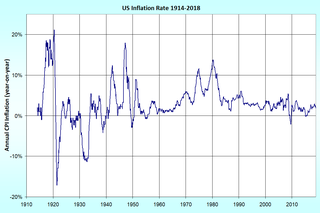

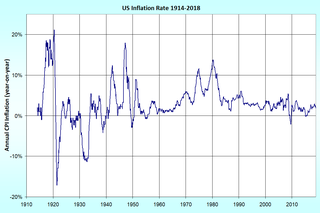

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. The measure of inflation is the inflation rate, the annualized percentage change in a general price index, usually the consumer price index, over time. The opposite of inflation is deflation.

Purchasing power parity (PPP) is a way of measuring economic variables in different countries so that irrelevant exchange rate variations do not distort comparisons. Purchasing power exchange rates are such that it would cost exactly the same number of, for example, US dollars to buy euros and then buy a basket of goods in the market as it would cost to purchase the same goods directly with dollars. The purchasing power exchange rate used in this conversion equals the ratio of the currencies' respective purchasing powers.

In economics, the GDP deflator is a measure of the level of prices of all new, domestically produced, final goods and services in an economy in a year. GDP stands for gross domestic product, the total monetary value of all final goods and services produced within the territory of a country over a particular period of time.

Pricing is the process whereby a business sets the price at which it will sell its products and services, and may be part of the business's marketing plan. In setting prices, the business will take into account the price at which it could acquire the goods, the manufacturing cost, the market place, competition, market condition, brand, and quality of product.

A market basket or commodity bundle is a fixed list of items, in given proportions, used specifically to track the progress of inflation in an economy or specific market.

A cost-of-living index is a theoretical price index that measures relative cost of living over time or regions. It is an index that measures differences in the price of goods and services, and allows for substitutions with other items as prices vary.

An extended warranty, sometimes called a service agreement, a service contract, or a maintenance agreement, is a prolonged warranty offered to consumers in addition to the standard warranty on new items. The extended warranty may be offered by the warranty administrator, the retailer or the manufacturer. Extended warranties cost extra and for a percentage of the item's retail price. Occasionally, some extended warranties that are purchased for multiple years state in writing that during the first year, the consumer must still deal with the manufacturer in the occurrence of malfunction. Thus, what is often promoted as a five-year extended guarantee, for example, is actually only a four-year guarantee.

The personal consumption expenditure (PCE) measure is the component statistic for consumption in gross domestic product (GDP) collected by the United States Bureau of Economic Analysis (BEA). It consists of the actual and imputed expenditures of households and includes data pertaining to durable and non-durable goods and services. It is essentially a measure of goods and services targeted towards individuals and consumed by individuals.

Substitution bias describes a possible bias in economic index numbers if they do not incorporate data on consumer expenditures switching from relatively more expensive products to cheaper ones as prices changed.

In the United Kingdom, the retail prices index or retail price index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and services.

The Boskin Commission, formally called the "Advisory Commission to Study the Consumer Price Index", was appointed by the United States Senate in 1995 to study possible bias in the computation of the Consumer Price Index (CPI), which is used to measure inflation in the United States. Its final report, titled "Toward A More Accurate Measure Of The Cost Of Living" and issued on December 4, 1996, concluded that the CPI overstated inflation by about 1.1 percentage points per year in 1996 and about 1.3 percentage points prior to 1996.

The United States Consumer Price Index (CPI) is a set of consumer price indices calculated by the U.S. Bureau of Labor Statistics (BLS). To be precise, the BLS routinely computes many different CPIs that are used for different purposes. Each is a time series measure of the price of consumer goods and services. The BLS publishes the CPI monthly.

The United States Chained Consumer Price Index (C-CPI-U), also known as chain-weighted CPI or chain-linked CPI is a time series measure of price levels of consumer goods and services created by the Bureau of Labor Statistics as an alternative to the US Consumer Price Index. It is based on the idea that in an inflationary environment, consumers will choose less-expensive substitutes. This reduces the rate of cost of living increases through the reduction of the quality of consumed goods. The "fixed weight" CPI also takes such substitutions into account, but does so through a periodic adjustment of the "basket of goods" that it represents, rather than through a continuous estimation of the declining quality of goods consumed. Application of the chained CPI to federal benefits has been controversially proposed to reduce the federal deficit.

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.

Economists and marketers use of the Search, Experience, Credence (SEC) classification of goods and services, which is based on the ease or difficulty with which consumers can evaluate or obtain information. These days most economics and marketers treat the three classes of goods as a continuum. Archetypal goods are: