A mortgage is a security interest in real property held by a lender as a security for a debt, usually a loan of money. A mortgage in itself is not a debt, it is the lender's security for a debt. It is a transfer of an interest in land from the owner to the mortgage lender, on the condition that this interest will be returned to the owner when the terms of the mortgage have been satisfied or performed. In other words, the mortgage is a security for the loan that the lender makes to the borrower.

Adverse possession, sometimes colloquially described as ‘squatter's rights’, is a legal principle under which a person who does not have legal title to a piece of property—usually land —acquires legal ownership based on continuous possession or occupation of the land without the permission of its legal owner.

A lease is a contractual arrangement calling for the lessee (user) to pay the lessor (owner) for use of an asset. Property, buildings and vehicles are common assets that are leased. Industrial or business equipment is also leased.

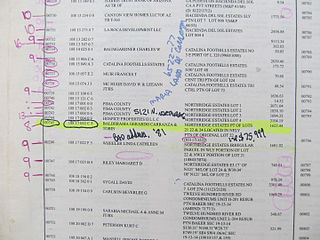

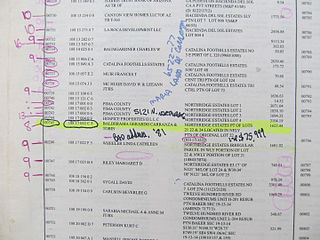

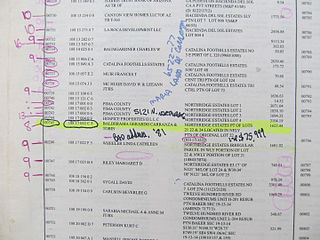

A tax lien is a lien imposed by law upon a property to secure the payment of taxes. A tax lien may be imposed for delinquent taxes owed on real property or personal property, or as a result of failure to pay income taxes or other taxes.

A leasehold estate is an ownership of a temporary right to hold land or property in which a lessee or a tenant holds rights of real property by some form of title from a lessor or landlord. Although a tenant does hold rights to real property, a leasehold estate is typically considered personal property.

In common law systems, land tenure is the legal regime in which land is owned by an individual, who is said to "hold" the land. It determines who can use land, for how long, and under what conditions. Tenure may be based both on official laws and policies, and on informal customs. The French verb "tenir" means "to hold" and "tenant" is the present participle of "tenir". The sovereign monarch, known as The Crown, held land in its own right. All private owners are either its tenants or sub-tenants. Tenure signifies the relationship between tenant and lord, not the relationship between tenant and land. Over history, many different forms of land ownership, i.e., ways of owning land, have been established.

A mechanic's lien is a security interest in the title to property for the benefit of those who have supplied labor or materials that improve the property. The lien exists for both real property and personal property. In the realm of real property, it is called by various names, including, generically, construction lien. It is also called a materialman's lien or supplier's lien when referring to those supplying materials, a laborer's lien when referring to those supplying labor, and a design professional's lien when referring to architects or designers who contribute to a work of improvement. In the realm of personal property, it is also called an artisan's lien. The term "lien" comes from a French root, with a meaning similar to link; it is related to "liaison". Mechanic's liens on property in the United States date from the 18th century.

The bundle of rights is a metaphor to explain the complexities of property ownership. Law school professors of introductory property law courses frequently use this conceptualization to describe "full" property ownership as a partition of various entitlements of different stakeholders.

In the United States, bankruptcy is governed by federal law, commonly referred to as the "Bankruptcy Code" ("Code"). The United States Constitution authorizes Congress to enact "uniform Laws on the subject of Bankruptcies throughout the United States." Congress has exercised this authority several times since 1801, including through adoption of the Bankruptcy Reform Act of 1978, as amended, codified in Title 11 of the United States Code and the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Hypothec, sometimes tacit hypothec, is a term used in mixed legal systems to refer to an express or implied non-possessory real security over corporeal movable property. This real right in security operates by way of hypothecation, often arises by operation of law, and gives a creditor a preferential right to have claims paid out of the hypothecated property as last recourse when the debtor is in default. At common law it is equivalent to an American non-possessory lien or English legal charge.

Lost, mislaid, and abandoned property are categories of the common law of property which deals with personal property or chattel which has left the possession of its rightful owner without having directly entered the possession of another person. Property can be considered lost, mislaid or abandoned depending on the circumstances under which it is found by the next party who obtains its possession.

A security interest is a legal right granted by a debtor to a creditor over the debtor's property which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations. One of the most common examples of a security interest is a mortgage: When person, by the action of an expressed conveyance, pledges by a promise to pay a certain sum of money, with certain conditions, on a said date or dates for a said period, that action on the page with wet ink applied on the part of the one wishing the exchange creates the original funds and negotiable Instrument. That action of pledging conveys a promise binding upon the mortgagee which creates a face value upon the Instrument of the amount of currency being asked for in exchange. It is therein in good faith offered to the Bank in exchange for local currency from the Bank to buy a house. The particular country's Bank Acts usually requires the Banks to deliver such fund bearing negotiable instruments to the Countries Main Bank such as is the case in Canada. This creates a security interest in the land the house sits on for the Bank and they file a caveat at land titles on the house as evidence of that security interest. If the mortgagee fails to pay defaulting in his promise to repay the exchange, the bank then applies to the court to for-close on your property to eventually sell the house and apply the proceeds to the outstanding exchange.

Equitable remedies are judicial remedies developed by courts of equity from about the time of Henry VIII to provide more flexible responses to changing social conditions than was possible in precedent-based common law.

Idem sonans is a legal doctrine whereby a person's identity is presumed known despite the misspelling of his or her name. The presumption lies in the similarity between the Phonology, or sounds of the correct name and the name as written. Such similar-sounding words are called a homonym, while similar-sounding phrases or names would be a holorime.

Tracing is a legal process, not a remedy, by which a claimant demonstrates what has happened to his/her property, identifies its proceeds and those persons who have handled or received them, and asks the court to award a proprietary remedy in respect of the property, or an asset substituted for the original property or its proceeds. Tracing allows transmission of legal claims from the original assets to either the proceeds of sale of the assets or new substituted assets.

In admiralty law, a maritime lien is a privileged claim upon sea-connected property, such as a ship, for services rendered to, or the injuries caused by that property. In common law, a lien is the right of the creditor to retain the properties of his debtor until the debt is paid.

A tax sale is the forced sale of property by a governmental entity for unpaid taxes by the property's owner.

The Landlord and Tenant Act 1985 is a UK Act of Parliament on English land law. It sets bare minimum standards in tenants' rights against their landlords.