A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich.

Economic inequality is an umbrella term for a) income inequality or distribution of income, b) wealth inequality or distribution of wealth, and c) consumption inequality. Each of these can be measured between two or more nations, within a single nation, or between and within sub-populations.

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes economic inequality which is a concern in almost all countries around the world.

Affluence refers to an individual's or household's economical and financial advantage in comparison to others. It may be assessed through either income or wealth.

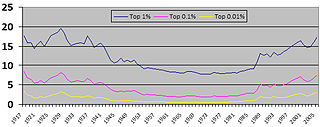

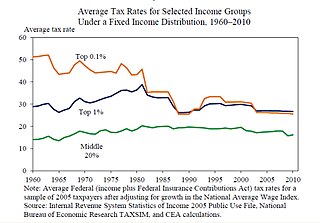

Income inequality has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980.

The inequality of wealth has substantially increased in the United States in recent decades. Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as well as any associated debts.

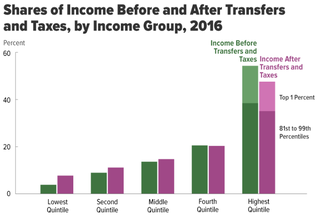

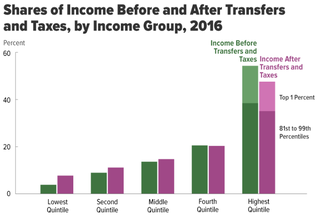

Redistribution of income and wealth is the transfer of income and wealth from some individuals to others through a social mechanism such as taxation, welfare, public services, land reform, monetary policies, confiscation, divorce or tort law. The term typically refers to redistribution on an economy-wide basis rather than between selected individuals.

Thomas Piketty is a French economist who is a professor of economics at the School for Advanced Studies in the Social Sciences, associate chair at the Paris School of Economics and Centennial Professor of Economics in the International Inequalities Institute at the London School of Economics.

The Great Compression refers to the period of substantial wage compression in the United States that began in the early 1940s. During that time, economic inequality as shown by wealth distribution and income distribution between the rich and poor became much smaller than it had been in preceding time periods. The term was reportedly coined by Claudia Goldin and Robert Margo in a 1992 paper, and is a takeoff on the Great Depression, an event during which the Great Compression started.

Occupy Wall Street (OWS) was a left-wing populist movement against economic inequality, corporate greed, big finance, and the influence of money in politics that began in Zuccotti Park, located in New York City's Financial District, and lasted for fifty-nine days—from September 17 to November 15, 2011.

The Buffett Rule is part of a tax plan which would require millionaires and billionaires to pay the same tax rate as middle-class families and working people. It was proposed by President Barack Obama in 2011. The tax plan proposed would apply a minimum tax rate of 30 percent on individuals making more than one million dollars a year. According to a White House official, the new tax rate would directly affect 0.3 percent of taxpayers.

The Occupy movement was an international populist socio-political movement that expressed opposition to social and economic inequality and to the perceived lack of real democracy around the world. It aimed primarily to advance social and economic justice and different forms of democracy. The movement has had many different scopes, since local groups often had different focuses, but its prime concerns included how large corporations control the world in a way that disproportionately benefits a minority, undermines democracy and causes instability.

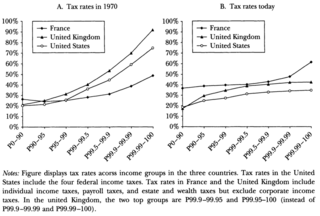

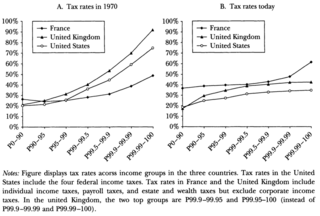

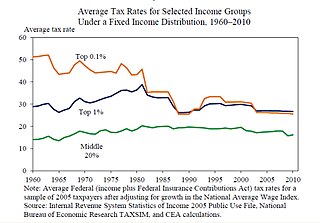

Tax policy and economic inequality in the United States discusses how tax policy affects the distribution of income and wealth in the United States. Income inequality can be measured before- and after-tax; this article focuses on the after-tax aspects. Income tax rates applied to various income levels and tax expenditures primarily drive how market results are redistributed to impact the after-tax inequality. After-tax inequality has risen in the United States markedly since 1980, following a more egalitarian period following World War II.

Since September 2011, the Occupy movement has spread to over 80 countries and 2,700 towns and cities, including in over 90 cities in the United States alone. The movement has generated reactions from the media, the general public, the United States government, and from international governments.

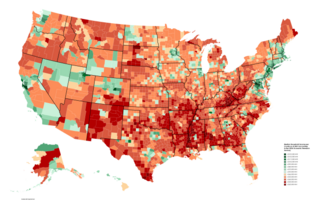

Socioeconomic mobility in the United States refers to the upward or downward movement of Americans from one social class or economic level to another, through job changes, inheritance, marriage, connections, tax changes, innovation, illegal activities, hard work, lobbying, luck, health changes or other factors.

The Occupy Wall Street demonstrations garnered reactions of both praise and criticism from organizations and public figures in many parts of the world. Over time, a long list of notable people from a range of backgrounds began and continue to lend their support or make reference to the Occupy movement in general.

The Great Divergence is a term given to a period, starting in the late 1970s, during which income differences increased in the US and, to a lesser extent, in other countries. The term originated with the Nobel laureate, Princeton economist and The New York Times columnist Paul Krugman, and is a reference to the "Great Compression", an earlier era in the 1930s and the 1940s when incomes became more equal in the US and elsewhere.

Capital in the Twenty-First Century is a book written by French economist Thomas Piketty. It focuses on wealth and income inequality in Europe and the United States since the 18th century. It was first published in French in August 2013; an English translation by Arthur Goldhammer followed in April 2014.

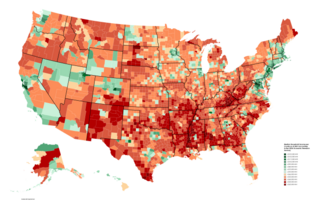

Causes of income inequality in the United States describes the reasons for the unequal distribution of income in the US and the factors that cause it to change over time. This topic is subject to extensive ongoing research, media attention, and political interest.