Related Research Articles

A chain letter is a message that attempts to convince the recipient to make a number of copies and pass them on to a certain number of recipients. The "chain" is an exponentially growing pyramid that cannot be sustained indefinitely.

A Ponzi scheme is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, this type of scheme misleads investors by either falsely suggesting that profits are derived from legitimate business activities, or by exaggerating the extent and profitability of the legitimate business activities, leveraging new investments to fabricate or supplement these profits. A Ponzi scheme can maintain the illusion of a sustainable business as long as investors continue to contribute new funds, and as long as most of the investors do not demand full repayment or lose faith in the non-existent assets they are purported to own.

A pyramid scheme is a business model which, rather than earning money by sale of legitimate products to an end consumer, mainly earns money by recruiting new members with the promise of payments. As the number of members multiplies, recruiting quickly becomes increasingly difficult until it is impossible, and therefore most of the newer recruits do not make a profit. As such, pyramid schemes are unsustainable. The unsustainable nature of pyramid schemes has led to most countries outlawing them as a form of fraud.

Email fraud is intentional deception for either personal gain or to damage another individual using email as the vehicle. Almost as soon as email became widely used, it began to be used as a means to defraud people, just as telephony and paper mail were used by previous generations.

A high-yield investment program (HYIP) is a type of Ponzi scheme, an investment scam that promises unsustainably high return on investment by paying previous investors with the money invested by new investors.

A matrix scheme is a business model involving the exchange of money for a certain product with a side bonus of being added to a waiting list for a product of greater value than the amount given. Matrix schemes are also sometimes considered similar to Ponzi or pyramid schemes. They have been called "unsustainable" by the United Kingdom's Office of Fair Trading. A matrix scheme is also an example of an 'exploding queue' in queueing theory.

BurnLounge, Inc. was a multi-level marketing online music store founded in 2004 and based in New York City. By 2006, the company reported 30,000 members using the site to sell music through its network. In 2007, the company was sued by the Federal Trade Commission for being an illegal pyramid scheme. The company lost the suit in 2012, and lost appeal in June 2014. In June 2015, the FTC began returning $1.9 million to people who had lost money in the scheme. The company is dormant pending additional appeals.

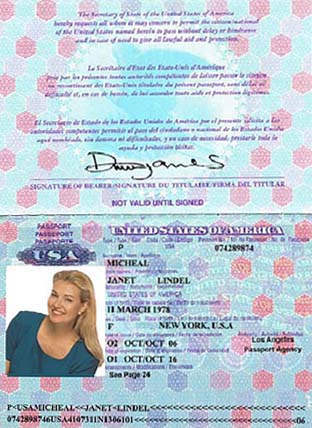

A romance scam is a confidence trick involving feigning romantic intentions towards a victim, gaining the victim's affection, and then using that goodwill to get the victim to send money to the scammer under false pretenses or to commit fraud against the victim. Fraudulent acts may involve access to the victim's money, bank accounts, credit cards, passports, Cash App, e-mail accounts, or national identification numbers; or forcing the victims to commit financial fraud on their behalf.

Employment fraud is the attempt to defraud people seeking employment by giving them false hope of better employment, offering better working hours, more respectable tasks, future opportunities, or higher wages. They often advertise at the same locations as genuine employers and may ask for money in exchange for the opportunity to apply for a job.

Telemarketing fraud is fraudulent selling conducted over the telephone. The term is also used for telephone fraud not involving selling.

Multi-level marketing (MLM), also called network marketing or pyramid selling, is a controversial and sometimes illegal marketing strategy for the sale of products or services in which the revenue of the MLM company is derived from a non-salaried workforce selling the company's products or services, while the earnings of the participants are derived from a pyramid-shaped or binary compensation commission system.

Make Money Fast is a title of an electronically forwarded chain letter created in 1988 which became so infamous that the term is often used to describe all sorts of chain letters forwarded over the Internet, by e-mail spam, or in Usenet newsgroups. In anti-spammer slang, the name is often abbreviated "MMF".

