The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Hay–Pauncefote Treaty is a treaty signed by the United States and Great Britain on 18 November 1901, as a legal preliminary to the U.S. building of the Panama Canal. It nullified the Clayton–Bulwer Treaty of 1850 and gave the United States the right to create and control a canal across the Central American isthmus to connect the Pacific Ocean and the Atlantic Ocean. In the Clayton–Bulwer Treaty, both nations had renounced building such a canal under the sole control of one nation.

The president of the Republic of Singapore is the head of state of Singapore. The president represents the country in official diplomatic functions and possesses certain executive powers over the Government of Singapore, including the control of the national reserves and the ability to revoke and appoint public service appointments.

The chairman of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Board of Governors of the Federal Reserve System. The chairman presides at meetings of the Board.

The Reserve Bank of Australia (RBA) is Australia's central bank and banknote issuing authority. It has had this role since 14 January 1960, when the Reserve Bank Act 1959 removed the central banking functions from the Commonwealth Bank.

The Reserve Bank of New Zealand (RBNZ) is the central bank of New Zealand. It was established in 1934 and is currently constituted under the Reserve Bank of New Zealand Act 2021. The governor of the Reserve Bank, currently Adrian Orr, is responsible for New Zealand's currency and operating monetary policy.

A military discharge is given when a member of the armed forces is released from their obligation to serve. Each country's military has different types of discharge. They are generally based on whether the persons completed their training and then fully and satisfactorily completed their term of service. Other types of discharge are based on factors such as the quality of their service, whether their service had to be ended prematurely due to humanitarian or medical reasons, whether they had been found to have drug or alcohol dependency issues and whether they were complying with treatment and counseling, and whether they had demerits or punishments for infractions or were convicted of any crimes. These factors affect whether they will be asked or allowed to re-enlist and whether they qualify for benefits after their discharge.

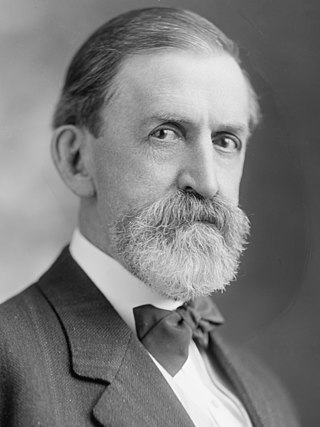

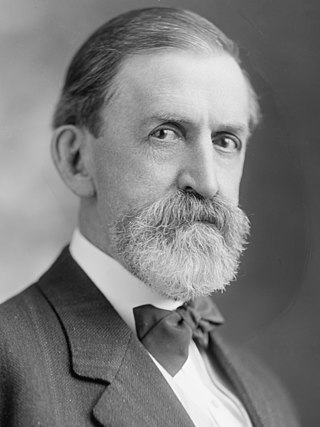

John Worth Kern was a Democratic United States Senator from Indiana. While the title was not official, he is considered to be the first Senate majority leader, while serving concurrently as chairman of the Senate Democratic Caucus. He was also the Democratic vice presidential nominee in the 1908 presidential election.

Proposition 59 was an amendment of the Constitution of California that introduced freedom of information or "sunshine" provisions. It was proposed by the California Legislature and overwhelmingly approved by the voters in an initiative held as part of the November 2004 elections.

Auxiliary police, also called volunteer police, reserve police, assistant police, civil guards, or special police, are usually the part-time reserves of a regular police force. They may be unpaid volunteers or paid members of the police service with which they are affiliated.

The 63rd United States Congress was a meeting of the legislative branch of the United States federal government, composed of the United States Senate and the United States House of Representatives. It met in Washington, D.C. from March 4, 1913, to March 4, 1915, during the first two years of Woodrow Wilson's presidency. The apportionment of seats in the House of Representatives was based on the 1910 United States census.

The USA PATRIOT Act was passed by the United States Congress in 2001 as a response to the September 11, 2001 attacks. It has ten titles, each containing numerous sections. Title III: International Money Laundering Abatement and Financial Anti-Terrorism Act of 2001 is actually an act of Congress in its own right as well as being a title of the USA PATRIOT Act, and is intended to facilitate the prevention, detection and prosecution of international money laundering and the financing of terrorism. The title's sections primarily amend portions of the Money Laundering Control Act of 1986 and the Bank Secrecy Act of 1970.

The Expedited Funds Availability Act was enacted in 1987 by the United States Congress for the purpose of standardizing hold periods on deposits made to commercial banks and to regulate institutions' use of deposit holds. It is also referred to as Regulation CC or Reg CC, after the Federal Reserve regulation that implements the act. The law is codified in Title 12, Chapter 41 of the US Code and Title 12, Part 229 of the Code of Federal Regulations.

The USA PATRIOT Act was passed by the United States Congress in 2001 as a response to the September 11 attacks in 2001. It has ten titles, with the third title written to prevent, detect, and prosecute international money laundering and the financing of terrorism.

The Pujo Committee was a United States congressional subcommittee in 1912–1913 that was formed to investigate the so-called "money trust", a community of Wall Street bankers and financiers that exerted powerful control over the nation's finances. After a resolution introduced by congressman Charles Lindbergh Sr. for a probe on Wall Street power, congressman Arsène Pujo of Louisiana was authorized to form a subcommittee of the House Committee on Banking and Currency. In 1913–1914, the findings inspired public support for ratification of the Sixteenth Amendment that authorized a federal income tax, passage of the Federal Reserve Act, and passage of the Clayton Antitrust Act.

Bank regulation in the United States is highly fragmented compared with other G10 countries, where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure, it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike Japan and the United Kingdom. Bank examiners are generally employed to supervise banks and to ensure compliance with regulations.

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing financial institutions and banks. The bill was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and was signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008. It created the $700 billion Troubled Asset Relief Program (TARP), which utilized congressionally appropriated taxpayer funds to purchase toxic assets from failing banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

The powers of the president of Singapore are divided into those which the president may exercise at their own discretion, and those they must exercise in accordance with the advice of the Cabinet of Singapore or of a minister acting under the general authority of the Cabinet. In addition, the president is required to consult the Council of Presidential Advisers (CPA) when performing some of their functions. In other cases, the president may consult the CPA if they wish to but is not bound to do so.

The Federal Reserve Reform Act of 1977 enacted a number of reforms to the Federal Reserve, making it more accountable for its actions on monetary and fiscal policy and tasking it with the goal to "promote maximum employment, production, and price stability". The act explicitly established price stability as a national policy goal for the first time. It also required quarterly reports to Congress "concerning the ranges of monetary and credit aggregates for the upcoming 12 months." It also modified the selection of the Class B and C Reserve Bank Directors. Discrimination on the basis of race, creed, color, sex, or national origin was prohibited, and the composition of the directors was required to represent interests of "agriculture, commerce, industry, services, labor and consumers". The Federal Reserve Act, which created the Federal Reserve in 1913, made no mention of services, labor, and consumers. Finally, the act established Senate confirmation of chairmen and vice chairmen of the Board of Governors of the Federal Reserve. The Federal Reserve Reform Act made the Federal Reserve more transparent to Congressional oversight.

The vice chair of the Board of Governors of the Federal Reserve System is the second-highest officer of the Federal Reserve, after the chair of the Federal Reserve. In the absence of the chair, the vice chair presides over the meetings Board of Governors of the Federal Reserve System.