The S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE, NASDAQ, or the Cboe BZX Exchange.

TMX Group Limited is a Canadian financial services company that operates equities, fixed income, derivatives, and energy markets exchanges. The company provides services encompassing listings, trading, clearing, settling and depository facilities, information services as well as technology services for the international financial community.

The Montreal Exchange or MX is a derivatives exchange, located in Montreal, that trades futures contracts and options on equities, indices, currencies, ETFs, energy and interest rates. Since 1965, it has been located in the Tour de la Bourse, Montreal's third-tallest building. It is owned by Toronto- based TMX Group.

A commodity price index is a fixed-weight index or (weighted) average of selected commodity prices, which may be based on spot or futures prices. It is designed to be representative of the broad commodity asset class or a specific subset of commodities, such as energy or metals. It is an index that tracks a basket of commodities to measure their performance. These indexes are often traded on exchanges, allowing investors to gain easier access to commodities without having to enter the futures market. The value of these indexes fluctuates based on their underlying commodities, and this value can be traded on an exchange in much the same way as stock index futures.

The NIFTY 50 index is National Stock Exchange of India's benchmark broad based stock market index for the Indian equity market. Full form of NIFTY is National Stock Exchange Fifty. It represents the weighted average of 50 Indian company stocks in 12 sectors and is one of the two main stock indices used in India, the other being the BSE Sensex.

The Philippine Stock Exchange, Inc. is the national stock exchange of the Philippines. The exchange was created in 1992 from the merger of the Manila Stock Exchange and the Makati Stock Exchange. Including previous forms, the exchange has been in operation since 1927.

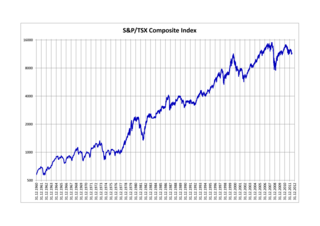

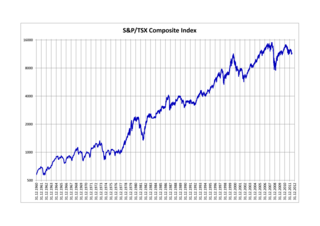

The S&P/TSX Composite Index is the benchmark Canadian index, representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX) with about 250 companies included in it. The Toronto Stock Exchange is made up of over 1,500 companies. On January 4, 2018, the S&P/TSX Composite Index reached an all-time high of 16,412.94. It replaces the earlier TSE 300 index.

The Athens Exchange is "the operator of the regulated markets, the multilateral trading facilities (MTFs) and carbon market as well as the over the counter market (OTC) in Greece". There are five markets operating in ATHEX: regulated securities market, regulated derivatives market, Alternative market, carbon market and OTC market. In the regulated securities market investors can trade in stocks, bonds, ETFs and other related securities. The term Athens Stock Exchange (ASE) is unofficially used for the stock exchange in ATHEX; this term was used in the past more extensively, a fact that was reflected in the address of the former corresponding website of the exchange.

The S&P Global 1200 Index is a free-float weighted stock market index of global equities from Standard & Poor's. The index covers 31 countries and approximately 70 percent of global stock market capitalization. It is composed of seven regional indices:

The S&P/TSX 60 Index is a stock market index of 60 large companies listed on the Toronto Stock Exchange. Maintained by the Canadian S&P Index Committee, a unit of Standard & Poor's, it exposes the investor to ten industry sectors.

The S&P 100 Index is a stock market index of United States stocks maintained by Standard & Poor's.

The S&P/ASX 200 index is a market-capitalization weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange. The index is maintained by Standard & Poor's and is considered the benchmark for Australian equity performance. It is based on the 200 largest ASX listed stocks, which together account for about 82% of Australia’s sharemarket capitalisation.

Canadian Securities Exchange (CSE), formerly the Canadian National Stock Exchange (CNSX), is an alternative stock exchange in Canada. It was the first full stock market to be approved by the Ontario Securities Commission in the past 70 years. The CSE offers simplified reporting requirements and reduced barriers to listing. It is an alternative for micro cap and emerging companies. It had been known as CNQ until the organization re-branded itself in November 2008. It is fully automated, rather than using the traditional "open outcry" physical trading floor system.

The S&P/ASX 20 index is a stock market index of stocks listed on the Australian Securities Exchange from Standard & Poor's. The S&P/ASX 20 index is composed of the 20 largest companies by market capitalisation. All 20 companies also feature in the S&P/ASX 50.

The S&P SL20, or the Standard & Poor's Sri Lanka 20, is a stock market index, based on market capitalization, that follows the performance of 20 leading publicly traded companies listed in the Colombo Stock Exchange. The 20 companies that make up the index is determined by Standard & Poor's global index methodology, according to which the index's listing is reviewed each year. All S&P SL20 listed stocks are classified according to S&P and MSCI's Global Industry Classification Standard, thereby enabling better comparison of performance of Sri Lanka's largest and most liquid stocks with other global indices.