Related Research Articles

Mining is the extraction of valuable geological materials from the Earth and other astronomical objects. Mining is required to obtain most materials that cannot be grown through agricultural processes, or feasibly created artificially in a laboratory or factory. Ores recovered by mining include metals, coal, oil shale, gemstones, limestone, chalk, dimension stone, rock salt, potash, gravel, and clay. The ore must be a rock or mineral that contains valuable constituent, can be extracted or mined and sold for profit. Mining in a wider sense includes extraction of any non-renewable resource such as petroleum, natural gas, or even water.

Phelps Dodge Corporation was an American mining company founded in 1834 as an import-export firm by Anson Greene Phelps and his two sons-in-law William Earle Dodge, Sr. and Daniel James. The latter two ran Phelps, James & Co., the part of the organization based in Liverpool, England. The import-export firm at first exported United States cotton from the Deep South to England and imported various metals to the US needed for industrialization. With the expansion of the Western frontier in North America, the corporation acquired mines and mining companies, including the Copper Queen Mine in Cochise County, Arizona and the Dawson, New Mexico coal mines. It operated its own mines and acquired railroads to carry its products. By the late 19th century, it was known as a mining company.

Sojitz Corporation is a sogo shosha based in Tokyo, Japan. It is engaged in a wide range of businesses globally, including buying, selling, importing, and exporting goods, manufacturing and selling products, providing services, and planning and coordinating projects, in Japan and overseas. Sojitz also invests in various sectors and conducts financing activities. The broad range of sectors in which Sojitz operates includes automobiles, energy, mineral resources, chemicals, foodstuff resources, agricultural and forestry resources, consumer goods, and industrial parks.

Newcrest Mining Limited is an Australian-based corporation which engages in the exploration, development, mining and sale of gold and the froth flotation product, gold-copper concentrate. It is Australia's leading gold mining company and its operations have expanded beyond Australia, for example Indonesia, thus becoming a prominent international mining corporation. Newmont initially started the company as a subsidiary in 1966. The subsidiary became Newmont Holdings Pty Ltd in 1980 and in 1990 acquired 100 per cent of Australmin Holdings Limited taking the current name.

Mount Lyell Mining and Railway Company was a Tasmanian mining company formed on 29 March 1893, most commonly referred to as Mount Lyell. Mount Lyell was the dominant copper mining company of the West Coast from 1893 to 1994, and was based in Queenstown, Tasmania.

Renison Bell is an underground tin mine and locality on the West Coast of Tasmania, Australia.

Edward Priaulx Tennant, 1st Baron Glenconner, known as Sir Edward Tennant, 2nd Baronet, from 1906 to 1911, was a Scottish businessman and Liberal politician. In 1911 he was raised to the peerage as Baron Glenconner.

Engelhard Corporation was an American Fortune 500 company headquartered in Iselin, New Jersey, United States. It is credited with developing the first production catalytic converter. In 2006, the German chemical manufacturer BASF bought Engelhard for US$5 billion.

Charles Tennant was a Scottish chemist and industrialist. He discovered bleaching powder and founded an industrial dynasty.

Sir Charles Clow Tennant, 1st Baronet JP DL was a Scottish businessman, industrialist and Liberal politician.

United Alkali Company Limited was a British chemical company formed in 1890, employing the Leblanc process to produce soda ash for the glass, textile, soap, and paper industries. It became one of the top four British chemical companies merged in 1926 with Brunner Mond, Nobel Explosives and British Dyestuffs Corporation to form Imperial Chemical Industries.

The mining industry of the Democratic Republic of the Congo produces copper, diamonds, tantalum, tin, gold, and more than 63% of global cobalt production. Minerals and petroleum are central to the DRC's economy, making up more than 95% of the value of its exports.

The eastern Democratic Republic of the Congo (DRC) has a history of conflict, where various armies, rebel groups, and outside actors have profited from mining while contributing to violence and exploitation during wars in the region. The four main end products of mining in the eastern DRC are tin, tungsten, tantalum, and gold, which are extracted and passed through a variety of intermediaries before being sold to international markets. These four products, are essential in the manufacture of a variety of devices, including consumer electronics such as smartphones, tablets, and computers.

