Environmental economics is a sub-field of economics concerned with environmental issues. It has become a widely studied subject due to growing environmental concerns in the twenty-first century. Environmental economics "undertakes theoretical or empirical studies of the economic effects of national or local environmental policies around the world. ... Particular issues include the costs and benefits of alternative environmental policies to deal with air pollution, water quality, toxic substances, solid waste, and global warming."

Standard of living is the level of income, comforts and services available to an individual, community or society. A contributing factor to an individual's quality of life, standard of living is generally concerned with objective metrics outside an individual's personal control, such as economic, societal, political, and environmental matters. Individuals or groups use the standard of living to evaluate where to live in the world, or when assessing the success of society.

Social cost in neoclassical economics is the sum of the private costs resulting from a transaction and the costs imposed on the consumers as a consequence of being exposed to the transaction for which they are not compensated or charged. In other words, it is the sum of private and external costs. This might be applied to any number of economic problems: for example, social cost of carbon has been explored to better understand the costs of carbon emissions for proposed economic solutions such as a carbon tax.

Copenhagen Consensus is a project that seeks to establish priorities for advancing global welfare using methodologies based on the theory of welfare economics, using cost–benefit analysis. It was conceived and organized around 2004 by Bjørn Lomborg, the author of The Skeptical Environmentalist and the then director of the Danish government's Environmental Assessment Institute.

The Second Assessment Report (SAR) of the Intergovernmental Panel on Climate Change (IPCC), published in 1995, is an assessment of the then available scientific and socio-economic information on climate change. The report was split into four parts: a synthesis to help interpret UNFCCC article 2, The Science of Climate Change, Impacts, Adaptations and Mitigation of Climate Change, Economic and Social Dimensions of Climate Change. Each of the last three parts was completed by a separate Working Group (WG), and each has a Summary for Policymakers (SPM) that represents a consensus of national representatives.

The Special Report on Emissions Scenarios (SRES) is a report by the Intergovernmental Panel on Climate Change (IPCC) that was published in 2000. The greenhouse gas emissions scenarios described in the Report have been used to make projections of possible future climate change. The SRES scenarios, as they are often called, were used in the IPCC Third Assessment Report (TAR), published in 2001, and in the IPCC Fourth Assessment Report (AR4), published in 2007. The SRES scenarios were designed to improve upon some aspects of the IS92 scenarios, which had been used in the earlier IPCC Second Assessment Report of 1995. The SRES scenarios are "baseline" scenarios, which means that they do not take into account any current or future measures to limit greenhouse gas (GHG) emissions.

Climate change mitigation (or decarbonisation) is action to limit the greenhouse gases in the atmosphere that cause climate change. Climate change mitigation actions include conserving energy and replacing fossil fuels with clean energy sources. Secondary mitigation strategies include changes to land use and removing carbon dioxide (CO2) from the atmosphere. Current climate change mitigation policies are insufficient as they would still result in global warming of about 2.7 °C by 2100, significantly above the 2015 Paris Agreement's goal of limiting global warming to below 2 °C.

The politics of climate change results from different perspectives on how to respond to climate change. Global warming is driven largely by the emissions of greenhouse gases due to human economic activity, especially the burning of fossil fuels, certain industries like cement and steel production, and land use for agriculture and forestry. Since the Industrial Revolution, fossil fuels have provided the main source of energy for economic and technological development. The centrality of fossil fuels and other carbon-intensive industries has resulted in much resistance to climate friendly policy, despite widespread scientific consensus that such policy is necessary.

A carbon footprint (or greenhouse gas footprint) is a calculated value or index that makes it possible to compare the total amount of greenhouse gases that an activity, product, company or country adds to the atmosphere. Carbon footprints are usually reported in tonnes of emissions (CO2-equivalent) per unit of comparison. Such units can be for example tonnes CO2-eq per year, per kilogram of protein for consumption, per kilometer travelled, per piece of clothing and so forth. A product's carbon footprint includes the emissions for the entire life cycle. These run from the production along the supply chain to its final consumption and disposal.

