Concepts of the place of business and fixed establishment (Art. 10-13 Reg.)

The definition of the "place where the business of a taxable person is established" deserves special attention, which is stated as the "place where the functions of the business's central administration are carried out" (cf. Art. 10 Reg.). This clarifies that the focus should not be on the day-to-day operations. [13] To specify the place of business, account must be taken of the place where:

- essential decisions are taken on the general management of the business

- the registered office of the business is located and

- management meets.

Where these criteria do not allow the place of establishment of a business to be determined with certainty, the place where essential decisions concerning the general management of the business are taken shall take precedence (cf. Art 10 Nr. 2 Reg.). Mere presence of a postal address may not be taken to be the place of establishment of a business of a taxable person (cf. Art. 10 No. 3 Reg.).

The term "fixed establishment" is characterized in Art. 11 of the Regulation by a "sufficient degree of permanence and a suitable structure" relating to "human and technical resources to enable it to provide the service which it supplies". Thus it is not required that the branch provides services by itself. Merely it needs to have the ability to receive and use such. Even if the services are only provided for the head office the conditions are met. [14] Nevertheless, where the resources of the fixed establishment are only used for administrative support they will not be regarded as being used for the supply of goods or services. Having a VAT number does not equal having a fixed establishment (cf. Art. 11 No. 3 Reg.). [15]

These provisions are important for purposes of determining the place of supply of a Business-to-Business transaction pursuant to Art. 44 of the VAT Directive. [16]

Concepts of status, capacity and location of the customer (Art. 17-25 Reg.)

The correct application of the rules based on the place of supply of services relies mainly on the status of the customer as a taxable person or non-taxable person, and on the capacity in which he is acting. [17]

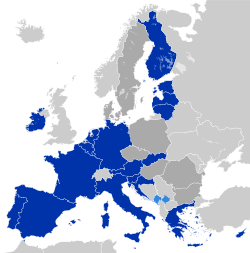

EU established customer

As mentioned in Art. 18 No. 1a of the Regulation a customer can be assumed as being a taxable person if the customer has communicated his VAT number and the supplier obtains confirmation of the validity of that identification number. The validity can be checked at the web site of the European Commission. Where the customer has not received a VAT number yet (Art. 18 No. 1b Reg.) the supplier shall obtain any other proof which demonstrates that the customer is a taxable person; and the supplier carries out a reasonable level of verification of the accuracy of the information. In accordance with Art. 18 No. 2 of the Regulation the customer is a non-taxable person if no identification number is provided.

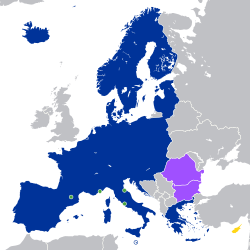

Customer established outside EU

According to Art. 18 Nr. 3a of the Regulation the customer can be regarded as a taxable person if he provides to the supplier a certificate issued by the competent tax authorities that the customer is engaged in economic activities in order to enable him to obtain a refund of VAT. If no such document is available the customer should provide to the supplier:

- VAT number or similar number; or

- any other proof that the customer is a taxable person, and

- the supplier carries out a reasonable level of verification of the accuracy of the information provided by the customer (cf. Art. 18 Nr. 3b Reg.).

The improvement of those provisions for the suppliers is to reduce the VAT risk and strengthen the cases where the supplier acts in good faith. [18]

Capacity of the customer

For the purpose of determining the place of supply in accordance with Art. 44 (Business-to-Business transactions) and Art. 45 (Business-to-Consumer transactions) of the VAT Directive, Art 19 of the Regulation clarifies that taxable persons or legal persons deemed to be taxable persons who receive services exclusively for private use, including by their staff, shall be regarded as non taxable persons.