The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The monetary policy of The United States is the set of policies which the Federal Reserve follows to achieve its twin objectives of high employment and stable inflation.

In macroeconomics, money supply refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation and demand deposits. Money supply data is recorded and published, usually by the national statistical agency or the central bank of the country. Empirical money supply measures are usually named M1, M2, M3, etc., according to how wide a definition of money they embrace. The precise definitions vary from country to country, in part depending on national financial institutional traditions.

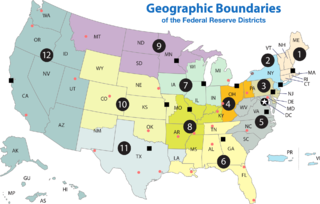

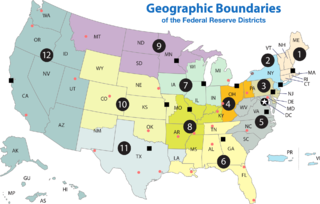

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows:

The chairman of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Board of Governors of the Federal Reserve System. The chairman presides at meetings of the Board.

Janet Louise Yellen is an American economist serving as the 78th United States secretary of the treasury since January 26, 2021. She previously served as the 15th chair of the Federal Reserve from 2014 to 2018. She is the first woman to hold either post, and has also led the White House Council of Economic Advisers.

The Community Reinvestment Act is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods. Congress passed the Act in 1977 to reduce discriminatory credit practices against low-income neighborhoods, a practice known as redlining.

The Federal Reserve System, commonly known as "the Fed," has faced various criticisms since its establishment in 1913. Critics have questioned its effectiveness in managing inflation, regulating the banking system, and stabilizing the economy. Notable critics include Nobel laureate economist Milton Friedman and his fellow monetarist Anna Schwartz, who argued that the Fed's policies exacerbated the Great Depression. More recently, former Congressman Ron Paul has advocated for the abolition of the Fed and a return to a gold standard.

The Depository Institutions Deregulation and Monetary Control Act of 1980 is a United States federal financial statute passed in 1980 and signed by President Jimmy Carter on March 31. It gave the Federal Reserve greater control over non-member banks.

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank.

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the State of New York, the 12 northern counties of New Jersey, Fairfield County in Connecticut, Puerto Rico, and the U.S. Virgin Islands. Located at 33 Liberty Street in Lower Manhattan, it is by far the largest, the most active, and the most influential of the Reserve Banks.

The Federal Reserve Bank of Chicago is one of twelve Federal Reserve Banks that, along with the Federal Reserve Board of Governors, make up the Federal Reserve System, the United States' central bank. The Chicago Fed serves the Seventh District, which encompasses the northern portions of Illinois and Indiana, southern Wisconsin, the Lower Peninsula of Michigan, and the state of Iowa. In addition to participation in the formulation of monetary policy, each Reserve Bank supervises member banks and bank holding companies, provides financial services to depository institutions and the U.S. government, and monitors economic conditions in its District.

The United States Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913. </ref> https://www.federalreserveeducation.org/about-the-fed/archive-history/#:~:text=1913%3A%20The%20Federal%20Reserve%20System%20is%20Born&text=By%20December%2023%2C%201913%2C%20when,private%20banks%20and%20populist%20sentiment.

Lael Brainard is an American economist serving as the 14th director of the National Economic Council since February 21, 2023. She previously served as the 22nd vice chair of the Federal Reserve between May 2022 and February 2023. Prior to her term as vice chair, Brainard served as a member of the Federal Reserve Board of Governors, taking office in 2014. Before her appointment to the Federal Reserve, she served as the under secretary of the treasury for international affairs from 2010 to 2013.

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis that has more than 816,000 economic time series from various sources. They cover banking, business/fiscal, consumer price indexes, employment and population, exchange rates, gross domestic product, interest rates, monetary aggregates, producer price indexes, reserves and monetary base, U.S. trade and international transactions, and U.S. financial data. The time series are compiled by the Federal Reserve and many are collected from government agencies such as the U.S. Census and the Bureau of Labor Statistics.

The Structure of the Federal Reserve System is unique among central banks in the world, with both public and private aspects. It is described as "independent within the government" rather than "independent of government".

This article details the history of banking in the United States. Banking in the United States is regulated by both the federal and state governments.

The Federal Reserve Archival System for Economic Research (FRASER) is a digital archive begun in 2004 by the Federal Reserve Bank of St. Louis to safeguard, preserve and provide easy access to the United States’ economic history, particularly the history of the Federal Reserve System, through digitization of documents related to the U.S. financial system.

The vice chair of the Board of Governors of the Federal Reserve System is the second-highest officer of the Federal Reserve, after the chair of the Federal Reserve. In the absence of the chair, the vice chair presides over the meetings Board of Governors of the Federal Reserve System.