An inflationary spike occurs when a particular section of the economy experiences a sudden price rise possibly due to external factors. For example, if a large amount of crop is destroyed, the value of the remaining crop will rise sharply. This will distort the overall measure of inflation (headline inflation). Core inflation seeks to avoid the influence of these spikes by excluding areas of the economy such as food and energy which may be susceptible to such shocks.

Demand-pull inflation occurs when aggregate demand in an economy is more than aggregate supply. It involves inflation rising as real gross domestic product rises and unemployment falls, as the economy moves along the Phillips curve. This is commonly described as "too much money chasing too few goods". More accurately, it should be described as involving "too much money spent chasing too few goods", since only money that is spent on goods and services can cause inflation. This would not be expected to happen, unless the economy is already at a full employment level. It is the opposite of cost-push inflation.

Cost-push inflation is a purported type of inflation caused by increases in the cost of important goods or services where no suitable alternative is available. As businesses face higher prices for underlying inputs, they are forced to increase prices of their outputs. It is contrasted with the theory of demand-pull inflation. Both accounts of inflation have at various times been put forward, with inconclusive evidence as to which explanation is superior. Cost-push inflation can also result from a rise in expected inflation, which in turn the workers will demand higher wages, thus causing inflation.

The economy of Grenada is largely tourism-based, small, and open economy. Over the past two decades, the main thrust of Grenada's economy has shifted from agriculture to services, with tourism serving as the leading foreign currency earning sector. The country's principal export crops are the spices nutmeg and mace. Other crops for export include cocoa, citrus fruits, bananas, cloves, and cinnamon. Manufacturing industries in Grenada operate mostly on a small scale, including production of beverages and other foodstuffs, textiles, and the assembly of electronic components for export.

In economics, stagflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. Stagflation, once thought impossible, poses a dilemma for economic policy, as measures to reduce inflation may exacerbate unemployment.

In economics, inflation is a general increase in the prices of goods and services in an economy. This is usually measured using a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose.

The Phillips curve is an economic model, named after Bill Phillips, that correlates reduced unemployment with increasing wages in an economy. While Phillips did not directly link employment and inflation, this was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place.

In economics, shock therapy is a group of policies intended to be implemented simultaneously in order to liberalize the economy, including liberalization of all prices, privatization, trade liberalization, and stabilization via tight monetary policies and fiscal policies. In the case of post-Communist states, it was implemented in order to transition from a command economy to a market economy.

In macroeconomics, a wage-price spiral is a proposed explanation for inflation, in which wage increases cause price increases which in turn cause wage increases, in a positive feedback loop. Greg Mankiw writes, "At some point, this spiral of ever-rising wages and prices will slow... In the long run, the economy returns to [the point] where the aggregate-demand curve crosses the long-run aggregate-supply curve."

The 1990 oil price shock occurred in response to the Iraqi invasion of Kuwait on August 2, 1990, Saddam Hussein's second invasion of a fellow OPEC member. Lasting only nine months, the price spike was less extreme and of shorter duration than the previous oil crises of 1973–1974 and 1979–1980, but the spike still contributed to the recession of the early 1990s in the United States. The average monthly price of oil rose from $17 per barrel in July to $36 per barrel in October. As the U.S.-led coalition experienced military success against Iraqi forces, concerns about long-term supply shortages eased and prices began to fall.

The price of oil, or the oil price, generally refers to the spot price of a barrel of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus, and Western Canadian Select (WCS). Oil prices are determined by global supply and demand, rather than any country's domestic production level.

Monetary inflation is a sustained increase in the money supply of a country. Depending on many factors, especially public expectations, the fundamental state and development of the economy, and the transmission mechanism, it is likely to result in price inflation, which is usually just called "inflation", which is a rise in the general level of prices of goods and services.

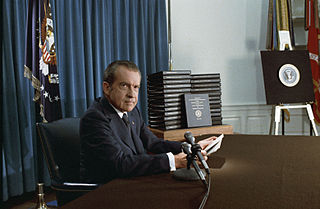

Nixonomics, a portmanteau of the words "Nixon" and "economics", refers either to the performance of the U.S. economy under U.S. President Richard Nixon or the Nixon administration's economic policies. Nixon is the first president to have his surname combined with the word "economics".

