Debt Management Office may refer to:

Debt Management Office may refer to:

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and minting coins, while the treasury executes currency circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes.

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition.

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

Debt is an obligation that requires one party, the debtor, to pay money borrowed or otherwise withheld from another party, the creditor. Debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity.

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

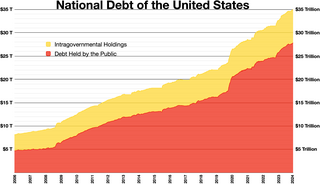

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

David Alan Stockman is an American politician and former businessman who was a Republican U.S. Representative from the state of Michigan (1977–1981) and the Director of the Office of Management and Budget (1981–1985) under President Ronald Reagan.

Principal may refer to:

A country's gross government debt is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt.

In corporate finance, capital structure refers to the mix of various forms of external funds, known as capital, used to finance a business. It consists of shareholders' equity, debt, and preferred stock, and is detailed in the company's balance sheet. The larger the debt component is in relation to the other sources of capital, the greater financial leverage the firm is said to have. Too much debt can increase the risk of the company and reduce its financial flexibility, which at some point creates concern among investors and results in a greater cost of capital. Company management is responsible for establishing a capital structure for the corporation that makes optimal use of financial leverage and holds the cost of capital as low as possible.

The Debt Management Office (DMO) of the United Kingdom is the executive agency responsible for debt and cash management for the UK Government, lending to local authorities and managing certain public sector funds.

Alice Mitchell Rivlin was an American economist and budget official. She served as the 16th vice chair of the Federal Reserve from 1996 to 1999. Before her appointment to the Federal Reserve, Rivlin was named director of the Office of Management and Budget in the Clinton administration from 1994 to 1996. Prior to that, she was instrumental in the establishment of the Congressional Budget Office and became its founding director from 1975 to 1983. A member of the Democratic Party, Rivlin was the first woman to hold either of those posts.

Gilt-edged securities, also referred to as gilts, are bonds issued by the UK Government. The term is of British origin, and then referred to the debt securities issued by the Bank of England on behalf of His Majesty's Treasury, whose paper certificates had a gilt edge, hence the name.

The New Zealand Treasury is the central public service department of New Zealand charged with advising the Government on economic policy, assisting with improving the performance of New Zealand's economy, and managing financial resources. The Minister responsible for the Treasury is the Minister of Finance of New Zealand; however, from 1996 to 2002, there existed a more specific position of Treasurer of New Zealand. The role was created for Winston Peters by the Fourth National Government under Jim Bolger after the 1996 election, and abolished by Helen Clark’s government in 2002.

The State Treasurer of Oklahoma is the chief custodian of Oklahoma’s cash deposits, monies from bond sales, and other securities and collateral and directs the investments of those assets. The treasurer provides for the safe and efficient operation of state government through effective banking, investment, and cash management. The state treasurer has the powers of a typical chief financial officer for a corporation.

DMO may refer to:

As a legal concept, administration is a procedure under the insolvency laws of a number of common law jurisdictions, similar to bankruptcy in the United States. It functions as a rescue mechanism for insolvent entities and allows them to carry on running their business. The process – in the United Kingdom colloquially called being "under administration" – is an alternative to liquidation or may be a precursor to it. Administration is commenced by an administration order.

The Australian government debt is the amount owed by the Australian federal government. The Australian Office of Financial Management, which is part of the Treasury Portfolio, is the agency which manages the government debt and does all the borrowing on behalf of the Australian government. Australian government borrowings are subject to limits and regulation by the Loan Council, unless the borrowing is for defence purposes or is a 'temporary' borrowing. Government debt and borrowings have national macroeconomic implications, and are also used as one of the tools available to the national government in the macroeconomic management of the national economy, enabling the government to create or dampen liquidity in financial markets, with flow on effects on the wider economy.

The United States federal budget for fiscal year 2018, which ran from October 1, 2017, to September 30, 2018, was named America First: A Budget Blueprint to Make America Great Again. It was the first budget proposed by newly elected president Donald Trump, submitted to the 115th Congress on March 16, 2017.

Shalanda Delores Young is an American political advisor who is the current director of the Office of Management and Budget, previously serving in an acting capacity from March 24, 2021, through March 17, 2022 concurrently as deputy director. She previously worked for the United States House Committee on Appropriations as its staff director.