Related Research Articles

Lehman Brothers Inc. was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

PaineWebber & Co. was an American investment bank and stock brokerage firm that was acquired by the Swiss bank UBS in 2000. The company was founded in 1880 in Boston, Massachusetts, by William Alfred Paine and Wallace G. Webber. Operating with two employees, they leased premises at 48 Congress Street in May 1881. The company was renamed Paine, Webber & Co. when Charles Hamilton Paine became a partner. Members of the Boston Stock Exchange, in 1890 the company acquired a seat on the New York Stock Exchange. Wallace G. Webber retired after the business weathered a major financial crisis of 1893.

Broad Street is a north–south street in the Financial District of Lower Manhattan in New York City. Originally the Broad Canal in New Amsterdam, it stretches from today's South Street to Wall Street.

Richard Whitney was an American financier, president of the New York Stock Exchange from 1930 to 1935. He was later convicted of embezzlement and imprisoned.

Bache & Company was a securities firm that provided stock brokerage and investment banking services. The firm, which was founded in 1879, was based in New York, New York.

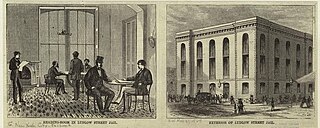

The Ludlow Street Jail was New York City's Federal prison, located on Ludlow Street and Broome Street in Manhattan. Some prisoners, such as soldiers, were held there temporarily awaiting extradition to other jurisdictions, but most of the inmates were debtors imprisoned by their creditors. Seward Park Campus now sits on the site of the jail.

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Association of Securities Dealers, Inc. (NASD) as well as to the member regulation, enforcement, and arbitration operations of the New York Stock Exchange. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC).

William Sylvester Silkworth, referred to in the U.S. press as "W. S. Silkworth", was an American financier known being president of the Consolidated Stock Exchange of New York and being forced to resign because of scandal. starting in 1919. He was also a sport shooter who competed in the 1924 Summer Olympics. In 1924, he won the gold medal as member of the American team in the team clay pigeons competition. Silkworth aggressively and successfully pursued new business for the exchange, and his career as president reached its peak in February 1922, when all trading records at the exchange were broken, ensuring that "Silkworth, not [NYSE president] McCormick, was the talk of Wall Street." Silkworth resigned on June 21, 1923, after an investigation into Consolidated insider corruption discovered irregularities in his personal finances. He later did time for mail fraud. By 1926, Silkworth was best known internationally as a member of the Olympic trap shooting team.

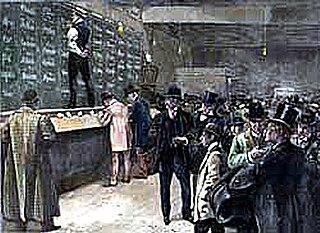

A bucket shop is a business that allows gambling based on the prices of stocks or commodities. A 1906 U.S. Supreme Court ruling defined a bucket shop as "an establishment, nominally for the transaction of a stock exchange business, or business of similar character, but really for the registration of bets, or wagers, usually for small amounts, on the rise or fall of the prices of stocks, grain, oil, etc., there being no transfer or delivery of the stock or commodities nominally dealt in".

Shearson was the name of a series of investment banking and retail brokerage firms from 1902 until 1994, named for Edward Shearson and the firm he founded, Shearson Hammill & Co. Among Shearson's most notable incarnations were Shearson / American Express, Shearson Lehman / American Express, Shearson Lehman Brothers, Shearson Lehman Hutton and finally Smith Barney Shearson.

Joab Hamilton Banton was New York County District Attorney from 1922 to 1929.

Shearson, Hammill & Co. was a Wall Street brokerage and investment banking firm founded in 1902 by Edward Shearson and Caleb Wild Hammill. The firm originally built its business as a stock broker as well as a broker of various commodities, particularly grain and cotton. The firm was a member of the New York Stock Exchange, the Chicago Stock Exchange and the Chicago Mercantile Exchange.

The Consolidated Stock Exchange of New York, also known as the New York Consolidated Stock Exchange or Consolidated, was a stock exchange in New York City, New York, in direct competition to the New York Stock Exchange (NYSE) from 1885 to 1926. It was formed from the merger of other smaller exchanges, and was referred to in the industry and press as the "Little Board." By its official formation in 1885, its membership of 2403 was considered the second largest membership of any exchange in the United States.

Peter F. McCoy was an American attorney based in New York City. Practicing law in New York at 342 Madison Avenue, McCoy started his legal career with Eaton, Lewis & Rowe before becoming an assistant United States Attorney in 1921. As an assistant United States Attorney General, McCoy was successful at prosecuting high-profile brokers for mail fraud and bucket shops in the early 1920s, with the New York Times proclaiming him a "foe of stock frauds." He also prosecuted people for violating the Food and Drug Acts, selling narcotics, and counterfeiting.