Phibro is a global low carbon commodity company focused on renewable assets' development, acquisition, optimization, and related contract structuring. Phibro's headquarters are located in Stamford, Connecticut.

China Minmetals Corporation is a Chinese metals and mineral trading company headquartered in Beijing. It is a state-owned corporation under direct supervision of the State-owned Assets Supervision and Administration Commission (SASAC). China Minmetals is engaged in the production and trading of metals and minerals, including copper, aluminum, tungsten, tin, antimony, lead, zinc, and nickel.

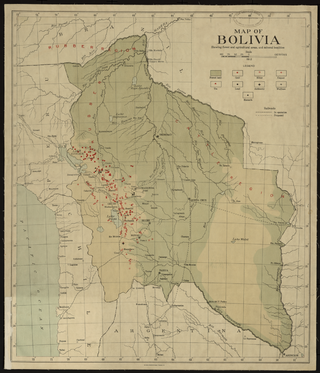

Mining in Bolivia has been a dominant feature of the Bolivian economy as well as Bolivian politics since 1557. Colonial era silver mining in Bolivia, particularly in Potosí, played a critical role in the Spanish Empire and the global economy. Tin mining supplanted silver by the twentieth century and the central element of Bolivian mining, and wealthy tin barons played an important role in national politics until they were marginalized by the industry's nationalization into the Bolivian Mining Corporation that followed the 1952 revolution. Bolivian miners played a critical part to the country's organized labor movement from the 1940s to the 1980s.

Tin mining began early in the Bronze Age, as bronze is a copper-tin alloy. Tin is a relatively rare element in the Earth's crust, with approximately 2 ppm, compared to iron with 50,000 ppm.

John Alexander Agnew was a New Zealand mining engineer who worked with future United States president Herbert Hoover and later became chairman of Consolidated Gold Fields, the first chairman of the firm to be from a mining engineering background. In his spare time he was a noted philatelist whose collection of Chinese stamps and postal history was regarded as one of the finest of his era.

In 1855, two merchants, Pavel Basnin and Petr Katyshevtsev, members of the top guild and honorary citizens of Irkutsk, founded the Lena Gold Mining Partnership. By the beginning of the 1870s, Evzel Gintsburg and the Meyer & Co trading house had begun accumulating shares of the mining partnership. In 1882, the Gintsburg dynasty – headed by father Evzel (Osip) Gabrielovich Gintsburg (1812–1878) and his son Horace (1833–1909) – started to dominate the gold trade in the Lena River region.

Guyana Goldfields was a Canadian company that owned and operated the Aurora gold mine in Guyana. Before being acquired by Zijin Mining in 2020, Guyana Goldfields was a publicly traded company with shares listed on the Toronto Stock Exchange and previously TSX Venture Exchange. Beginning in 1996 the company acquired exploration rights to the former Peters and Aurora mines with the objective of utilizing modern exploration technology to re-evaluate the potential gold reserves. Following positive exploratory results, the company received financing from the International Finance Corporation and other investors and conducted economic and technical feasibility studies. The Aurora gold mine began commercial production in 2015 and has produced approximately 125,000 to 160,000 ounces of gold per year from the mine since then. These lower than expected results and a revised technical study that significantly lowered the recoverable reserves estimates, led to the removal of the CEO and directors involved in making the investment decision and a class action lawsuit alleging misrepresentations in public disclosures.

References

- ↑ "Tennant Brochure" . Retrieved 26 May 2020.

- ↑ "The Peerage" . Retrieved 26 May 2020.

- ↑ Blow, Simon (1987). Broken Blood - The Rise and Fall of the Tennant family. London: Faber. ISBN 0-571-13374-6.

- ↑ "Obituary of Lord Denman" . Retrieved 26 May 2020.

- ↑ William Lee Baldwin (1983). The World Tin Market: Political Pricing and Economic Competition. Duke University Press, Durham, N.C.

- ↑ Robert Porter (2020). Consolidated Gold Fields in Australia: The Rise and Decline of a British Mining House, 1926–1998. ANU Press, Canberra.