The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2010, taxes collected by federal, state, and municipal governments amounted to 24.8% of GDP. In the OECD, only Chile and Mexico are taxed less as a share of their GDP.

A taxpayer is a person or organization subject to pay a tax. Taxpayers have an Identification Number, a reference number issued by a government to its citizens.

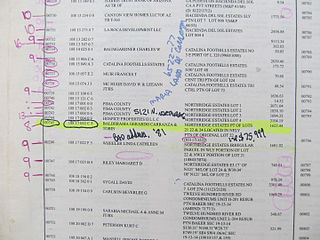

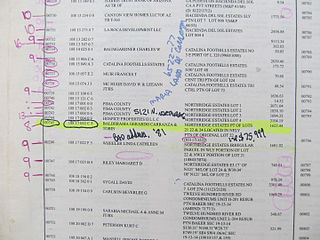

A tax lien is a lien imposed by law upon a property to secure the payment of taxes. A tax lien may be imposed for delinquent taxes owed on real property or personal property, or as a result of failure to pay income taxes or other taxes.

Though the actual definitions vary between jurisdictions, in general, a direct tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction, which is described as an indirect tax. The term may be used in economic and political analyses, but does not itself have any legal implications. However, in the United States, the term has special constitutional significance because of a provision in the U.S. Constitution that any direct taxes imposed by the national government be apportioned among the states on the basis of population. In the European Union direct taxation remains the sole responsibility of member states.

A transfer tax is a tax on the passing of title to property from one person to another.

Gross income is all a person's receipts and gains from all sources, before any deductions. The adjective "gross", as opposed to "net", generally qualifies a word referring to an amount, value, weight, number, or the like, specifying that necessary deductions have not been taken into account.

Income taxes in the United States are imposed by the federal, most state, and many local governments. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels.

John J. Cullerton is an American politician who is currently a Democratic member of the Illinois Senate, representing the 6th district since his appointment in 1991. He was elected President of the Illinois Senate in 2009. Cullerton is involved in an ongoing corruption scandal in which he is accused of pressuring the Cook County Department of Transportation and Highways to pave public green space at taxpayer expense to enable a real estate development that he co-owns.

Proposition 218 was an adopted initiative constitutional amendment which revolutionized local and regional government finance in California. Called the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in 1978.

The Washington Park Subdivision is the name of the historic 3-city block by 8-city block subdivision in the northwest corner of the Woodlawn community area, on the South Side of Chicago in Illinois that stands in the place of the original Washington Park Race Track. The area evolved as a redevelopment of the land previously occupied by the racetrack. It was originally an exclusively white neighborhood that included residential housing, amusement parks, and beer gardens.

The Howard Jarvis Taxpayers Association is a California nonprofit lobbying and policy organization that advocates against taxation.

Frank Lyon Company v. United States, 435 U.S. 561 (1978), was a United States Supreme Court case in which the Court held that the title owner that acquired depreciable real estate as if the owner were a mere conduit or agent was indeed the owner and, for Federal income tax purposes, had the legal right to take tax deductions associated with depreciation on the building.

Tax protesters in the United States advance a number of constitutional arguments asserting that the imposition, assessment and collection of the federal income tax violates the United States Constitution. These kinds of arguments, though related to, are distinguished from statutory and administrative arguments, which presuppose the constitutionality of the income tax, as well as from general conspiracy arguments, which are based upon the proposition that the three branches of the federal government are involved together in a deliberate, on-going campaign of deception for the purpose of defrauding individuals or entities of their wealth or profits. Although constitutional challenges to U.S. tax laws are frequently directed towards the validity and effect of the Sixteenth Amendment, assertions that the income tax violates various other provisions of the Constitution have been made as well.

James Tobin is an American economist and educator. He is the founder of Taxpayers United of America and a proponent of tax relief.

Wallace Leroy DeWolf, sometimes De Wolf, was an American lawyer, businessman, philanthropist, and artist. He was born in Chicago, Illinois and spent most of his life in the city. Originally a lawyer, DeWolf founded a successful real estate company in 1894. In 1901, he was named the president of the Kellogg Switchboard & Supply Company. His seven-year tenure featured a stock controversy that reached the Illinois Supreme Court and a large strike.

Tax resistance in the United States has been practiced at least since colonial times, and has played important parts in American history.