A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities.

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

The soybean, soy bean, or soya bean is a species of legume native to East Asia, widely grown for its edible bean, which has numerous uses.

In finance, a futures contract is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. Because it is a function of an underlying asset, a futures contract is a derivative product.

Pit is a fast-paced card game for three to eight players, designed to simulate open outcry bidding for commodities. The game first went on sale in 1904 by the American games company Parker Brothers, having been developed by the clairvoyant Edgar Cayce.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. Originally, the exchange was a non-profit organization. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

Tokyo Commodity Exchange, also known as TOCOM, is Japan's largest and one of Asia's most prominent commodity futures exchanges. TOCOM operates electronic markets for precious metals, oil, rubber and soft commodities. It offers futures and options contracts for precious metals ; energy ; natural rubber and agricultural products.

Central Japan Commodity Exchange (C-COM) was a futures exchange based in Nagoya, Japan that closed in 2011.

Fukuoka Futures Exchange (FFE) was a futures exchange founded 1893, based in Fukuoka, Japan. It was absorbed by Kansai Commodities Exchange, based in Ôsaka, and no longer exists. Trading was conducted at six specified session times through the day. At each session, a price was established for each contract month in each commodity. Daily price movement limits apply, including open position limits for members and customers. There were no position limits for hedging.

Zhengzhou Commodity Exchange, established in 1990, is a futures exchange in Zhengzhou, one of the four futures exchanges in China. The ZCE is under the vertical management of China Securities Regulatory Commission (CSRC).

The Dalian Commodity Exchange (DCE) is a Chinese futures exchange based in Dalian, Liaoning province, China. It is a non-profit, self-regulating and membership legal entity established on February 28, 1993.

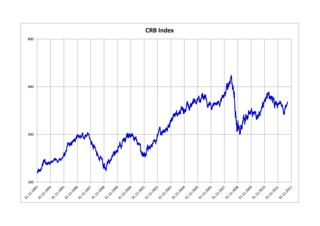

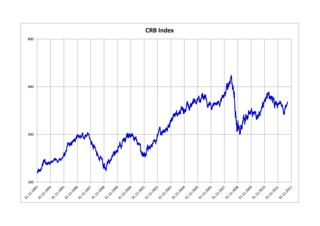

The Refinitiv/CoreCommodity CRB Index is a commodity futures price index. It was first calculated by Commodity Research Bureau, Inc. in 1957 and made its inaugural appearance in the 1958 CRB Commodity Year Book.

A commodity broker is a firm or an individual who executes orders to buy or sell commodity contracts on behalf of the clients and charges them a commission. A firm or individual who trades for his own account is called a trader. Commodity contracts include futures, options, and similar financial derivatives. Clients who trade commodity contracts are either hedgers using the derivatives markets to manage risk, or speculators who are willing to assume that risk from hedgers in hopes of a profit.

The Rosario Board of Trade is a non-profit making association based in Rosario, in the Province of Santa Fe, Argentina. Founded on August 18, 1884, it serves as a forum for the conduct of trade negotiations in several markets including grain, oilseed, agricultural products and their by-products, as well as securities and other assets.

The revealed comparative advantage is an index used in international economics for calculating the relative advantage or disadvantage of a certain country in a certain class of goods or services as evidenced by trade flows. It is based on the Ricardian comparative advantage concept.

Commodity trading in China has a short but high-growth history. With an increasing product variety and deepening liquidity pools, the mainland's futures market is playing an increasingly important role in serving the national economy.

A genetically modified soybean is a soybean that has had DNA introduced into it using genetic engineering techniques. In 1996 the first genetically modified soybean was introduced to the U.S. market, by Monsanto. In 2014, 90.7 million hectares of GM soy were planted worldwide, 82% of the total soy cultivation area.

The commodity status of animals is the legal status as property of most non-human animals, particularly farmed animals, working animals and animals in sport, and their use as objects of trade. In the United States, Free-roaming animals are (broadly) held in trust by the state; only if captured can be claimed as personal property.

Osaka Dojima Commodity Exchange (ODE) is a futures exchange based in Osaka, Japan. It started as the Osaka Grain Exchange in 1952. In 1993 it merged with the Osaka Sugar Exchange and the Kobe Grain Exchange, taking the name Kansai Agricultural Commodities Exchange. The exchange merged with the Kobe Raw Silk Exchange in 1997, becoming the Kansai Commodities Exchange (KEX), and with the Fukuoka Commodities Exchange in 2006. In February 2013 it took over the rice exchange from the Tokyo Grain Exchange and took its current name.