Related Research Articles

A pension is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement.

Holos Ukrayiny, is a Ukrainian daily newspaper published in Kyiv. Laws adopted by the Verkhovna Rada of Ukraine are published in Holos Ukrayiny when they come into force the next day.

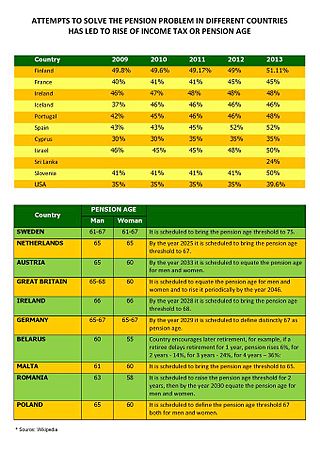

The pensions crisis or pensions timebomb is the predicted difficulty in paying for corporate or government employment retirement pensions in various countries, due to a difference between pension obligations and the resources set aside to fund them. The basic difficulty of the pension problem is that institutions must be sustained over far longer than the political planning horizon. Shifting demographics are causing a lower ratio of workers per retiree; contributing factors include retirees living longer, and lower birth rates. An international comparison of pension institution by countries is important to solve the pension crisis problem. There is significant debate regarding the magnitude and importance of the problem, as well as the solutions. One aspect and challenge of the "Pension timebomb" is that several countries' governments have a constitutional obligation to provide public services to its citizens, but the funding of these programs, such as healthcare are at a lack of funding, especially after the 2008 recession and the strain caused on the dependency ratio by an ageing population and a shrinking workforce, which increases costs of elderly care.

In Australia, superannuation, or just super, is the term for retirement pension benefit funds. Employers make compulsory contributions into these funds on behalf of their employees. Members can also make voluntary contributions subject to limits.

In France employees of some government-owned corporations enjoy a special retirement plan, collectively known as régimes spéciaux de retraite. These professions include employees of the SNCF, the RATP, the electrical and gas companies which used to be government-owned; as well as some employees whose functions are directly related to the State such as the military, French National Police, sailors, Civil law notaries' assistants, employees of the Opéra de Paris, etc. The main differences between the special retirement plan and the usual private sector retirement plans are the retirement age and the number of years a worker must contribute to the fund before being allowed a full pension. In the private sector the minimum retirement age is 62 and the minimum number of quarters of contribution to the retirement fund in order to receive a full pension is between 166 and 172 quarters depending on date of birth. Employees who are enrolled in the special retirement plan can retire earlier.

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

Pensions in Norway fall into three major divisions; State Pensions, Occupational Pensions and Individual or personal Pensions.

The Ministry of Finance of Ukraine is the ministry of the Ukrainian government charged with developing and implementing national financial and budget policies, and with defining national policies in customs and taxation. The ministry is responsible for ensuring that the state has enough resources to perform its functions and that financial policies promote economic growth.

Pensions in Germany are based on a “three pillar system”.

Pensions in Spain consist of a mandatory state pension scheme, and voluntary company and individual pension provision.

India operates a complex pension system. There are however three major pillars to the Indian pension system: the solidarity social assistance called the National Social Assistance Programme (NSAP) for the elderly poor, the civil servants pension and the mandatory defined contribution pension programs run by the Employees' Provident Fund Organisation of India for private sector employees and employees of state owned companies, and several voluntary plans.

The Swiss pension system rests on three pillars:

There are various types of Pensions in Armenia, including social pensions, mandatory funded pensions, or voluntary funded pensions. Currently, Amundi-ACBA and Ampega act as the mandatory pension fund managers within Armenia.

Pensions in Israel consist of a state old age pension system, a private pension system which employees are legally required to participate in and that is supervised and regulated by the government, and a pension system for civil servants.

