The New South Wales Office of State Revenue (OSR) and State Debt Recovery rebranded as Revenue NSW on 31 July 2017.

The United States federal budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that the U.S. is facing a series of long-term financial challenges, as the population of the country ages and healthcare costs continue growing faster than the economy, leading to the debt held by the public exceeding GDP by 2030. The United States has the largest external debt in the world and the 14th largest government debt as % of GDP in the world.

Proposition 218 was an adopted initiative constitutional amendment which revolutionized local and regional government finance in California. Called the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in 1978.

The Oregon Department of Revenue is the principal tax collection agency in the U.S. state of Oregon. It is charged with administering the state's tax laws and collection of state taxes including personal and corporate income and excise taxes; gift and inheritance taxes; and tobacco taxes and those imposed by more than thirty other tax programs. The agency also has the responsibility for collection of delinquent fees and other accounts on behalf of various state agencies, and provides training to local and regional government finance officials and their staffs. In addition, it appraises and establishes values for properties owned by utilities, forest lands, and most large industrial properties for county tax assessors, who are responsible for administration and collection of property taxes within the state.

The Pennsylvania State Treasurer is the head of the Pennsylvania Treasury Department, an independent department of state government. The state treasurer is elected every four years. Treasurers are limited to two terms.

The Division of Alcoholic Beverages and Tobacco (ABT) is the Florida state government agency which licenses and regulates the sale of alcoholic beverages and tobacco. It is part of the Florida Department of Business and Professional Regulation (DBPR).

The Ministry of Finance is a cabinet ministry in the Government of Thailand.

The Internal Revenue Service (IRS) is the revenue service of the United States federal government. The government agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The IRS is responsible for collecting taxes and administering the Internal Revenue Code, the main body of federal statutory tax law of the United States. The duties of the IRS include providing tax assistance to taxpayers and pursuing and resolving instances of erroneous or fraudulent tax filings. The IRS has also overseen various benefits programs, and enforces portions of the Affordable Care Act.

This article refers to Taxation in Afghanistan.

The New York City Department of Finance (DOF) is the revenue service, taxation agency and recorder of deeds of the government of New York City. Its Parking Violations Bureau is an administrative court that adjudicates parking violations, while its Sheriff's Office is the city's primary civil law enforcement agency.

The Budget of the State of Oklahoma is the Governor's proposal to the Oklahoma Legislature which recommends funding levels to operate the state government for the next fiscal year, beginning July 1. Legislative decisions are governed by rules and legislation regarding the state budget process.

The Oklahoma State Budget for Fiscal Year 2011, is a spending request by Governor Brad Henry to fund government operations for July 1, 2010–June 30, 2011. Governor Henry and legislative leader approved the budget in May 2010. This was Governor Henry's eight and final budget submitted as governor.

The Oklahoma State Budget for Fiscal Year 2012, is a spending request by Governor Mary Fallin to fund government operations for July 1, 2011–June 30, 2012. Governor Fallin proposed the budget on February 7, 2011. This was Governor Fallin's first budget submitted as governor.

The Oklahoma State Budget for Fiscal Year 2010, is a spending request by Governor Brad Henry to fund government operations for July 1, 2009–June 30, 2010. Governor Henry and legislative leader approved the budget in May 2009.

Fiscal policy refers to the "measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures. Fiscal measures are frequently used in tandem with monetary policy to achieve certain goals." In the Philippines, this is characterized by continuous and increasing levels of debt and budget deficits, though there have been improvements in the last few years.

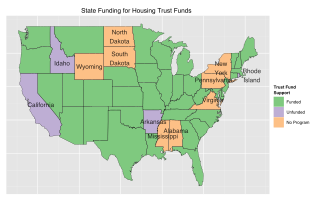

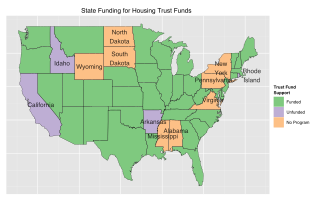

Housing trust funds are established sources of funding for affordable housing construction and other related purposes created by governments in the United States (U.S.). Housing Trust Funds (HTF) began as a way of funding affordable housing in the late 1970s. Since then, elected government officials from all levels of government in the U.S. have established housing trust funds to support the construction, acquisition, and preservation of affordable housing and related services to meet the housing needs of low-income households. Ideally, HTFs are funded through dedicated revenues like real estate transfer taxes or document recording fees to ensure a steady stream of funding rather than being dependent on regular budget processes. As of 2016, 400 state, local and county trust funds existed across the U.S.

The Oklahoma State Budget for Fiscal Year 2015, is a spending request by Governor Mary Fallin to fund government operations for July 1, 2014 – June 30, 2015. Governor Fallin proposed the budget on February 3, 2014. This was Governor Fallin's fourth budget submitted as governor.

The Rivers State Internal Revenue Service was formed in 1993 under the Board of Internal Revenue Law 1993. It is a government agency entrusted to assess, collect and account for all taxes, fees and levies in Rivers State, Nigeria. It is involved in the formulation of tax policy as well as the supervision of revenue collection due to the state. Its headquarters are at 22 William Jumbo Street in Old GRA, Port Harcourt.

The Road Repair and Accountability Act of 2017, also known as the "Gas Tax", and Senate Bill 1 is a California legislative bill that was passed on April 6, 2017 with the aim of repairing roads, improving traffic safety, and expanding public transit systems across the state. The approval of the fuel tax was for $52.4 billion, or $5.24 billion per year, to be raised over the next 10 years to fund the state's infrastructure. It passed 27–11 in the State Senate and 54–26 in the State Assembly. According to California Department of Transportation, for maintenance projects on state highways, while providing funding to enhance trade corridors, transit, and active transportation facilities, in addition to repairing local streets and roads throughout California.

The Minnesota Department of Revenue (DOR) is a department of the State of Minnesota in the United States. The department manages and enforces the reporting, payment, and receipt of state taxes. As of 2017, the Minnesota Department of Revenue administered more than 30 taxes totaling almost $21 billion per year. With more than one thousand employees, the agency is headquartered in Saint Paul, Minnesota, the state's capital city.