Agflation is an economic phenomenon of an advanced increase in the price for food and for industrial agricultural crops when compared with the general rise in prices or with the rise in prices in the non-agricultural sector. The term was increasingly used in the analytical reports, for example, by the investment banks Merrill Lynch in early 2007 and Goldman Sachs in early 2008. They used the term to denote a sharp rise in prices for agricultural products, or, more precisely, a rapid increase in food prices against the background of a decrease in its reserves, a relatively low general inflation rate, and insignificant growth in the level of wages. Agflation has become an increasingly important issue for many governments. From time to time agflation may become so severe that the World Food Programme has described the phenomenon as a "silent tsunami". Agflation endangers food security, particularly for developing countries, and can cause social unrest.

The economic history of Ecuador covers the development of Ecuador's economy throughout its history, beginning with colonization by the Spanish Empire, through independence and up to the 21st century.

Inflation rate in India was 4.83% as of April 2024, as per the Indian Ministry of Statistics and Programme Implementation. This represents a modest reduction from the previous figure of 5.69% for December 2023. CPI for the months of January, February and March 2024 are 5.10, 5.09 and 4.85 respectively. Inflation rates in India are usually quoted as changes in the Consumer Price Index (CPI), for all commodities.

Hyperinflation in Brazil occurred between the first three months of 1990. The monthly inflation rates between January and March 1990 were 71.9%, 71.7% and 81.3% respectively. As accepted by the International Monetary Fund (IMF), hyperinflation is defined as a period of time in which the average price level of goods and services rise by more than 50% a month.

Food prices refer to the average price level for food across countries, regions and on a global scale. Food prices affect producers and consumers of food. Price levels depend on the food production process, including food marketing and food distribution. Fluctuation in food prices is determined by a number of compounding factors. Geopolitical events, global demand, exchange rates, government policy, diseases and crop yield, energy costs, availability of natural resources for agriculture, food speculation, changes in the use of soil and weather events directly affect food prices. To a certain extent, adverse price trends can be counteracted by food politics.

Following the COVID-19 pandemic in 2020, a worldwide surge in inflation began in mid-2021 and lasted until mid-2022. Many countries saw their highest inflation rates in decades. It has been attributed to various causes, including pandemic-related economic dislocation, supply chain disruptions, the fiscal and monetary stimulus provided in 2020 and 2021 by governments and central banks around the world in response to the pandemic, and price gouging. Preexisting factors that may have contributed to the surge included housing shortages, climate impacts, and government budget deficits have also been cited as factors. Recovery in demand from the COVID-19 recession had, by 2021, revealed significant supply shortages across many business and consumer economic sectors.

During 2022 and 2023 there were food crises in several regions as indicated by rising food prices. In 2022, the world experienced significant food price inflation along with major food shortages in several regions. Sub-Saharan Africa, Iran, Sri Lanka, Sudan and Iraq were most affected. Prices of wheat, maize, oil seeds, bread, pasta, flour, cooking oil, sugar, egg, chickpea and meat increased. Many factors have contributed to the ongoing world food crisis. These include supply chain disruptions due to the COVID-19 pandemic, the 2021–2023 global energy crisis, the Russian invasion of Ukraine, and floods and heatwaves during 2021. Droughts were also a factor; in early 2022, some areas of Spain and Portugal lost 60–80% of their crops due to widespread drought.

The 1970s commodities boom refers to the rise of many commodity prices in the 1970s. Excess demand was created with money supply increasing too much and supply shocks that came from Arab–Israeli conflict, initially between Israel and Egypt. The Six-Day War where Israel captured and occupied the Sinai Peninsula for 15 years, the Closure of the Suez Canal (1967–1975) for 8 years of that, lead to supply shocks. 66% of oil consumed by Europe at that time came through the Suez Canal and had to be redirected around the continent of Africa. 15% of all maritime trade passed through the Suez Canal in 1966, the year before it closed.