Related Research Articles

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

The Toronto Stock Exchange is a stock exchange located in Toronto, Ontario, Canada. It is the 10th largest exchange in the world and the third largest in North America based on market capitalization. Based in the EY Tower in Toronto's Financial District, the TSX is a wholly owned subsidiary of the TMX Group for the trading of senior equities.

TMX Group Limited is a Canadian financial services company that operates equities, fixed income, derivatives, and energy markets exchanges. The company provides services encompassing listings, trading, clearing, settling and depository facilities, information services as well as technology services for the international financial community.

Dow Jones is a combination of the names of business partners Charles Dow and Edward Jones.

CCL Industries Inc. is an American-Canadian company founded in 1951. It describes itself as the world's largest label maker. It is listed on the Toronto Stock Exchange, and is an S&P/TSX 60 Component. CCL consists of five divisions – CCL Label, CCL Container, Avery, Checkpoint, and Innovia. It has 154 manufacturing facilities in North America, Latin America, Europe, Asia, Australia and Africa operated by approximately 20,000 employees.

The Chicago Board Options Exchange (CBOE), located at 433 West Van Buren Street in Chicago, is the largest U.S. options exchange with an annual trading volume of around 1.27 billion at the end of 2014. CBOE offers options on over 2,200 companies, 22 stock indices, and 140 exchange-traded funds (ETFs).

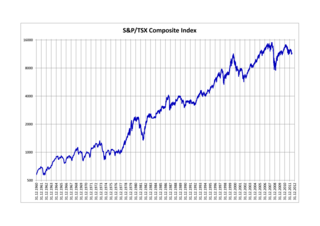

The S&P/TSX Composite Index is the benchmark Canadian index representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX). Having replaced the TSE 300 Composite Index on May 1, 2002, as of September 20, 2021 the S&P/TSX Composite Index comprises 237 of the 3,451 companies listed on the TSX. The index reached an all-time closing high of 22,185.25 on April 1, 2024 and an intraday record high of 22,220.91 on March 28, 2024.

The S&P Global 1200 Index is a free-float weighted stock market index of global equities from Standard & Poor's. The index was launched on Sep 30, 1999 and covers 31 countries and approximately 70 percent of global stock market capitalization. It is composed of seven regional indices:

The S&P/ASX 50 Index is a stock market index of Australian stocks listed on the Australian Securities Exchange from Standard & Poor's.

A capitalization-weightedindex, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value, in a capitalization-weighted index. In other types of indices, different ratios are used.

Canadian Securities Exchange (CSE), operated by CNSX Inc., is a stock exchange domiciled in Canada. When recognized by the Ontario Securities Commission in 2004, CSE was the first new exchange approved in Ontario in 70 years. The CSE is a rapidly growing stock exchange focused on working with entrepreneurs to access the public capital markets in Canada and internationally. The Exchange's efficient operating model, advanced technology and low fee structure help companies of all sizes minimize their cost of capital and maximize access to liquidity.

The S&P/TSX Venture Composite Index is a stock market index intended as a broad market indicator for the TSX Venture Exchange, which lists Canadian companies that do not meet the criteria to be listed on the Toronto Stock Exchange. The index includes about 500 companies, weighted by market capitalization. It is revised quarterly to remove companies which have a weight of less than 0.05% of the index, and to include companies which, if included, would have a weight of more than 0.05%. The index is managed by Standard & Poor's, which also manages other stock market indices in Canada and other countries.

The S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

New Gold Inc. is a Canadian mining company that owns and operates the New Afton gold-silver-copper mine in British Columbia and the Rainy River gold-silver mine in Ontario, Canada. Through a Mexican subsidiary company, they also own the Cerro San Pedro gold-silver mine in San Luis Potosí, Mexico, which ceased operation in 2017. While New Gold was founded in 1980 for the purposes of mineral exploration, the company became a mine operator with its merger of Peak Gold and Metallica Resources in 2008. A fourth company, Western Goldfields, joined in 2009. Together they operated the Peak mine in Australia and Mesquite Mine in California but sold both in 2018. Headquartered in Toronto, shares of the company are traded on the Toronto Stock Exchange and NYSE American.

The S&P SL20, or the Standard & Poor's Sri Lanka 20, is a stock market index, based on market capitalization, that follows the performance of 20 leading publicly traded companies listed in the Colombo Stock Exchange. The 20 companies that make up the index is determined by Standard & Poor's global index methodology, according to which the index's listing is reviewed each year. All S&P SL20 listed stocks are classified according to S&P and MSCI's Global Industry Classification Standard, thereby enabling better comparison of performance of Sri Lanka's largest and most liquid stocks with other global indices.

Guyana Goldfields was a Canadian company that owned and operated the Aurora gold mine in Guyana. Before being acquired by Zijin Mining in 2020, Guyana Goldfields was a publicly traded company with shares listed on the Toronto Stock Exchange and previously TSX Venture Exchange. Beginning in 1996 the company acquired exploration rights to the former Peters and Aurora mines with the objective of utilizing modern exploration technology to re-evaluate the potential gold reserves. Following positive exploratory results, the company received financing from the International Finance Corporation and other investors and conducted economic and technical feasibility studies. The Aurora gold mine began commercial production in 2015 and has produced approximately 125,000 to 160,000 ounces of gold per year from the mine since then. These lower than expected results and a revised technical study that significantly lowered the recoverable reserves estimates, led to the removal of the CEO and directors involved in making the investment decision and a class action lawsuit alleging misrepresentations in public disclosures.

Sienna Senior Living Inc. is a Canadian publicly traded senior housing company based in Markham, Ontario. As at 31 December 2019, the company owned and operated 70 seniors’ living residences in addition to managing 13 residences for third parties; all were located either in Ontario or B.C. In Ontario, Sienna was the largest long-term care operator. The company is listed on the Toronto Stock Exchange.

References

- ↑ "S&P/TSX 60". - S&P Dow Jones Indices. Retrieved May 6, 2020.

- 1 2 3 "S&P/TSX 60 Index". TMX Datalinx. Retrieved October 12, 2022.