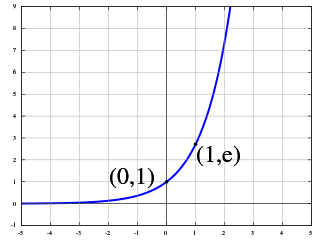

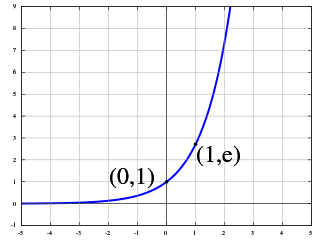

The exponential function is a mathematical function denoted by or . Unless otherwise specified, the term generally refers to the positive-valued function of a real variable, although it can be extended to the complex numbers or generalized to other mathematical objects like matrices or Lie algebras. The exponential function originated from the notion of exponentiation, but modern definitions allow it to be rigorously extended to all real arguments, including irrational numbers. Its ubiquitous occurrence in pure and applied mathematics led mathematician Walter Rudin to opine that the exponential function is "the most important function in mathematics".

Mathematical optimization or mathematical programming is the selection of a best element, with regard to some criterion, from some set of available alternatives. It is generally divided into two subfields: discrete optimization and continuous optimization. Optimization problems of sorts arise in all quantitative disciplines from computer science and engineering to operations research and economics, and the development of solution methods has been of interest in mathematics for centuries.

The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference.

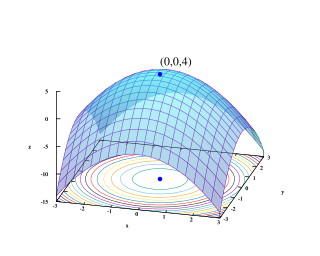

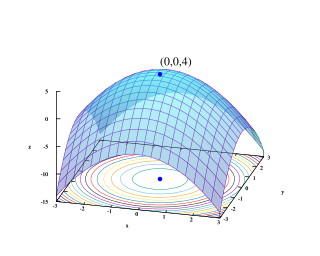

In mathematics and physics, the heat equation is a certain partial differential equation. Solutions of the heat equation are sometimes known as caloric functions. The theory of the heat equation was first developed by Joseph Fourier in 1822 for the purpose of modeling how a quantity such as heat diffuses through a given region.

Bertil Gotthard Ohlin was a Swedish economist and politician. He was a professor of economics at the Stockholm School of Economics from 1929 to 1965. He was also leader of the People's Party, a social-liberal party which at the time was the largest party in opposition to the governing Social Democratic Party, from 1944 to 1967. He served briefly as Minister of Commerce and Industry from 1944 to 1945 in the Swedish coalition government during World War II. He was President of the Nordic Council in 1959 and 1964.

The Modigliani–Miller theorem is an influential element of economic theory; it forms the basis for modern thinking on capital structure. The basic theorem states that in the absence of taxes, bankruptcy costs, agency costs, and asymmetric information, and in an efficient market, the enterprise value of a firm is unaffected by how that firm is financed. This is not to be confused with the value of the equity of the firm. Since the value of the firm depends neither on its dividend policy nor its decision to raise capital by issuing shares or selling debt, the Modigliani–Miller theorem is often called the capital structure irrelevance principle.

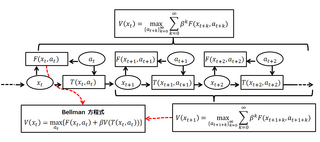

In optimal control theory, the Hamilton-Jacobi-Bellman (HJB) equation gives a necessary and sufficient condition for optimality of a control with respect to a loss function. It is, in general, a nonlinear partial differential equation in the value function, which means its solution is the value function itself. Once this solution is known, it can be used to obtain the optimal control by taking the maximizer of the Hamiltonian involved in the HJB equation.

Economic Order Quantity (EOQ), also known as Economic Buying Quantity (EPQ), is the order quantity that minimizes the total holding costs and ordering costs in inventory management. It is one of the oldest classical production scheduling models. The model was developed by Ford W. Harris in 1913, but R. H. Wilson, a consultant who applied it extensively, and K. Andler are given credit for their in-depth analysis.

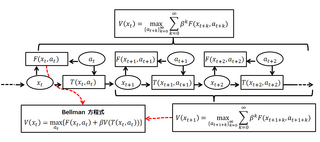

In mathematics, a Markov decision process (MDP) is a discrete-time stochastic control process. It provides a mathematical framework for modeling decision making in situations where outcomes are partly random and partly under the control of a decision maker. MDPs are useful for studying optimization problems solved via dynamic programming. MDPs were known at least as early as the 1950s; a core body of research on Markov decision processes resulted from Ronald Howard's 1960 book, Dynamic Programming and Markov Processes. They are used in many disciplines, including robotics, automatic control, economics and manufacturing. The name of MDPs comes from the Russian mathematician Andrey Markov as they are an extension of Markov chains.

A Bellman equation, named after Richard E. Bellman, is a necessary condition for optimality associated with the mathematical optimization method known as dynamic programming. It writes the "value" of a decision problem at a certain point in time in terms of the payoff from some initial choices and the "value" of the remaining decision problem that results from those initial choices. This breaks a dynamic optimization problem into a sequence of simpler subproblems, as Bellman's “principle of optimality" prescribes. The equation applies to algebraic structures with a total ordering; for algebraic structures with a partial ordering, the generic Bellman's equation can be used.

Stumpage is the price a private firm pays for the right to harvest timber from a given land base. It is paid to the current owner of the land. Historically, the price was determined on a basis of the number of trees harvested, or "per stump". Currently it is dictated by more standard measurements such as cubic metres, board feet, or tons. To determine stumpage, any stand that will be harvested by the firm is first assessed and appraised through processes aimed at finding the volume of timber that is to be harvested. A given stumpage rate, measured in $/volume, is then applied to the amount of timber to be harvested. The firm will then pay this price to the landowner.

This article is the index of forestry topics.

In probability theory, the Kelly criterion, is a formula that determines the optimal theoretical size for a bet. It is valid when the expected returns are known. The Kelly bet size is found by maximizing the expected value of the logarithm of wealth, which is equivalent to maximizing the expected geometric growth rate. J. L. Kelly Jr, a researcher at Bell Labs, described the criterion in 1956. Because the Kelly Criterion leads to higher wealth than any other strategy in the long run, it is a scientific gambling method.

The cross-entropy (CE) method is a Monte Carlo method for importance sampling and optimization. It is applicable to both combinatorial and continuous problems, with either a static or noisy objective.

The following outline is provided as an overview of and topical guide to finance:

In mathematics, the theory of optimal stopping or early stopping is concerned with the problem of choosing a time to take a particular action, in order to maximise an expected reward or minimise an expected cost. Optimal stopping problems can be found in areas of statistics, economics, and mathematical finance. A key example of an optimal stopping problem is the secretary problem. Optimal stopping problems can often be written in the form of a Bellman equation, and are therefore often solved using dynamic programming.

Stochastic approximation methods are a family of iterative methods typically used for root-finding problems or for optimization problems. The recursive update rules of stochastic approximation methods can be used, among other things, for solving linear systems when the collected data is corrupted by noise, or for approximating extreme values of functions which cannot be computed directly, but only estimated via noisy observations.

In forestry, the optimal rotation age is the growth period required to derive maximum value from a stand of timber. The calculation of this period is specific to each stand and to the economic and sustainability goals of the harvester.

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets.