Insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

In voting methods, tactical voting occurs, in elections with more than two candidates, when a voter supports another candidate more strongly than their sincere preference in order to prevent an undesirable outcome.

Within economics the concept of utility is used to model worth or value, but its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or satisfaction within the theory of utilitarianism by moral philosophers such as Jeremy Bentham and John Stuart Mill. But the term has been adapted and reapplied within neoclassical economics, which dominates modern economic theory, as a utility function that represents a consumer's preference ordering over a choice set. As such, it is devoid of its original interpretation as a measurement of the pleasure or satisfaction obtained by the consumer from that choice.

The term homo economicus, or economic man, is the portrayal of humans as agents who are consistently rational, narrowly self-interested, and who pursue their subjectively-defined ends optimally. It is a word play on Homo sapiens, used in some economic theories and in pedagogy.

This aims to be a complete article list of economics topics:

Gray goo is a hypothetical end-of-the-world scenario involving molecular nanotechnology in which out-of-control self-replicating robots consume all biomass on Earth while building more of themselves, a scenario that has been called ecophagy. The original idea assumed machines were designed to have this capability, while popularizations have assumed that machines might somehow gain this capability by accident.

In economics and finance, risk aversion is the behavior of humans, who, when exposed to uncertainty, attempt to lower that uncertainty. It is the hesitation of a person to agree to a situation with an unknown payoff rather than another situation with a more predictable payoff but possibly lower expected payoff. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value.

In economics, contract theory studies how economic actors can and do construct contractual arrangements, generally in the presence of asymmetric information. Because of its connections with both agency and incentives, contract theory is often categorized within a field known as Law and economics. One prominent application of it is the design of optimal schemes of managerial compensation. In the field of economics, the first formal treatment of this topic was given by Kenneth Arrow in the 1960s. In 2016, Oliver Hart and Bengt R. Holmström both received the Nobel Memorial Prize in Economic Sciences for their work on contract theory, covering many topics from CEO pay to privatizations.

In economics and finance, risk neutral preferences are preferences that are neither risk averse nor risk seeking. A risk neutral party's decisions are not affected by the degree of uncertainty in a set of outcomes, so a risk neutral party is indifferent between choices with equal expected payoffs even if one choice is riskier. For example, if offered either $50 or a 50% chance each of $100 and $0, a risk neutral person would have no preference. In contrast, a risk averse person would prefer the first offer, while a risk seeking person would prefer the second.

In mathematical optimization and decision theory, a loss function or cost function is a function that maps an event or values of one or more variables onto a real number intuitively representing some "cost" associated with the event. An optimization problem seeks to minimize a loss function. An objective function is either a loss function or its negative, in which case it is to be maximized.

In camera is a legal term that means in private. The same meaning is sometimes expressed in the English equivalent: in chambers. Generally, in-camera describes court cases, parts of it, or process where the public and press are not allowed to observe the procedure or process. In-camera is the opposite of trial in open court where all parties and witnesses testify in a public courtroom, and attorneys publicly present their arguments to the trier of fact.

For an individual, a risk premium is the minimum amount of money by which the expected return on a risky asset must exceed the known return on a risk-free asset in order to induce an individual to hold the risky asset rather than the risk-free asset. It is positive if the person is risk averse. Thus it is the minimum willingness to accept compensation for the risk.

In economics, game theory, and decision theory, the expected utility hypothesis, concerning people's preferences with regard to choices that have uncertain outcomes (gambles), states that the subjective value associated with an individual's gamble is the statistical expectation of that individual's valuations of the outcomes of that gamble, where these valuations may differ from the dollar value of those outcomes.

Build–operate–transfer (BOT) or build–own–operate–transfer (BOOT) is a form of project financing, wherein a private entity receives a concession from the private or public sector to finance, design, construct, own, and operate a facility stated in the concession contract. This enables the project proponent to recover its investment, operating and maintenance expenses in the project.

Off-the-grid is a system and lifestyle designed to help people function without the support of remote infrastructure, such as an electrical grid. In electricity, off-grid can be stand-alone power system or microgrids typically to provide a smaller community with electricity.

Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. Usually, a project financing structure involves a number of equity investors, known as 'sponsors', a 'syndicate' of banks or other lending institutions that provide loans to the operation. They are most commonly non-recourse loans, which are secured by the project assets and paid entirely from project cash flow, rather than from the general assets or creditworthiness of the project sponsors, a decision in part supported by financial modeling. The financing is typically secured by all of the project assets, including the revenue-producing contracts. Project lenders are given a lien on all of these assets and are able to assume control of a project if the project company has difficulties complying with the loan terms.

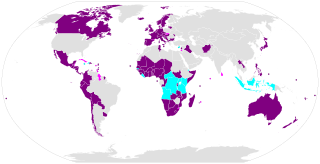

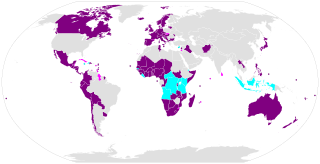

The Convention on Cluster Munitions (CCM) is an international treaty that prohibits the use, transfer, and stockpiling of cluster bombs, a type of explosive weapon which scatters submunitions ("bomblets") over an area. The convention was adopted on 30 May 2008 in Dublin, and was opened for signature on 3 December 2008 in Oslo. It entered into force on 1 August 2010, six months after it was ratified by 30 states. As of September 2018, 108 states have signed the treaty and 105 have ratified it or acceded to it.

Self-report sexual risk behaviors are a cornerstone of reproductive health–related research, particularly when related to assessing risk-related outcomes such as pregnancy or acquisition of sexually transmitted diseases (STDs) such as HIV. Despite their frequency of use, the utility of self-report measures to provide an accurate account of actual behavior are questioned, and methods of enhancing their accuracy should be a critical focus when administering such measures. Self-reported assessments of sexual behavior are prone to a number of measurement concerns which may affect the reliability and validity of a measure, ranging from a participant's literacy level and comprehension of behavioral terminology to recall biases and self-presentation.

A preference is a technical term in psychology, economics and philosophy usually used in relation to choosing between alternatives. For example, someone prefers A over B if they would rather choose A than B.

Instrumental convergence is the hypothetical tendency for most sufficiently intelligent agents to pursue potentially unbounded instrumental goals such as self-preservation and resource acquisition, provided that their ultimate goals are themselves unbounded.