Mortimer Hartwell Wagar was an American banker and businessperson. Wagar was a member of the Consolidated Exchange for 33 years. He was president from 1900 until 1903. He retired from the exchange in June 1923, at which point he was vice president. He also helped organize the Clearing House of the Consolidated Exchange, where he was president.

E. M. Fuller and Co. bankruptcy trial, or the Fuller case, was a criminal trial referring to the prosecution of Edward M. Fuller and William F. McGee for using their brokerage firm E. M. Fuller and Co. as a "bucket shop" in the early 1920s. United States Attorney William Hayward was assisted in the case by assistant US Attorney John E. Joyce. The case started when the firm went bankrupt in 1922, and creditors petitioned to recover assets from E. M. Fuller & Co., as the assets "mysteriously disappeared" when the firm went bankrupt. Ultimately Fuller and McGee pled guilty, and were convicted of operating a bucketshop in connection with E.M. Fuller Co., for defrauding its customers around $4,000,000 by bucketing the orders of customers. The case also resulted in trials for high-profile New Yorkers such as Consolidated Exchange president William S. Silkworth, attorney William J. Fallon, sports broker Charles A. Stoneham, and gambler Arnold Rothstein.

Raynor, Nicholas & Truesdell was a New York brokerage based on Broadway in the 1920s. It was a member of the Consolidated Stock Exchange, before failing on April 29, 1922. The failure resulted in a highly publicized lawsuit over whether the firm committed mail fraud and bucketing before failing.

Watson Bradley Dickerman was an American banker who founded Dominick & Dickerman and served as president of the New York Stock Exchange.

Vickers, da Costa was a prominent stockbroking firm of the London Stock Exchange in the City of London, and later also of the New York Stock Exchange and the Tokyo Stock Exchange. It was in business from its creation in 1917 until 1986, when after a takeover by Citicorp it was merged into a new firm called Scrimgeour Vickers. In 1987, this was closed.

W. E. Hutton & Co. was an American investment bank that became a powerhouse Wall Street stock brokerage. It was founded in Ohio in 1887 and was absorbed by Thomson & McKinnon Auchincloss Kohlmeyer, Inc., another investment bank. in 1974.

References

- 1 2 3 4 5 6 7 8 "E.M. Fuller & Co. Fail". The New York Times . New York City, New York. June 28, 1922. Retrieved April 18, 2017.

- 1 2 "REPORTS ON FULLER TO EXCHANGE LOST; Made when Broker Now in Jail Applied for Membership in the Consolidated. (Published 1923)". The New York Times. 22 May 1923.

- 1 2 3 4 5 6 7 8 9 Sobel, Robert (2000). AMEX: A History of the American Stock Exchange. p. 30. ISBN 9781893122482.

- ↑ "Mercy for Unruly Woman; Miss Black Gets Suspended Sentence for Annoying Broker". The New York Times . June 16, 1922. Retrieved May 29, 2017.

- 1 2 "HINT OUTSIDERS GOT FULLer's MILLIONS; Creditors' Attorney Calls on Federal and County Prosecutors to Investigate". The New York Times. 28 June 1923.

- ↑ "Bankruptcy Attorney Guide". Saturday, April 18, 2020

- ↑ "Court Denies Banton Use of Fuller Books; Stipulation Made by Brokers When They Failed Upheld by Judge Hand". The New York Times . August 3, 1922. Retrieved May 29, 2017.

- ↑ "Silkworth, Target of Censure, to Quite the Consolidated. New Exchange Committee May Demand President's Immediate Resignation". The New York Times . June 7, 1923. pp. 1, 2. Retrieved March 4, 2017.

- ↑ "FULLER TO REVEAL 'HIGHER-UPS' TODAY; Bucket Shop Disclosures Expected if Broker is Well Enough to Leave Jail". The New York Times. 18 June 1923.

- ↑ "FULLER AND M'GEE GO TO PRISON TODAY; Judge Refuses Appeal for a Further Stay of Sentence Imposed Four Years Ago. BANTON URGES ACTION Says Brokers Won Immunity in Other Cases -- Term in Sing Sing Is From 15 Months to 4 Years". The New York Times. June 7, 1927. Retrieved May 25, 2017.

- ↑ "Fuller and McGee Win Sing Sing Paroles; Served Year for $4,000,000 Bucketing Frauds". The New York Times. June 1, 1928. Retrieved May 25, 2017.

- ↑ "TO BAR FULLER AND McGEE.; Division of Licenses Reported Averse to Them as Realty Brokers". The New York Times . June 18, 1928. Retrieved May 25, 2017.