Natural law is a system of law based on a close observation of natural order and human nature, from which values, thought by natural law's proponents to be intrinsic to human nature, can be deduced and applied independently of positive law. According to the theory of law called jusnaturalism, all people have inherent rights, conferred not by act of legislation but by "God, nature, or reason". Natural law theory can also refer to "theories of ethics, theories of politics, theories of civil law, and theories of religious morality".

Santa Clara County v. Southern Pacific Railroad Company, 118 U.S. 394 (1886), is a corporate law case of the United States Supreme Court concerning taxation of railroad properties. The case is most notable for a headnote stating that the Equal Protection Clause of the Fourteenth Amendment grants constitutional protections to corporations.

A joint-stock company (JSC) is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares. Shareholders are able to transfer their shares to others without any effects to the continued existence of the company.

The London Charterhouse is a historic complex of buildings in Clerkenwell, London, dating to the 14th century. It occupies land to the north of Charterhouse Square, and lies within the London Borough of Islington. It was originally built a Carthusian priory, founded in 1371 on the site of a Black Death burial ground. Following the priory's dissolution in 1537, it was rebuilt from 1545 onwards to become one of the great courtyard houses of Tudor London. In 1611, the property was bought by Thomas Sutton, a businessman and "the wealthiest commoner in England", who established a school for the young and an almshouse for the old. The almshouse remains in occupation today, while the school was re-located in 1872 to Godalming, Surrey.

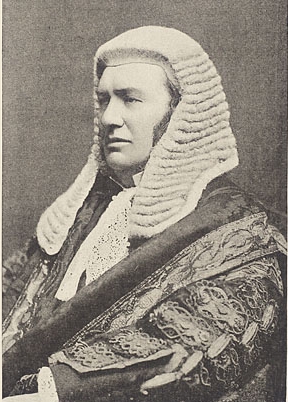

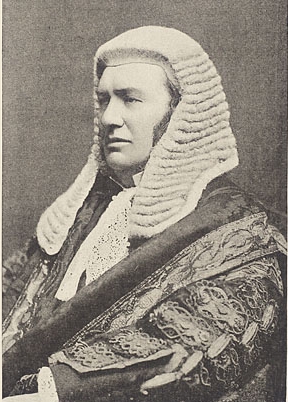

Nathaniel Lindley, Baron Lindley, was an English judge.

Corporate law is the body of law governing the rights, relations, and conduct of persons, companies, organizations and businesses. The term refers to the legal practice of law relating to corporations, or to the theory of corporations. Corporate law often describes the law relating to matters which derive directly from the life-cycle of a corporation. It thus encompasses the formation, funding, governance, and death of a corporation.

Thomas Sutton was an English civil servant and businessman, born in Knaith, Lincolnshire. He is remembered as the founder of the London Charterhouse and of Charterhouse School.

Ultra vires is a Latin phrase used in law to describe an act that requires legal authority but is done without it. Its opposite, an act done under proper authority, is intra vires. Acts that are intra vires may equivalently be termed "valid", and those that are ultra vires termed "invalid".

Piercing the corporate veil or lifting the corporate veil is a legal decision to treat the rights or duties of a corporation as the rights or liabilities of its shareholders. Usually a corporation is treated as a separate legal person, which is solely responsible for the debts it incurs and the sole beneficiary of the credit it is owed. Common law countries usually uphold this principle of separate personhood, but in exceptional situations may "pierce" or "lift" the corporate veil.

Pinnel's Case [1602] 5 Co. Rep. 117a, also known as Pinnel v Cole, is an important case in English contract law, on the doctrine of part performance. In it, Sir Edward Coke opined that a part payment of a debt could not extinguish the obligation to pay the whole.

Salomon v A Salomon & Co Ltd[1896] UKHL 1, [1897] AC 22 is a landmark UK company law case. The effect of the House of Lords' unanimous ruling was to uphold firmly the doctrine of corporate personality, as set out in the Companies Act 1862, so that creditors of an insolvent company could not sue the company's shareholders for payment of outstanding debts.

Lennard's Carrying Co Ltd v Asiatic Petroleum Co Ltd [1915] AC 705 is a famous decision by the House of Lords on the ability to impose liability upon a corporation. The decision expands upon the earlier decision in Salomon v Salomon & Co. [1897] AC 22 and first introduced the "alter ego" theory of corporate liability.

Kosmopoulos v Constitution Insurance Co of Canada is a leading Supreme Court of Canada decision on the court's ability to pierce the corporate veil—to impose an interest or liability, that is, upon the shareholders of a company instead of the company itself. It was held that the veil can only be lifted where it would be "just and equitable", specifically to third parties.

The United Kingdom company law regulates corporations formed under the Companies Act 2006. Also governed by the Insolvency Act 1986, the UK Corporate Governance Code, European Union Directives and court cases, the company is the primary legal vehicle to organise and run business. Tracing their modern history to the late Industrial Revolution, public companies now employ more people and generate more of wealth in the United Kingdom economy than any other form of organisation. The United Kingdom was the first country to draft modern corporation statutes, where through a simple registration procedure any investors could incorporate, limit liability to their commercial creditors in the event of business insolvency, and where management was delegated to a centralised board of directors. An influential model within Europe, the Commonwealth and as an international standard setter, UK law has always given people broad freedom to design the internal company rules, so long as the mandatory minimum rights of investors under its legislation are complied with.

Daimler Co Ltd v Continental Tyre and Rubber Co Ltd [1916] 2 AC 307 is a UK company law case, concerning the concept of "control" and enemy character of a company. It is usually discussed in the context of lifting the corporate veil, however it is merely an example of where the corporate veil is not in issue as a matter of company law, since the decision turns on correct interpretation of a statute.

Trustor AB v Smallbone [2001] EWHC 703 (Ch) is a UK company law case concerning piercing the corporate veil.

The corporate veil in the United Kingdom is a metaphorical reference used in UK company law for the concept that the rights and duties of a corporation are, as a general principle, the responsibility of that company alone. Just as a natural person cannot be held legally accountable for the conduct or obligations of another person, unless they have expressly or implicitly assumed responsibility, guaranteed or indemnified the other person, as a general principle shareholders, directors and employees cannot be bound by the rights and duties of a corporation. This concept has traditionally been likened to a "veil" of separation between the legal entity of a corporation and the real people who invest their money and labor into a company's operations.

South African company law is that body of rules which regulates corporations formed under the Companies Act. A company is a business organisation which earns income by the production or sale of goods or services. This entry also covers rules by which partnerships and trusts are governed in South Africa, together with cooperatives and sole proprietorships.

Prest v Petrodel Resources Ltd[2013] UKSC 34, [2013] 2 AC 415 is a leading UK company law decision of the UK Supreme Court concerning the nature of the doctrine of piercing the corporate veil, resulting trusts and equitable proprietary remedies in the context of English family law.

VTB Capital plc v Nutritek International Corp[2013] UKSC 5, [2013] 2 AC 337 is an English company law case, concerning piercing the corporate veil for fraud.