Related Research Articles

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey.

A civil union is a legally recognized arrangement similar to marriage, created primarily as a means to provide recognition in law for same-sex couples. Civil unions grant some or all of the rights of marriage except child adoption and/or the title itself.

A domestic partnership is a legal relationship, usually between couples, who live together and share a common domestic life, but are not married. People in domestic partnerships receive benefits that guarantee right of survivorship, hospital visitation, and others.

Under United States tax law, a personal exemption is an amount that a resident taxpayer is entitled to claim as a tax deduction against personal income in calculating taxable income and consequently federal income tax. In 2017, the personal exemption amount was $4,050, though the exemption is subject to phase-out limitations. The personal exemption amount is adjusted each year for inflation. The Tax Cuts and Jobs Act of 2017 eliminates personal exemptions for tax years 2018 through 2025.

The Canada Revenue Agency is the revenue service of the Canadian federal government, and most provincial and territorial governments. The CRA collects taxes, administers tax law and policy, and delivers benefit programs and tax credits. Legislation administered by the CRA includes the Income Tax Act, parts of the Excise Tax Act, and parts of laws relating to the Canada Pension Plan, employment insurance (EI), tariffs and duties. The agency also oversees the registration of charities in Canada, and enforces much of the country's tax laws.

Carole Migden is an American politician from San Francisco who represented the third district of the California State Senate from 2004 to 2008 and the 13th district of the California State Assembly from 1996 to 2002. She is the state's second openly lesbian legislator.

In addition to federal income tax collected by the United States, most individual U.S. states collect a state income tax. Some local governments also impose an income tax, often based on state income tax calculations. Forty-two states and many localities in the United States impose an income tax on individuals. Eight states impose no state income tax, and a ninth, New Hampshire, imposes an individual income tax on dividends and interest income but not other forms of income. Forty-seven states and many localities impose a tax on the income of corporations.

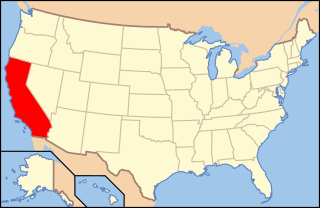

A California domestic partnership is a legal relationship, analogous to marriage, created in 1999 to extend the rights and benefits of marriage to same-sex couples. It was extended to all opposite-sex couples as of January 1, 2016 and by January 1, 2020 to include new votes that updated SB-30 with more benefits and rights to California couples choosing domestic partnership before their wedding. California Governor Newsom signed into law on July 30, 2019.

Same-sex marriage in the District of Columbia has been legal since March 3, 2010. On December 18, 2009, Mayor Adrian Fenty signed a bill passed by the Council of the District of Columbia on December 15 legalizing same-sex marriage. Following the signing, the measure entered a mandatory congressional review of 30 work days. Marriage licenses became available on March 3, and marriages began on March 9, 2010. The District of Columbia became the first jurisdiction in the United States below the Mason–Dixon line to allow same-sex couples to marry.

In the United States, domestic partnership is a city-, county-, state-, or employer-recognized status that may be available to same-sex couples and, sometimes, opposite-sex couples. Although similar to marriage, a domestic partnership does not confer any of the myriad rights and responsibilities of marriage afforded to married couples by the federal government. Domestic partnerships in the United States are determined by each state or local jurisdiction, so there is no nationwide consistency on the rights, responsibilities, and benefits accorded domestic partners.

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels.

Domestic partnerships were established in the state of Maine by statute in April 2004, taking effect on July 30, 2004. This placed Maine in the category of U.S. states that offered limited recognition of same-sex relationships, but not all of the legal protections of marriage, as Maine does not recognize common law marriages.

State Registered Domestic Partnerships (SRDP) in Washington were created in 2007 following the Andersen v. King County decision. Subsequent legislation has made an SRDP the equivalent of marriage under state law. As a result of the legalization of same-sex marriage in the state, from June 30, 2014, SRDP will be available only when at least one of the partners is sixty-two years of age or older.

Under United States federal income tax law, filing status determines which tax return form an individual will use and is an important factor in computing taxable income. Filing status is based on marital status and family situation.

Same-sex unions in the United States are available in various forms in all states and territories, except American Samoa. All states have legal same-sex marriage, while others have the options of civil unions, domestic partnerships, or reciprocal beneficiary relationships. The federal government only recognizes marriage and no other legal union for same-sex couples.

The United States federal earned income tax credit or earned income credit is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.

California is seen as one of the most liberal states in the U.S. in regard to lesbian, gay, bisexual, transgender (LGBT) rights, which have received nationwide recognition since the 1970s. Same-sex sexual activity has been legal in the state since 1976. Discrimination protections regarding sexual orientation and gender identity or expression were adopted statewide in 2003. Transgender people are also permitted to change their legal gender on official documents without any medical interventions, and mental health providers are prohibited from engaging in conversion therapy on minors.

Lesbian, gay, bisexual, and transgender (LGBT) rights in the U.S. state of Washington have evolved significantly since the late 20th century. Same-sex sexual activity was legalized in 1976. LGBT people are fully protected from discrimination in the areas of employment, housing and public accommodations; the state enacting comprehensive anti-discrimination legislation regarding sexual orientation and gender identity in 2006. Same-sex marriage has been legal since 2012, and same-sex couples are allowed to adopt. Conversion therapy on minors has also been illegal since 2018.

CalFile is the current tax preparation program/service of the California Franchise Tax Board (FTB).

Arnold Schwarzenegger was an early opponent of same-sex marriage in the United States, including during his Governorship of California. He has since wavered in this opposition to reverse his political stance on LGBT rights.

References

- ↑ SB 1827, 2006-2007 Legislative Session

- 1 2 California Franchise Tax Board Registered Domestic Partner AGI Limitation Discussion, February 21, 2007

- ↑ California Franchise Tax Board Registered Domestic Partners and SB 1827

- ↑ California Revenue and Taxation Code section 17024.5(h)(2)(B) [ permanent dead link ]