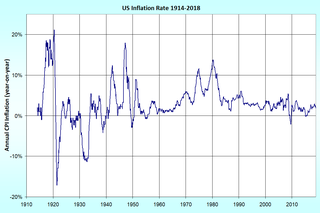

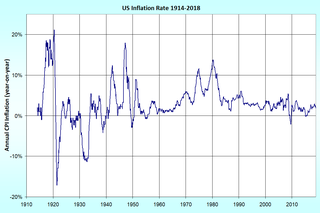

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.

When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. The measure of inflation is the inflation rate, the annualized percentage change in a general price index, usually the consumer price index, over time. The opposite of inflation is deflation.

In finance, a bond is an instrument of indebtedness of the bond issuer to the holders. The most common types of bonds include municipal bonds and corporate bonds.

A Site of Special Scientific Interest (SSSI) in Great Britain or an Area of Special Scientific Interest (ASSI) in the Isle of Man and Northern Ireland is a conservation designation denoting a protected area in the United Kingdom and Isle of Man. SSSI/ASSIs are the basic building block of site-based nature conservation legislation and most other legal nature/geological conservation designations in the United Kingdom are based upon them, including national nature reserves, Ramsar sites, Special Protection Areas, and Special Areas of Conservation. The acronym "SSSI" is often pronounced "triple-S I".

In human sexual behavior, foreplay is a set of emotionally and physically intimate acts between two or more people meant to create sexual arousal and desire for sexual activity. Foreplay results in physiological and mental responses in both parties in anticipation of the expected sexual activity. Either or any of the sexual partners may indicate sexual interest and initiate foreplay, and the initiator may not be the active partner during the sexual activity. Foreplay stimulates both partners' sexuality, lowers inhibitions and increases emotional intimacy between partners, and implies a certain level of confidence and trust between the partners. In animal sexual behavior, the loose equivalent is sometimes termed 'precoital activity'.

The classic, etymological, and salient meaning of interest is the possession of a share in or a right to something. In today's finance and economics, interest is considered a payment from a borrower or deposit-taking financial institution to a usurer, either a lender or depositor, of an amount above repayment of the principal sum, at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs.

Debt is when something, usually money, is owed by one party, the borrower or debtor, to a second party, the lender or creditor. Debt is a deferred payment, or series of payments, that is owed in the future, which is what differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. The term can also be used metaphorically to cover moral obligations and other interactions not based on economic value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person.

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited or borrowed. The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited or borrowed.

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations etc. The recipient incurs a debt, and is usually liable to pay interest on that debt until it is repaid, and also to repay the principal amount borrowed.

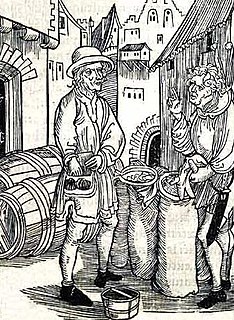

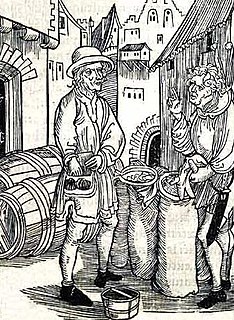

Usury is the practice of making unethical or immoral monetary loans that unfairly enrich the lender. Originally, usury meant interest of any kind. A loan may be considered usurious because of excessive or abusive interest rates or other factors. Historically, in some Christian societies, and in many Islamic societies even today, charging any interest at all would be considered usury. Someone who practices usury can be called a usurer, but a more common term in contemporary English is loan shark.

A conflict of interest (COI) is a situation in which a person or organization is involved in multiple interests, financial or otherwise, and serving one interest could involve working against another. Typically, this relates to situations in which the personal interest of an individual or organization might adversely affect a duty owed to make decisions for the benefit of a third party.

Monetary policy is the process by which the monetary authority of a country, typically the central bank or currency board, controls either the cost of very short-term borrowing or the money supply, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest. Compound interest is standard in finance and economics.

A swap is a derivative in which two counterparties exchange cash flows of one party's financial instrument for those of the other party's financial instrument. The benefits in question depend on the type of financial instruments involved. For example, in the case of a swap involving two bonds, the benefits in question can be the periodic interest (coupon) payments associated with such bonds. Specifically, two counterparties agree to exchange one stream of cash flows against another stream. These streams are called the legs of the swap. The swap agreement defines the dates when the cash flows are to be paid and the way they are accrued and calculated. Usually at the time when the contract is initiated, at least one of these series of cash flows is determined by an uncertain variable such as a floating interest rate, foreign exchange rate, equity price, or commodity price.

In accounting and finance, earnings before interest and taxes (EBIT) is a measure of a firm's profit that includes all incomes and expenses except interest expenses and income tax expenses.

In business and accounting, net income is an entity's income minus cost of goods sold, expenses and taxes for an accounting period. It is computed as the residual of all revenues and gains over all expenses and losses for the period, and has also been defined as the net increase in shareholders' equity that results from a company's operations. In the context of the presentation of financial statements, the IFRS Foundation defines net income as synonymous with profit and loss. The difference between revenue and the cost of making a product or providing a service, before deducting overheads, payroll, taxation, and interest payments. This is different from operating profit.

Riba can be roughly translated as "usury", or unjust, exploitative gains made in trade or business under Islamic law. Riba is mentioned and condemned in several different verses in the Qur'an. It is also mentioned in many hadith.

A mortgage loan or, simply, mortgage is used either by purchasers of real property to raise funds to buy real estate, or alternatively by existing property owners to raise funds for any purpose, while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word mortgage is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form of a collateral for a benefit (loan)".

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's promise to the card issuer to pay them for the amounts plus the other agreed charges. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance.

A bank is a financial institution that accepts deposits from the public and creates credit. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial stability of a country, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords.

Person of Interest is an American science fiction crime drama television series that aired on CBS from September 22, 2011, to June 21, 2016, its five seasons comprising 103 episodes. The series was created by Jonathan Nolan, with Nolan, J. J. Abrams, Bryan Burk, Greg Plageman, Denise Thé, and Chris Fisher serving as executive producers.