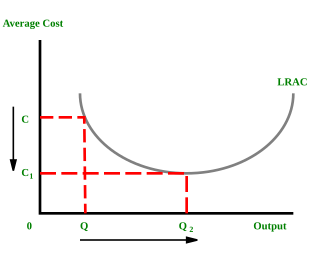

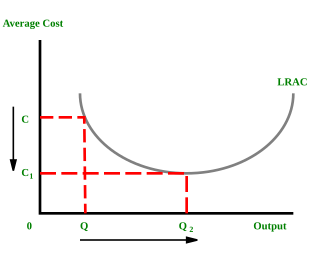

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables an increase in scale. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of market control. This is just a partial description of the concept.

In the field of management, strategic management involves the formulation and implementation of the major goals and initiatives taken by an organization's managers on behalf of stakeholders, based on consideration of resources and an assessment of the internal and external environments in which the organization operates. Strategic management provides overall direction to an enterprise and involves specifying the organization's objectives, developing policies and plans to achieve those objectives, and then allocating resources to implement the plans. Academics and practicing managers have developed numerous models and frameworks to assist in strategic decision-making in the context of complex environments and competitive dynamics. Strategic management is not static in nature; the models can include a feedback loop to monitor execution and to inform the next round of planning.

Marketing management is the organizational discipline which focuses on the practical application of marketing orientation, techniques and methods inside enterprises and organizations and on the management of a firm's marketing resources and activities.

In business, a competitive advantage is an attribute that allows an organization to outperform its competitors.

Porter's Five Forces Framework is a method of analysing the operating environment of a competition of a business. It draws from industrial organization (IO) economics to derive five forces that determine the competitive intensity and, therefore, the attractiveness of an industry in terms of its profitability. An "unattractive" industry is one in which the effect of these five forces reduces overall profitability. The most unattractive industry would be one approaching "pure competition", in which available profits for all firms are driven to normal profit levels. The five-forces perspective is associated with its originator, Michael E. Porter of Harvard University. This framework was first published in Harvard Business Review in 1979.

Porter's generic strategies describe how a company pursues competitive advantage across its chosen market scope. There are three/four generic strategies, either lower cost, differentiated, or focus. A company chooses to pursue one of two types of competitive advantage, either via lower costs than its competition or by differentiating itself along dimensions valued by customers to command a higher price. A company also chooses one of two types of scope, either focus or industry-wide, offering its product across many market segments. The generic strategy reflects the choices made regarding both the type of competitive advantage and the scope. The concept was described by Michael Porter in 1980.

In industry, models of the learning or experience curve effect express the relationship between experience producing a good and the efficiency of that production, specifically, efficiency gains that follow investment in the effort. The effect has large implications for costs and market share, which can increase competitive advantage over time.

Marketing strategy is an organization's promotional efforts to allocate its resources across a wide range of platforms, channels to increase its sales and achieve sustainable competitive advantage within its corresponding market.

In theories of competition in economics, a barrier to entry, or an economic barrier to entry, is a fixed cost that must be incurred by a new entrant, regardless of production or sales activities, into a market that incumbents do not have or have not had to incur. Because barriers to entry protect incumbent firms and restrict competition in a market, they can contribute to distortionary prices and are therefore most important when discussing antitrust policy. Barriers to entry often cause or aid the existence of monopolies and oligopolies, or give companies market power. Barriers of entry also have an importance in industries. First of all it is important to identify that some exist naturally, such as brand loyalty. Governments can also create barriers to entry to meet consumer protection laws, protecting the public. In other cases it can also be due to inherent scarcity of public resources needed to enter a market.

Market penetration refers to the successful selling of a good or service in a specific market. It is measured by the amount of sales volume of an existing good or service compared to the total target market for that product or service. Market penetration is the key for a business growth strategy stemming from the Ansoff Matrix (Richardson, M., & Evans, C.. H. Igor Ansoff first devised and published the Ansoff Matrix in the Harvard Business Review in 1957, within an article titled "Strategies for Diversification". The grid/matrix is utilized across businesses to help evaluate and determine the next stages the company must take in order to grow and the risks associated with the chosen strategy. With numerous options available, this matrix helps narrow down the best fit for an organization.

The growth–share matrix is a chart created in a collaborative effort by BCG employees: Alan Zakon first sketched it and then, together with his colleagues, refined it. BCG's founder Bruce D. Henderson popularized the concept in an essay titled "The Product Portfolio" in BCG's publication Perspectives in 1970. The purpose of the matrix is to help corporations to analyze their business units, that is, their product lines. This helps the company allocate resources and is used as an analytical tool in brand marketing, product management, strategic management, and portfolio analysis.

Bruce Doolin Henderson was an American businessman and management expert. He founded Boston Consulting Group (BCG) in 1963 in Boston, Massachusetts and headed the firm as the president and CEO until 1980. He continued to serve as chairman of BCG until 1985.

A business can use a variety of pricing strategies when selling a product or service. To determine the most effective pricing strategy for a company, senior executives need to first identify the company's pricing position, pricing segment, pricing capability and their competitive pricing reaction strategy. Pricing strategies and tactics vary from company to company, and also differ across countries, cultures, industries and over time, with the maturing of industries and markets and changes in wider economic conditions.

In marketing, segmenting, targeting and positioning (STP) is a framework that implements market segmentation. Market segmentation is a process, in which groups of buyers within a market are divided and profiled according to a range of variables, which determine the market characteristics and tendencies. The S-T-P framework implements market segmentation in three steps:

Context analysis is a method to analyze the environment in which a business operates. Environmental scanning mainly focuses on the macro environment of a business. But context analysis considers the entire environment of a business, its internal and external environment. This is an important aspect of business planning. One kind of context analysis, called SWOT analysis, allows the business to gain an insight into their strengths and weaknesses and also the opportunities and threats posed by the market within which they operate. The main goal of a context analysis, SWOT or otherwise, is to analyze the environment in order to develop a strategic plan of action for the business.

The term "mass market" refers to a market for goods produced on a large scale for a significant number of end consumers. The mass market differs from the niche market in that the former focuses on consumers with a wide variety of backgrounds with no identifiable preferences and expectations in a large market segment. Traditionally, businesses reach out to the mass market with advertising messages through a variety of media including radio, TV, newspapers and the Web.

The six forces model is an analysis model used to give a holistic assessment of any given industry and identify the structural underlining drivers of profitability and competition. The model is an extension of the Porter's five forces model proposed by Michael Porter in his 1979 article published in the Harvard Business Review "How Competitive Forces Shape Strategy". The sixth force was proposed in the mid-1990s. The model provides a framework of six key forces that should be considered when defining corporate strategy to determine the overall attractiveness of an industry.

The following outline is provided as an overview of and topical guide to marketing:

Hypercompetition, a term first coined in business strategy by Richard D’Aveni, describes a dynamic competitive world in which no action or advantage can be sustained for long. Hypercompetition is a key feature of the new global digital economy. Not only is there more competition, there is also tougher and smarter competition. It is a state in which the rate of change in the competitive rules of the game are in such flux that only the most adaptive, fleet, and nimble organizations will survive. Hypercompetitive markets are also characterized by a “quick-strike mentality” to disrupt, neutralize, or moot the competitive advantage of market leaders and important rivals.

Creating shared value (CSV) is a business concept first introduced in a 2006 Harvard Business Review article, Strategy & Society: The Link between Competitive Advantage and Corporate Social Responsibility. The concept was further expanded in the January 2011 follow-up piece entitled Creating Shared Value: Redefining Capitalism and the Role of the Corporation in Society. Written by Michael E. Porter, a leading authority on competitive strategy and head of the Institute for Strategy and Competitiveness at Harvard Business School, and Mark R. Kramer, of the Kennedy School at Harvard University and co-founder of FSG, the article provides insights and relevant examples of companies that have developed deep links between their business strategies and corporate social responsibility (CSR). Porter and Kramer define shared value as "the policies and practices that enhance the competitiveness of a company while simultaneously advancing social and economic conditions in the communities in which it operates", while a review published in 2021 defines the concept as "a strategic process through which corporations can turn social problems into business opportunities".