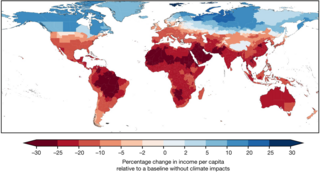

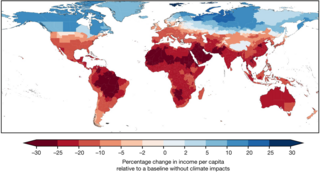

An economic analysis of climate change uses economic tools and models to calculate the magnitude and distribution of damages caused by climate change. It can also give guidance for the best policies for mitigation and adaptation to climate change from an economic perspective. There are many economic models and frameworks. For example, in a cost–benefit analysis, the trade offs between climate change impacts, adaptation, and mitigation are made explicit. For this kind of analysis, integrated assessment models (IAMs) are useful. Those models link main features of society and economy with the biosphere and atmosphere into one modelling framework. The total economic impacts from climate change are difficult to estimate. In general, they increase the more the global surface temperature increases.

The Stern Review on the Economics of Climate Change is a 700-page report released for the Government of the United Kingdom on 30 October 2006 by economist Nicholas Stern, chair of the Grantham Research Institute on Climate Change and the Environment at the London School of Economics (LSE) and also chair of the Centre for Climate Change Economics and Policy (CCCEP) at Leeds University and LSE. The report discusses the effect of global warming on the world economy. Although not the first economic report on climate change, it is significant as the largest and most widely known and discussed report of its kind.

Integrated assessment modelling (IAM) or integrated modelling (IM) is a term used for a type of scientific modelling that tries to link main features of society and economy with the biosphere and atmosphere into one modelling framework. The goal of integrated assessment modelling is to accommodate informed policy-making, usually in the context of climate change though also in other areas of human and social development. While the detail and extent of integrated disciplines varies strongly per model, all climatic integrated assessment modelling includes economic processes as well as processes producing greenhouse gases. Other integrated assessment models also integrate other aspects of human development such as education, health, infrastructure, and governance.

The Potsdam Institute for Climate Impact Research is a German government-funded research institute addressing crucial scientific questions in the fields of global change, climate impacts, and sustainable development. Ranked among the top environmental think tanks worldwide, it is one of the leading research institutions and part of a global network of scientific and academic institutions working on questions of global environmental change. It is a member of the Leibniz Association, whose institutions perform research on subjects of high relevance to society.

Terry Barker is a British economist and former Director of the Cambridge Centre for Climate Change Mitigation Research (4CMR) part of the Department of Land Economy, University of Cambridge. He is also a member of the Tyndall Centre, the Chairman of Cambridge Econometrics, and chairman of the Cambridge Trust for New Thinking in Economics, which is a charitable organisation with a mission to promote new approaches to solving economic problems.

Ottmar Georg Edenhofer is a German economist who is regarded as one of the world's leading experts on climate change policy, environmental and energy policy, and energy economics. His work has been heavily cited. Edenhofer currently holds the professorship of the Economics of Climate Change at Technische Universität Berlin. Together with Earth scientist Johan Rockström, economist Ottmar Edenhofer is scientific director of the Potsdam Institute for Climate Impact Research (PIK), representing the interdisciplinary and solutions-oriented approach of the institute. Furthermore, he is director of the Mercator Research Institute on Global Commons and Climate Change (MCC). From 2008 to 2015 he served as one of the co-chairs of the Intergovernmental Panel on Climate Change (IPCC) Working Group III "Mitigation of Climate Change".

Carlo Carraro is the chancellor of the University of Venice for the three-year period 2009–2012, with a two-year extension of his mandate in accordance to the Gelmini University Law bringing it up to summer 2014. He is also professor of environmental economics at the same university. He is director of the Sustainable Development Programme of the Fondazione Eni Enrico Mattei and director of the Climate Impacts and Policy Division of the Euro-Mediterranean Center for Climate Change (CMCC). In 2008, Carraro was elected vice-chair of the Working Group III and member of the bureau of the Nobel Laureate Intergovernmental Panel on Climate Change (IPCC).

The economics of climate change mitigation is a contentious part of climate change mitigation – action aimed to limit the dangerous socio-economic and environmental consequences of climate change.

The Centre for Climate Change Economics and Policy (CCCEP) is a climate change research centre in England, which studies the economics of global warming. It is hosted jointly by the University of Leeds and the London School of Economics and Political Science (LSE).

Susana Mourato is a professor of environmental economics at the London School of Economics and Political Science. She holds a leader position at the Grantham Research Institute on Climate Change and the Environment.

Green recovery packages are proposed environmental, regulatory, and fiscal reforms to rebuild prosperity in the wake of an economic crisis, such as the COVID-19 recession or the 2007–2008 financial crisis. They pertain to fiscal measures that intend to recover economic growth while also positively benefitting the environment, including measures for renewable energy, efficient energy use, nature-based solutions, sustainable transport, green innovation and green jobs, amongst others.