A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities.

The Reserve Bank of India, abbreviated as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. Owned by the Ministry of Finance, Government of India, it is responsible for the control, issue and maintaining supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development. Bharatiya Reserve Bank Note Mudran (BRBNM) is a specialised division of RBI through which it prints and mints Indian currency notes (INR) in two of its currency printing presses located in Mysore and Salboni. The RBI, along with the Indian Banks' Association, established the National Payments Corporation of India to promote and regulate the payment and settlement systems in India. Deposit Insurance and Credit Guarantee Corporation was established by RBI as one of its specialized division for the purpose of providing insurance of deposits and guaranteeing of credit facilities to all Indian banks.

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price.

The Export–Import Bank of the United States (EXIM) is the official export credit agency (ECA) of the United States federal government. Operating as a wholly owned federal government corporation, the bank "assists in financing and facilitating U.S. exports of goods and services", particularly when private sector lenders are unable or unwilling to provide financing. Its current chairman and president, Reta Jo Lewis, was confirmed by the Senate on February 9, 2022.

In macroeconomics, an open market operation (OMO) is an activity by a central bank to exchange liquidity in its currency with a bank or a group of banks. The central bank can either transact government bonds and other financial assets in the open market or enter into a repurchase agreement or secured lending transaction with a commercial bank. The latter option, often preferred by central banks, involves them making fixed period deposits at commercial banks with the security of eligible assets as collateral.

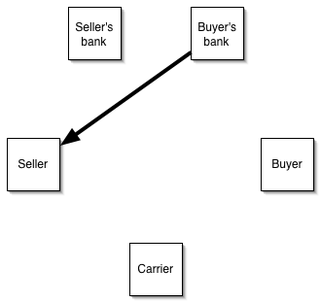

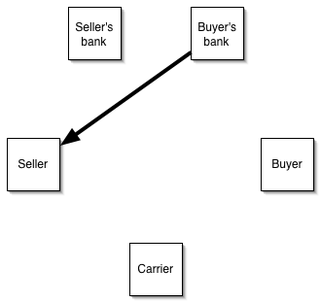

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

An export credit agency or investment insurance agency is a private or quasi-governmental institution that acts as an intermediary between national governments and exporters to issue export insurance solutions and guarantees for financing. The financing can take the form of credits or credit insurance and guarantees or both, depending on the mandate the ECA has been given by its government. ECAs can also offer credit or cover on their own account. This does not differ from normal banking activities. Some agencies are government-sponsored, others private, and others a combination of the two.

This article gives descriptions of mortgage terminology in the United Kingdom.

The Foreign Exchange Management Act, 1999 (FEMA) is an Act of the Parliament of India "to consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and for promoting the orderly development and maintenance of foreign exchange market in India". It was passed on 29 December 1999 in parliament, replacing the Foreign Exchange Regulation Act (FERA). This act makes offences related to foreign exchange civil offenses. It extends to the whole of India, replacing FERA, which had become incompatible with the pro-liberalization policies of the Government of India. It enabled a new foreign exchange management regime consistent with the emerging framework of the World Trade Organization (WTO). It also paved the way for the introduction of the Prevention of Money Laundering Act, 2002, which came into effect on 1 July 2005.

In trade finance, forfaiting is a service providing medium-term financial support for export/import of capital goods. The third party providing the support is termed the forfaiter. The forfaiter provides medium-term finance to, and will commonly also take on certain risks from, the importer; and takes on all risk from the exporter, in return for a margin. Payment may be by negotiable instrument, enabling the forfaiter to lay off some risks. Like factoring, forfaiting involves sale of financial assets from the seller's receivables. Key differences are that forfait supports the buyer (importer) as well as the seller (exporter), and is available only for export/import transactions and in relation to capital goods. The word forfaiting is derived from the French word forfait, meaning to relinquish the right.

Small Industries Development Bank of India (SIDBI) is the apex regulatory body for overall licensing and regulation of micro, small and medium enterprise finance companies in India. It is under the jurisdiction of Ministry of Finance, Government of India headquartered at Lucknow and having its offices all over the country.

Murabaḥah, murabaḥa, or murâbaḥah was originally a term of fiqh for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments. Murabaha financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and sukuk that use murabahah contracts.

The Export Yellow Pages (EYP) was a multi-media trade and promotion resource for exporters that provides U.S. companies, exporters and export related service providers across all industries a convenient way to engage in export promotion and establish contacts and conduct business and trade around the globe with international buyers. Through the EYP, the Department of Commerce offers all U.S. companies and service providers a free online and print business directory listing and access to the directory and multi-media export.

ECGC Limited is a government owned export credit agency of India. It is under the ownership of the Ministry of Commerce and Industry, Government of India, and is headquartered in Mumbai, Maharashtra. It provides export credit insurance support to Indian exporters and banks. Its topmost official is designated as Chairman and Managing Director, who is a central government civil servant under Indian Trade Service (ITS) cadre.

Trade finance is a phrase used to describe different strategies that are employed to make international trade easier. It signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction requires a seller of goods and services as well as a buyer. Various intermediaries such as banks and financial institutions can facilitate these transactions by financing the trade. Trade finance manifests itself in the form of letters of credit (LOC), guarantees, or insurance, and is usually provided by intermediaries.

External commercial borrowing (ECBs) are loans in India made by non-resident lenders in foreign currency to Indian borrowers. They are used widely in India to facilitate access to foreign money by Indian corporations and PSUs. ECBs include commercial bank loans, buyers' credit, suppliers' credit, securitised instruments such as floating rate notes and fixed rate bonds etc., credit from official export credit agencies and commercial borrowings from the private sector window of multilateral financial Institutions such as International Finance Corporation (Washington), ADB, AFIC, CDC, etc. ECBs cannot be used for investment in stock market or speculation in real estate. The DEA, Ministry of Finance, Government of India along with Reserve Bank of India, monitors and regulates ECB guidelines and policies.

China Export & Credit Insurance Corporation, commonly known as Sinosure, is a major Chinese state owned enterprise (SOE) under the administration of Ministry of Finance of the People's Republic of China serving as the provider of export credit insurance, in particular coverage for the export of high-value added goods in China.

Supply chain financing is a form of financial transaction wherein a third party facilitates an exchange by financing the supplier on the customer's behalf. The term also refers to practices used by banks and other financial institutions to manage capital invested into the supply chain and reduce risk for the parties involved.

The Digital Rupee (e₹) or eINR or E-Rupee is a tokenised digital version of the Indian Rupee, issued by the Reserve Bank of India (RBI) as a central bank digital currency (CBDC). The Digital Rupee was proposed in January 2017 and launched on 1 December 2022. Digital Rupee is using blockchain distributed-ledger technology.

The Export-Import Bank of India is a specialized financial institution in India that was established in 1982. The bank's primary function is to finance, facilitate and promote India's international trade. It is owned by the Government of India and operates as a statutory corporation. Its operations are governed by the Export-Import Bank of India Act, 1981.