Council Tax is a local taxation system used in England, Scotland and Wales. It is a tax on domestic property which was introduced in 1993 by the Local Government Finance Act 1992, replacing the short lived Community Charge, which in turn replaced the domestic rates. Each property is assigned one of, eight bands in England and Scotland, or nine bands in Wales based on property value, and the tax is set as a fixed amount for each band. The more valuable the property, the higher the tax, except for properties valued above £320,000. Some property is exempt from the tax, some people are exempt from the tax, while some get a discount.

The Valuation Office Agency is a government body in England and Wales. It is an executive agency of Her Majesty's Revenue and Customs.

Business rates in England or non-domestic rates is a tax on the occupation of non-domestic property. Rates are a property tax with ancient roots that was formerly used to fund local services that was formalised with the Poor Law 1572 and superseded by the Poor Law of 1601. The Local Government Finance Act 1988 introduced business rates in England and Wales from 1990, repealing its immediate predecessor, the General Rate Act 1967. The act also introduced business rates in Scotland, but as an amendment to the existing system which had evolved separately to that in the rest of Great Britain. Since the establishment, in 1997, of a Welsh Assembly able to pass legislation, the English and Welsh systems have been able to diverge. In 2015 business rates for Wales were devolved.

The Merchant Shipping (Pollution) Act 2006 is an Act of the Parliament of the United Kingdom. It has three main purposes: to give effect to the Supplementary Fund Protocol 2003, to give effect to Annex IV of the MARPOL Convention, and to amend section 178(1) of the Merchant Shipping Act 1995.

In British law and some related legal terms, an enactment is spent if it is "exhausted in operation by the accomplishment of the purposes for which it was enacted".

The Holocaust Act 2009 is an Act of the Parliament of the United Kingdom. Its purpose is to confer, on certain national institutions, a power that was already possessed by other museums to return to their rightful owners cultural objects unlawfully acquired during the Nazi era. It was introduced into Parliament as the Holocaust Restitution Bill. The Bill was amended to give it a different name.

The Corporation Tax Act 2009 is an Act of the Parliament of the United Kingdom. It restated certain legislation relating to corporation tax, with minor changes that were mainly intended "to clarify existing provisions, make them consistent or bring the law into line with well established practice." The Bill was the work of the Tax Law Rewrite Project team at HM Revenue and Customs.It has the distinction of being the longest Act in British Parliamentary history

The Health and Safety (Offences) Act 2008 is an Act of the Parliament of the United Kingdom.

The Rating Act 2007 is an Act of the Parliament of the United Kingdom. It implements recommendations of the Barker Review of Land Use Planning and the Lyons Inquiry into Local Government, and proposals in the report Budget 2007: Building Britain's long-term future: Prosperity and fairness for families.

The Natural Environment and Rural Communities Act 2006, also referred to as the NERC Act (2006), is an Act of the Parliament of the United Kingdom.

The Housing Corporation (Delegation) etc. Act 2006 is an Act of the Parliament of the United Kingdom. It was enacted because it was discovered that the Housing Corporation had been delegating its functions without lawful authority. Its purpose was to retroactively legalise this.

The Commons Act 2006 is an Act of the Parliament of the United Kingdom. It implements recommendations contained in the Common Land Policy Statement 2002.

The Commissioner for Older People (Wales) Act 2006 is an Act of the Parliament of the United Kingdom that establishes the office of Commissioner for Older People in Wales. The Report and Recommendations of the Welsh Assembly Government’s Advisory Group on a Commissioner for Older People in Wales published in March 2004 is the precursor of the Act.

The International Organisations Act 2005 is an Act of the Parliament of the United Kingdom. Its purpose is to enable the United Kingdom to fulfil a number of international commitments.

The Income Tax Act 2005 is an Act of the Parliament of the United Kingdom.

The Child Benefit Act 2005 is an Act of the Parliament of the United Kingdom.

The Income Tax Act 2003 is an Act of the Parliament of the United Kingdom.

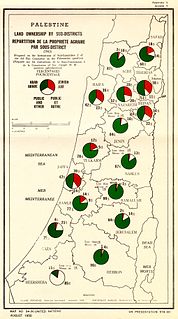

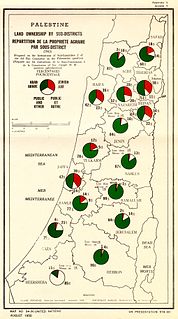

Village Statistics, 1945 was a joint survey work prepared by the Government Office of Statistics and the Department of Lands of the British Mandate Government for the Anglo-American Committee of Inquiry on Palestine which acted in early 1946. The data were calculated as of April 1, 1945, and was later published and also served the UNSCOP committee that operated in 1947.

Rates are a tax on property in the United Kingdom used to fund local government. Business rates are collected throughout the United Kingdom. Domestic rates are collected in Northern Ireland and were collected in England and Wales before 1990 and in Scotland before 1989.