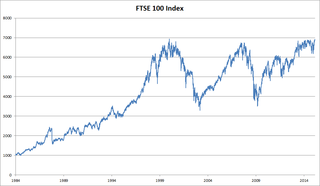

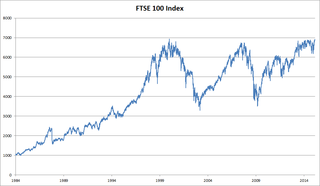

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

The Abbey National Building Society was formed in 1944 by the merger of the Abbey Road and the National building societies.

Lloyds Bank plc is a British retail and commercial bank with branches across England and Wales. It has traditionally been considered one of the "Big Four" clearing banks. Lloyds Bank is the largest retail bank in Britain, and has an extensive network of branches and ATMs in England and Wales and offers 24-hour telephone and online banking services. As of 2012 it had 16 million personal customers and small business accounts.

Alliance & Leicester plc was a British bank and former building society, formed by the merger in 1985 of the Alliance Building Society and the Leicester Building Society. The business demutualised in the middle of 1997, when it was floated on the London Stock Exchange. It was listed in the FTSE 250 Index, and had been listed in the FTSE 100 Index from April 1997 until June 2008.

Bradford & Bingley plc was a British bank with headquarters in the West Yorkshire town of Bingley.

Countrywide is one of the UK's largest integrated property services group including residential property surveying, a collaboration of estate agents, and corporate services. It employs circa 8,500 personnel nationwide, working across 650+ estate agency or lettings offices operating under 50+ brands. Countrywide is a wholly owned subsidiary of Connells Group

National Girobank was a British public sector financial institution run by the General Post Office that opened for business in October 1968. It started life as National Giro then National Girobank and finally Girobank plc before being absorbed into Alliance & Leicester plc in 2003.

Banco Santander, S.A., doing business as Santander Group, is a Spanish multinational financial services company based in Madrid and Santander in Spain. Additionally, Santander maintains a presence in all global financial centres as the 16th-largest banking institution in the world. Although known for its European banking operations, it has extended operations across North and South America, and more recently in continental Asia. It is considered a systemically important bank by Financial Stability Board.

cahoot is an internet-only division of Santander UK plc, the British subsidiary of the Santander Group. Cahoot was launched in June 2000, as the internet based banking brand of Abbey National plc. Cahoot is based in Belfast, Northern Ireland.

Advance is a certified, independent trade union affiliated to the TUC representing workers within the bank Santander UK, the UK subsidiary of Santander Group. The union was formerly known as the Abbey National Group Union (ANGU) before it expanded to include staff of Alliance & Leicester and Bradford & Bingley following their acquisitions by Santander. Its aims are the supporting and representing its members in all aspects of their employment.

The Banking Act 2008 is an Act of the Parliament of the United Kingdom that entered into force on the 21 February 2008 in order to enable the UK government to nationalise high-street banks under emergency circumstances by secondary legislation. The Act was introduced in order to nationalise the failing bank Northern Rock after the bank was supported by Bank of England credit and a private-sector solution was deemed "not to provide sufficient value for the taxpayer" by the UK government.

Alliance & Leicester International Limited (ALIL) was the international banking subsidiary of Alliance & Leicester, which was subsequently bought by the Santander Group in October 2008.

Santander UK plc is a British bank, wholly owned by the Spanish Santander Group. Santander UK plc manages its affairs autonomously, with its own local management team, responsible solely for its performance.

Landmark Mortgages Limited, formerly Northern Rock plc and later NRAM plc, is a British asset holding and management company which was split away from the Northern Rock bank in 2010. It was publicly owned through the British Government's UK Asset Resolution following Northern Rock's nationalisation in 2008 until NRAM plc was sold to Cerberus Capital Management in 2016. The company is closed to new business.

Richard Lee Banks is a British banker who is Chief Executive of UK Asset Resolution, the state-owned "bad bank" that was formed from Northern Rock and Bradford & Bingley, when those banks failed in 2008. In 2014, an opinion piece in the Evening Standard asked if he was "Britain's best banker", as he had successfully reduced the assets of UK Asset Resolution by 40 percent and repaid £4bn to the British government.

RL360 Insurance Company Limited (RL360°) is an international offshore savings, protection and investment provider, headquartered in the Isle of Man serving clients in Asia, Africa, the Middle East, Europe, the UK and Latin America. It is part of the International Financial Group Limited ("IFGL").