The airplane game, also known as the plane game, is a style of pyramid scheme first recorded in the 1980s in North America and later Western Europe.

Success University, founded in January 2005 by Matt Morris, is a privately held company based in Dallas, Texas. It has also been identified as a pyramid scheme. Success University does not employ any professors and does not have any premises; instead members are offered online courses on topics such as success in business, or physical wellbeing. Members have to pay an introduction fee, and are then encouraged to invite other people to join in exchange for a part of the benefits.

A susu or sou-sou or osusu or asue is a form of rotating savings and credit association, a type of informal savings club arrangement between a small group of people who take turns by throwing hand as the partners call it. The name is used in Africa and the Caribbean. Each person contributes periodically the same amount to a common fund; the total contributions are disbursed to a single member of the group. Each time, the recipient changes so that eventually all members are recipients. Participants of a susu do not make a profit. Instead, small periodic contributions are turned into a larger lump sum of the same value, with the susu acting as a savings club.

Qnet Ltd, formerly known as QuestNet and GoldQuest, is a Hong Kong–based multi-level marketing (MLM) company owned by the QI Group. QNet was founded in 1998 by Vijay Eswaran and Joseph Bismark. The company's products include energy, weight management, nutrition, personal care, home care and fashion accessories on an e-commerce platform.

MMM Global is a Ponzi scheme launched in 2011 by Sergei Mavrodi, with subsidiaries in up to 110 countries. MMM Global is a new avatar of the Russian company MMM, also created by Mavrodi and which operated from 1989 to 2004. The difference between the two is that MMM Global targets developing countries. MMM Global became widely popular in various African countries such as South Africa, Nigeria, Zimbabwe, Kenya and Ghana, with some attributing this popularity to poverty and poor government regulation or law enforcement.

OneCoin is a fraudulent cryptocurrency scheme conducted by offshore companies OneCoin Ltd, based in Bulgaria and registered in Dubai, and OneLife Network Ltd, both founded by Ruja Ignatova in concert with Sebastian Greenwood. OneCoin is considered a Ponzi scheme due to its organisational structure of paying early investors using money obtained from newer ones. It was also a pyramid scheme due to the recruiting of investors without providing any actual product. The company maintained its own database of coins rather than using a blockchain and had no mining process which limited its ability to release and circulate coins. Many of the people central to OneCoin had been previously involved in similar schemes and business malpractice. OneCoin was described by The Times as "one of the biggest scams in history".

Elite Activity is the name used for several pyramid schemes typically targeting Christian churches and their congregations. Elite Activity solicited cash gifts of $100 to start, required participants to sign up two other people, required each of those two to sign up two more, and promised payouts of between $800 and $48,000. Marketing materials emphasized that money paid into the scheme was a gift, using language likened to prosperity gospel teachings.

References

- 1 2 Garrand, Danielle (2018-11-13). ""Secret Sister" gift exchange on Facebook returns — and it's a scam". CBS News. Retrieved 2018-11-16.

- ↑ "Beware of this holiday gift exchange scam circulating on Facebook — again". WGN TV. Chicago, Illinois. Tribune Media Wire. 28 November 2016. Retrieved 14 January 2019.

- ↑ Adams, Dwight (14 December 2017). "7 reasons to avoid the 'Secret Sister Gift Exchange' scam". Indy Star. Indianapolis, Indiana: USA Today. Retrieved 14 January 2019.

- ↑ "Don't fall for the 'secret sister' gift exchange scam on Facebook". News.com.au. Australia. 20 November 2018. Retrieved 14 January 2019.

- ↑ "BBB Warning: "Secret Sister" Gift Exchange is Illegal". Better Business Bureau. 2020-11-10. Retrieved 2020-11-10.

- 1 2 "FACT CHECK: Secret Sisters Gift Exchange". Snopes.com. Retrieved 2018-11-16.

- ↑ "Don't fall for the 'secret sister' gift exchange scam on Facebook". TODAY.com. Retrieved 2018-11-16.