1) The marginal efficiency of capital (MEC) is that rate of discount which would equate the price of a fixed capital asset with its present discounted value of expected income.

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date. The discount, or charge, is the difference between the original amount owed in the present and the amount that has to be paid in the future to settle the debt.

Fixed assets, also known as tangible assets or property, plant and equipment (PP&E), is a term used in accounting for assets and property that cannot easily be converted into cash. This can be compared with current assets such as cash or bank accounts, described as liquid assets. In most cases, only tangible assets are referred to as fixed.

IAS 16 defines Fixed Assets as assets whose future economic benefit is probable to flow into the entity, whose cost can be measured reliably. Fixed assets belong to one of 2 types: "Freehold Assets" – assets which are purchased with legal right of ownership and used, and "Leasehold Assets" – assets used by owner without legal right for a particular period of time.

In economics, capital consists of assets that can enhance one's power to perform economically useful work. For example, in a fundamental sense a stone or an arrow is capital for a caveman who can use it as a hunting instrument, while roads are capital for inhabitants of a city.

The term “marginal efficiency of capital” was introduced by John Maynard Keynes in his General Theory , and defined as “the rate of discount which would make the present value of the series of annuities given by the returns expected from the capital asset during its life just equal its supply price”. [1]

John Maynard Keynes, 1st Baron Keynes, was a British economist, trained mathematician, whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. He built on and greatly refined earlier work on the causes of business cycles, and was one of the most influential economists of the 20th century. Widely considered the founder of modern macroeconomics, his ideas are the basis for the school of thought known as Keynesian economics, and its various offshoots.

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is always less than or equal to the future value because money has interest-earning potential, a characteristic referred to as the time value of money, except during times of negative interest rates, when the present value will be more than the future value. Time value can be described with the simplified phrase, "A dollar today is worth more than a dollar tomorrow". Here, 'worth more' means that its value is greater. A dollar today is worth more than a dollar tomorrow because the dollar can be invested and earn a day's worth of interest, making the total accumulate to a value more than a dollar by tomorrow. Interest can be compared to rent. Just as rent is paid to a landlord by a tenant without the ownership of the asset being transferred, interest is paid to a lender by a borrower who gains access to the money for a time before paying it back. By letting the borrower have access to the money, the lender has sacrificed the exchange value of this money, and is compensated for it in the form of interest. The initial amount of the borrowed funds is less than the total amount of money paid to the lender.

A capital asset is defined to include property of any kind held by an assessee, whether connected with their business or profession or not connected with their business or profession. It includes all kinds of property, movable or immovable, tangible or intangible, fixed or circulating. Thus, land and building, plant and machinery, motorcar, furniture, jewellery, route permits, goodwill, tenancy rights, patents, trademarks, shares, debentures, securities, units, mutual funds, zero-coupon bonds etc. are capital assets.

The MEC is the net rate of return that is expected from the purchase of additional capital. It is calculated as the profit that a firm is expected to earn considering the cost of inputs and the depreciation of capital. It is influenced by expectations about future input costs and demand. The MEC and capital outlays are the elements that a firm takes into account when deciding about an investment project.

In accountancy, depreciation refers to two aspects of the same concept: first, the actual decrease in value of fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wears, and second, the allocation in accounting statements of the original cost of the assets to periods in which the assets are used.

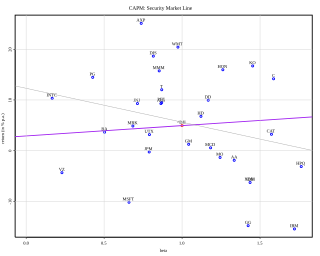

The MEC needs to be higher than the rate of interest, r, for investment to take place. This is because the present value PV of future returns to capital needs to be higher than the cost of capital, Ck. These variables can be expressed as follows:

- where n is the number of years during which the capital will be productive, and Ri is the net return in year i;

- where Ck is the upfront capital outlays; this equation defines the MEC.

Hence, for investment to take place, it is necessary that PV > Ck; that is, MEC > r. As a consequence, an inverse relationship between the rate of interest and investment is found (i.e.: a higher rate of interest generates less investment).

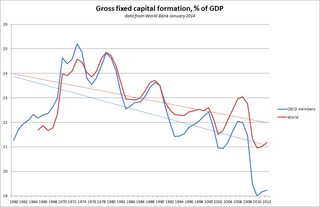

With the European Commission according to its data bank "AMECO" (Annual Macro-Economic Data) the marginal efficiency of capital is defined as "Change in GDP at constant market prices of year T per unit of gross fixed capital formation at constant prices of year T-.5 [that is, lagged by half a year]. [2]

The European Commission (EC) is the executive branch of the European Union, responsible for proposing legislation, implementing decisions, upholding the EU treaties and managing the day-to-day business of the EU. Commissioners swear an oath at the European Court of Justice in Luxembourg City, pledging to respect the treaties and to be completely independent in carrying out their duties during their mandate. The Commissioners are proposed by the Council of the European Union, on the basis of suggestions made by the national governments, and then appointed by the European Council after the approval of the European Parliament. It is common, although not a formal requirement, that the commissioners have previously held senior political positions, such as being a member of the European Parliament or a government minister.

Gross fixed capital formation (GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households less disposals of fixed assets. GFCF is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed.