Personal property is property that is movable. In common law systems, personal property may also be called chattels or personalty. In civil law systems, personal property is often called movable property or movables – any property that can be moved from one location to another.

A lien is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation. The owner of the property, who grants the lien, is referred to as the lienee and the person who has the benefit of the lien is referred to as the lienor or lien holder.

A mortgage is a legal instrument which is used to create a security interest in real property held by a lender as a security for a debt, usually a loan of money. A mortgage in itself is not a debt, it is the lender's security for a debt. It is a transfer of an interest in land from the owner to the mortgage lender, on the condition that this interest will be returned to the owner when the terms of the mortgage have been satisfied or performed. In other words, the mortgage is a security for the loan that the lender makes to the borrower.

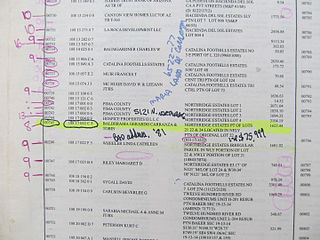

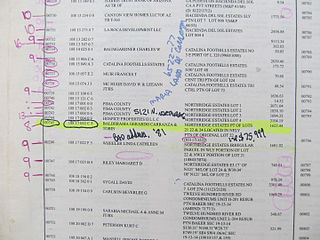

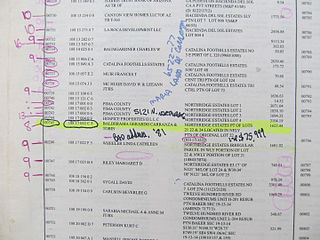

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

A tax lien is a lien imposed by law upon a property to secure the payment of taxes. A tax lien may be imposed for delinquent taxes owed on real property or personal property, or as a result of failure to pay income taxes or other taxes.

A mechanic's lien is a security interest in the title to property for the benefit of those who have supplied labor or materials that improve the property. The lien exists for both real property and personal property. In the realm of real property, it is called by various names, including, generically, construction lien. It is also called a materialman's lien or supplier's lien when referring to those supplying materials, a laborer's lien when referring to those supplying labor, and a design professional's lien when referring to architects or designers who contribute to a work of improvement. In the realm of personal property, it is also called an artisan's lien. The term "lien" comes from a French root, with a meaning similar to link; it is related to "liaison". Mechanic's liens on property in the United States date from the 18th century.

In the United States, bankruptcy is governed by federal law, commonly referred to as the "Bankruptcy Code" ("Code"). The United States Constitution authorizes Congress to enact "uniform Laws on the subject of Bankruptcies throughout the United States". Congress has exercised this authority several times since 1801, including through adoption of the Bankruptcy Reform Act of 1978, as amended, codified in Title 11 of the United States Code and the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Allodial title constitutes ownership of real property that is independent of any superior landlord. Allodial title is related to the concept of land held "in allodium", or land ownership by occupancy and defense of the land. Historically, much of land was uninhabited and could, therefore, be held "in allodium".

Hypothec, sometimes tacit hypothec, is a term used in mixed legal systems to refer to an express or implied non-possessory real security over corporeal movable property. At common law it is equivalent to an American non-possessory lien or English legal charge.

A second mortgage is a lien on a property which is subordinate to a more senior mortgage or loan. Called lien holders positioning, the second mortgage falls behind the first mortgage. This means second mortgages are riskier for lenders and thus generally come with a higher interest rate than first mortgages. This is because if the loan goes into default, the first mortgage gets paid off first before the second mortgage. Commercial loans can have multiple loans as long as the equity supports it.

A home equity loan is a type of loan in which the borrower uses the equity of his or her home as collateral. The loan amount is determined by the value of the property, and the value of the property is determined by an appraiser from the lending institution.

A security interest is a legal right granted by a debtor to a creditor over the debtor's property which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations. One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

A secured loan is a loan in which the borrower pledges some asset as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan. The debt is thus secured against the collateral, and if the borrower defaults, the creditor takes possession of the asset used as collateral and may sell it to regain some or all of the amount originally loaned to the borrower. An example is the foreclosure of a home. From the creditor's perspective, that is a category of debt in which a lender has been granted a portion of the bundle of rights to specified property. If the sale of the collateral does not raise enough money to pay off the debt, the creditor can often obtain a deficiency judgment against the borrower for the remaining amount.

Airservices Australia v Canadian Airlines International Ltd (2000) 202 CLR 133 is a High Court of Australia case that affirms previous High Court definitions of a tax.

In admiralty law, a maritime lien is a privileged claim upon sea-connected property, such as a ship, for services rendered to, or the injuries caused by that property. In common law, a lien is the right of the creditor to retain the properties of his debtor until the debt is paid.

A tax sale is the forced sale of property by a governmental entity for unpaid taxes by the property's owner.

Permanent Mission of India v. City of New York, 551 U.S. 193 (2007), was a United States Supreme Court case in which the Court construed the Foreign Sovereign Immunities Act to allow a federal court to hear a lawsuit brought by the City of New York to recover unpaid property taxes levied against India and Mongolia, both of which own real estate in New York.

A short sale is a sale of real estate in which the net proceeds from selling the property will fall short of the debts secured by liens against the property. In this case, if all lien holders agree to accept less than the amount owed on the debt, a sale of the property can be accomplished.

United Kingdom commercial law is the law which regulates the sale and purchase of goods and services, when doing business in the United Kingdom.

Provident Institution for Savings v. Mayor of Jersey City, 113 U.S. 506 (1885), was a bill in equity filed in the Court of Chancery of New Jersey by the appellant, to foreclose two mortgages given to it on a certain lot in Jersey City, New Jersey by Michael Nugent and wife, and another person.