Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor.

Chapter 7 of Title 11 U.S. Code is the bankruptcy code that governs the process of liquidation under the bankruptcy laws of the U.S. In contrast to bankruptcy under Chapter 11 and Chapter 13, which govern the process of reorganization of a debtor, Chapter 7 bankruptcy is the most common form of bankruptcy in the U.S.

In the United States, bankruptcy is largely governed by federal law, commonly referred to as the "Bankruptcy Code" ("Code"). The United States Constitution authorizes Congress to enact "uniform Laws on the subject of Bankruptcies throughout the United States". Congress has exercised this authority several times since 1801, including through adoption of the Bankruptcy Reform Act of 1978, as amended, codified in Title 11 of the United States Code and the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

In accounting, insolvency is the state of being unable to pay the debts, by a person or company (debtor), at maturity; those in a state of insolvency are said to be insolvent. There are two forms: cash-flow insolvency and balance-sheet insolvency.

A trustee in bankruptcy is an entity, often an individual, in charge of administering a bankruptcy estate.

Bankruptcy in the United Kingdom is divided into separate local regimes for England and Wales, for Northern Ireland, and for Scotland. There is also a UK insolvency law which applies across the United Kingdom, since bankruptcy refers only to insolvency of individuals and partnerships. Other procedures, for example administration and liquidation, apply to insolvent companies. However, the term 'bankruptcy' is often used when referring to insolvent companies in the general media.

The Bankruptcy and Insolvency Act is one of the statutes that regulates the law on bankruptcy and insolvency in Canada. It governs bankruptcies, consumer and commercial proposals, and receiverships in Canada.

An individual voluntary arrangement (IVA) is a formal alternative in England and Wales for individuals wishing to avoid bankruptcy. In Scotland, the equivalent statutory debt solution is known as a protected trust deed.

The Enterprise Act 2002 is an Act of the Parliament of the United Kingdom which made major changes to UK competition law with respect to mergers and also changed the law governing insolvency bankruptcy. It made cartels illegal with a maximum prison sentence of 5 years and states that level of competition in a market should be the basis for investigation.

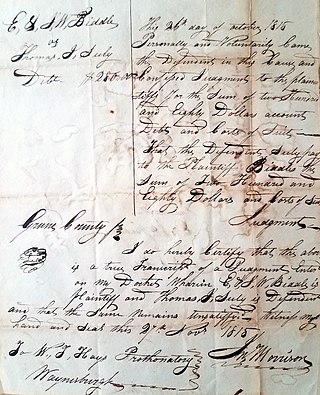

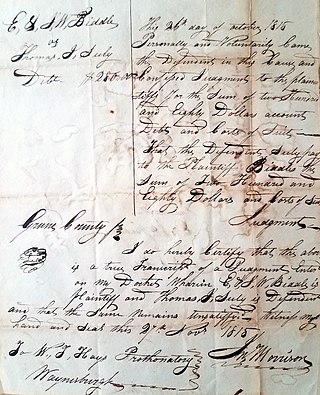

In English and American law, a judgment debtor is a person against whom a judgment ordering him to pay a sum of money has been obtained and remains unsatisfied. Such a person may be examined as to their assets, and if the judgment debt is of the necessary amount he may be made bankrupt if he fails to comply with a bankruptcy notice served on him by the judgment creditors.

Bankruptcy Act is a stock short title used for legislation in Australia, Hong Kong, Malaysia, the Republic of Ireland, the United Kingdom and the United States relating to bankruptcy. The Bill for an Act with this short title will usually have been known as a Bankruptcy Bill during its passage through Parliament.

A private company limited by shares is a class of private limited company incorporated under the laws of England and Wales, Hong Kong, Northern Ireland, Scotland, certain Commonwealth jurisdictions and the Republic of Ireland. It has shareholders with limited liability and its shares may not be offered to the general public, unlike those of a public limited company.

The history of bankruptcy law begins with the first legal remedies available for recovery of debts. Bankruptcy is the legal status of a legal person unable to repay debts.

Bankruptcy in Irish Law is a legal process, supervised by the High Court whereby the assets of a personal debtor are realised and distributed amongst his or her creditors in cases where the debtor is unable or unwilling to pay his debts.

The Act 6 Geo 4 c 16, sometimes called the Bankruptcy Act 1825, the Bankrupt Act, the Bankrupts Act 1825 or the Bankrupts England Act 1825, was an Act of the Parliament of the United Kingdom. It was repealed by section 1 of, and Schedule A to, the Bankrupt Law Consolidation Act 1849. It was repealed for the Republic of Ireland by section 2(1) and 3 of, and Part 4 of Schedule 2 to, the Statute Law Revision Act 2007.

The Bankruptcy Act 1861 was an Act of the Parliament of the United Kingdom.

Bankruptcy tourism is the phenomenon whereby residents of one country move to another jurisdiction in order to declare a personal bankruptcy there, before returning to their original country of residence. This is done in order facilitate bankruptcy in a new jurisdiction where the insolvency laws are deemed to be more favourable. It is most prevalent in Europe where EU laws allow the free movement of residents to other Eurozone countries. Once in the new jurisdiction a person seeking bankruptcy must establish their Centre of Main Interests there in order to qualify as a resident and, therefore, petition for a successful bankruptcy.

British Virgin Islands bankruptcy law is principally codified in the Insolvency Act, 2003, and to a lesser degree in the Insolvency Rules, 2005. Most of the emphasis of bankruptcy law in the British Virgin Islands relates to corporate insolvency rather than personal bankruptcy. As an offshore financial centre, the British Virgin Islands has many times more resident companies than citizens, and accordingly the courts spend more time dealing with corporate insolvency and reorganisation.

Anguillan bankruptcy law regulates the position of individuals and companies who are unable to meet their financial obligations.

The Bankruptcy Act 1967, is a Malaysian laws which enacted relating to the law of bankruptcy.