Related Research Articles

Myron Samuel Scholes is a Canadian–American financial economist. Scholes is the Frank E. Buck Professor of Finance, Emeritus, at the Stanford Graduate School of Business, Nobel Laureate in Economic Sciences, and co-originator of the Black–Scholes options pricing model. Scholes is currently the Chief Investment Strategist at Janus Henderson. Previously he served as the chairman of Platinum Grove Asset Management and on the Dimensional Fund Advisors board of directors, American Century Mutual Fund board of directors, chairman of the Board of Economic Advisers of Stamos Capital Partners, and the Cutwater Advisory Board. He was a principal and limited partner at Long-Term Capital Management (LTCM), a highly leveraged hedge fund that collapsed in 1998, and a managing director at Salomon Brothers. Other positions Scholes held include the Edward Eagle Brown Professor of Finance at the University of Chicago, senior research fellow at the Hoover Institution, director of the Center for Research in Security Prices, and professor of finance at MIT's Sloan School of Management. Scholes earned his PhD at the University of Chicago.

Citadel LLC is an American multinational hedge fund and financial services company. Founded in 1990 by Ken Griffin, it has more than $63 billion in assets under management as of June 2024. The company has over 2,800 employees, with corporate headquarters in Miami, Florida, and offices throughout North America, Asia, and Europe. Founder, CEO and Co-CIO Griffin owns approximately 85% of the firm. As of December 2022, Citadel is one of the most profitable hedge funds in the world, posting $74 billion in net gains since its inception in 1990, making it the most successful hedge fund in history, according to CNBC.

A financial centre or financial hub is a location with a significant concentration of participants in banking asset management, insurance, and financial markets, with venues and supporting services for these activities to take place. Participants can include financial intermediaries, institutional investors, and issuers. Trading activity can take place on venues such as exchanges and involve clearing houses, although many transactions take place over-the-counter (OTC), directly between participants. Financial centres usually host companies that offer a wide range of financial services, for example relating to mergers and acquisitions, public offerings, or corporate actions; or which participate in other areas of finance, such as private equity, hedge funds, and reinsurance. Ancillary financial services include rating agencies, as well as provision of related professional services, particularly legal advice and accounting services.

Eton Park Capital Management was an investment firm. The firm aimed to provide risk-adjusted returns for investors over multi-year periods. The firm invested in a range of markets and products, including public equity, fixed income and derivatives markets. Eric Mindich was the firm's Chief Executive Officer. Eton Park had offices in New York City, London, and Hong Kong. From 2012 to 2014, Eton Park's annualized return averaged over 13% while the S&P500 averaged nearly 18%.

Renaissance Capital is an emerging and frontier markets focused investment bank founded in 1995 in Russia. The firm has offices in Moscow, London, New York, Lagos, Nairobi, Cairo and Nicosia.

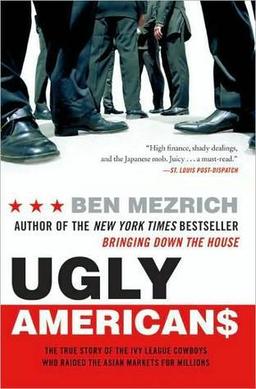

Ugly Americans: The True Story of the Ivy League Cowboys Who Raided the Asian Markets for Millions is a book by Ben Mezrich that recounts the exploits of an American called John Malcolm arbitraging index futures in Japan in the 1990s. The book was released on May 4, 2004 by William Morrow and Company.

TP ICAP Group plc is a financial services firm headquartered in London, United Kingdom. Its stock is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

TPG Angelo Gordon is a global alternative investment manager founded in 1988 by John Angelo and Michael Gordon who together ran the arbitrage department of L.F. Rothschild in the 1980s. The firm focuses on four main investment disciplines: credit, real estate, private equity, and multi-strategy.

China International Capital Corporation Limited is a Chinese partially state-owned multinational investment management and financial services company. Founded in China in 1995, CICC provides investment banking, securities and investment management services to corporations, institutions and individuals worldwide.

BNP Paribas Corporate and Institutional Banking (CIB) is the global investment banking arm of BNP Paribas, the largest banking group in the world. In October 2010, BNP Paribas was ranked by Bloomberg and Forbes as the largest bank and largest company in the world by assets with over US$3.1 trillion. BNP Paribas CIB's main centres are in Paris and London, with large scale operations in New York, Hong Kong, and Singapore, and smaller operations in almost every financial centre in the world. It employs 185,000 people across 56 countries and provides financing, advisory and capital markets services. BNP Paribas CIB is a globally recognised leader in two areas of expertise: trading derivatives on all asset classes, and structured financing. BNP Paribas CIB also has a large corporate advisory network in Europe and Asia. BNP Paribas CIB has 13,000 clients, consisting of companies, financial institutions, governments, investment funds and hedge funds.

Brevan Howard is a European hedge fund management company based in Jersey with its funds domiciled in the Cayman Islands. Brevan Howard was founded in 2002 by Alan Howard, alongside four other co-founders including Chris Rokos, and is widely considered to be one of the top global macro hedge funds.

Samena Capital is an Asia, India and MENA-focused alternative investments group, co-established in 2008 by Shirish Saraf and key partners from a cross section of industries and regions. This name was chosen due to the markets that Samena invests in. These are the Indian Subcontinent, Asia, Middle East and North Africa – a region collectively known as SAMENA. Also in ancient Buddhist script, Samena means "together" or "collective", which reflects the collective investment model the company is based on. The company and its subsidiaries employ 26 people in 3 locations worldwide, and has 48 shareholders.

ECI is a provider of managed services, cyber security and business transformation for mid-market financial services organizations across the globe. The firm was founded when Eze Castle Consulting split into two independent entities. It employs 900 plus people, with offices in Singapore, Europe, Hong Kong, India, the Philippines, and nine US locations.

Value Partners Group Limited is a Hong Kong–based asset management company.

Göran Bronner was CFO of Swedbank AB (publ) from 2011 to 2016.

Dymon Asia is an Asia-focused investment management firm based in Singapore. It is considered one of the largest hedge funds in Singapore and Asia.

Capstone Investment Advisors LLC (Capstone) is an American investment management firm headquartered in New York City with additional offices in Europe and Asia. The firm specializes in volatility arbitrage which involves volatility and derivatives trading in various markets.

Pinpoint Asset Management, is a Chinese hedge fund management firm headquartered in Hong Kong with its other main office based in Shanghai. It is one of the earliest hedge funds established in Mainland China.

Verition Fund Management (Verition) is an American multi-strategy hedge fund management firm headquartered in Greenwich, Connecticut. It has additional offices in Europe and Asia.