Treasury Tax and Loan Service, or TT&L, is a service offered by the Federal Reserve Banks of the United States that keeps tax receipts in the banking sector by depositing them into select banks that meet certain criteria.

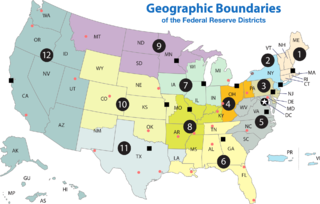

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows:

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2010, taxes collected by federal, state, and municipal governments amounted to 24.8% of GDP. In the OECD, only Chile and Mexico are taxed less as a share of their GDP.

TT&L accounts are Treasury accounts created at commercial banks to accept electronic tax payments and to disburse Treasury funds. This is an alternative to the direct deposit of tax payments into Treasury accounts with Federal Reserve banks. [1]

There are two types of TT&L accounts: 80% of TT&L accounts clear tax payments overnight, the remainder (note option) accounts receive Treasury funds for longer periods of time. [1] TT&L accounts provide stability to the supply of banking reserves within the banking system. [1]

Banking reserves are the interbank "currency" used to settle payments between banks and the government. Management of the supply of reserves within the system is critical to ensuring that interbank payments clear on a daily basis. Because tax payments to the government reduce the amount of reserves in the banking system, the TT&L program provides a buffer for system reserve management, preventing reserve shortfalls on heavy tax payment days which would threaten the ability of banks to settle their payment obligations (ATM transaction and cheque clearing).

The interbank lending market is a market in which banks extend loans to one another for a specified term. Most interbank loans are for maturities of one week or less, the majority being overnight. Such loans are made at the interbank rate. A sharp decline in transaction volume in this market was a major contributing factor to the collapse of several financial institutions during the financial crisis of 2007.

Cheque clearing or bank clearance is the process of moving cash from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.

Note option banks, which retain TT&L funds for longer periods, are free to use those funds in any way allowed for deposits, which includes investing them. Note option banks are required to pay interest to the Treasury on deposited funds. [1]