated by the Associated Press to result in an average tax increase of $545 per household in 2016.

The California state elections in 2020 were held on Tuesday, November 3, 2020. Unlike previous election cycles, the primary elections were held on Super Tuesday, March 3, 2020.

California state elections in 2018 were held on Tuesday, November 6, 2018, with the primary elections being held on June 5, 2018. Voters elected one member to the United States Senate, 53 members to the United States House of Representatives, all eight state constitutional offices, all four members to the Board of Equalization, 20 members to the California State Senate, and all 80 members to the California State Assembly, among other elected offices.

Idaho Proposition 1 (2018) was a ballot initiative titled the "Save Horse Racing in Idaho Act". Voters failed to pass the initiative during the General Election held on November 6, 2018; the proposition would have allowed a limited number of Idaho racetracks to operate historical racing gaming terminals. Proposition 1 was an effort to restore a law that previously allowed historical racing in Idaho.

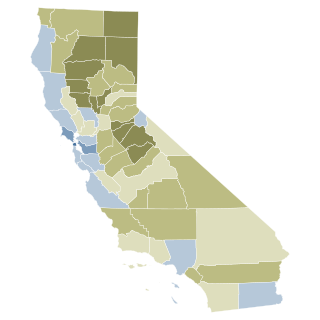

California Proposition 15 was a failed citizen-initiated proposition on the November 3, 2020, ballot. It would have provided $6.5 billion to $11.5 billion in new funding for public schools, community colleges, and local government services by creating a "split roll" system that increased taxes on large commercial properties by assessing them at market value, without changing property taxes for small business owners or residential properties for homeowners or renters. The measure failed by a small margin of about four percentage points.

References

- ↑ "Memorandum Re:Property Tax Relief Act of 2006" (PDF). Idaho State Tax Commission. 28 June 2008. Retrieved 2009-07-22.

- ↑ "2006 General Results statewide". sos.idaho.gov. Retrieved 2017-08-28.