Luxembourg has an extensive welfare system. It comprises a social security, health, and pension funds. The labour market is highly regulated, and Luxembourg is a corporatist welfare state. Enrollment is mandatory in one of the welfare schemes for any employed person. Luxembourg's social security system is the Centre Commun de la Securite Sociale (CCSS). Both employees and employers make contributions to the fund at a rate of 25% of total salary, which cannot eclipse more than five times the minimum wage. Social spending accounts for 21.8% of GDP.

The Pension Fund of Ukraine is a central executive body that manages a solidarity system of compulsory state pension provision, collects, accumulates and records insurance premiums, allocates pensions and prepares documents for their payment, provides timely and full financing and payment pensions, burial assistance and other social benefits.

Prozorro.Sale is a state-owned enterprise managed by the Ministry of Economy. The enterprise is an online electronic auction system of the same name for the sale and lease of property. The SOE "Prozorro.Sale" administers this IT system, which guarantees the bid security, technical reliability and non-interference in auctions.

The pensions system in Austria is composed of three parts: occupational pensions, private pensions, and state pensions. However, private and occupational pensions are secondary to the public pension issued through the state. According to the Organization for Economic Co-Operation and Development (OECD), Austria's pension system is categorized as targeted. This means that their system is set up to preferentially benefit poorer pensioners than those that are better off.

Public pensions in Greece are designed to provide incomes to Greek pensioners upon reaching retirement. For decades pensions in Greece were known to be among the most generous in the European Union, allowing many pensioners to retire earlier than pensioners in other European countries. This placed a heavy burden on Greece's public finances which made the Greek state increasingly vulnerable to external economic shocks, culminating in a recession due to the 2008 financial crisis and subsequent European debt crisis. This series of crises has forced the Greek government to implement economic reforms aimed at restructuring the pension system and eliminating inefficiencies within it. Measures in the Greek austerity packages imposed upon Greek citizens by the European Central Bank have achieved some success at reforming the pension system despite having stark ramifications for standards of living in Greece, which have seen a sharp decline since the beginning of the crisis.

Galina Yevgeniya Burkatskaya was a Soviet activist of the collective farm movement, twice Hero of Socialist Labor. Member of the Central Committee of the Communist Party in 1952-1966. Deputy of the Supreme Soviet of the USSR of the 3rd-6th convocations, member of the Presidium of the Supreme Soviet of the USSR (1958-1962). Member of the Central Audit Commission of the Communist Party of the Soviet Union (CPSU) in 1961-1966.

References

- ↑ "Про загальнообов'язкове державне пенсійне страхування". Офіційний вебпортал парламенту України (in Ukrainian). Retrieved 2022-01-06.

- ↑ Ukraine: Pension system profile, International Organisation of Pension Supervisors (December 2009)

- ↑ Ukraine (Social Security Programs Throughout the World: Europe, 2014), Social Security Administration (2014)

- 1 2 "Pension System of Ukraine". www.westinvestgroup.com.ua. Retrieved 2018-06-06.

- ↑ "Ukraine | Country profiles | Pension watch". www.pension-watch.net. Retrieved 2022-07-25.

- ↑ "Про недержавне пенсійне забезпечення". Офіційний вебпортал парламенту України (in Ukrainian). Retrieved 2021-11-16.

- ↑ "Pension System of Ukraine". www.westinvestgroup.com.ua. Retrieved 2018-05-02.

- 1 2 "10 things you should know about Ukraine's pension reform • Global Ukraine". global-ukraine.com. Retrieved 2018-06-06.

- ↑ "New law hikes pension burden now, cuts it in future". KyivPost. 2017-10-06. Retrieved 2017-12-10.

- ↑ "New Pension Reform: What It Suggests". Ukraine crisis media center. 2017-10-05. Retrieved 2017-12-10.

- ↑ "Ukraine adopts long-awaited pension reform :: Daily News :: Research :: Concorde Capital. IPO, M&A;, research, sales and trading". Archived from the original on 2017-10-07. Retrieved 2017-10-06.

- ↑ "New law hikes pension burden now, cuts it in future | KyivPost". KyivPost. 2017-10-06. Retrieved 2017-12-10.