Related Research Articles

The Federal Advisory Committee Act (FACA), is a United States federal law which governs the behavior of federal advisory committees. In particular, it has special emphasis on open meetings, chartering, public involvement, and reporting. The U.S. General Services Administration (GSA) oversees the process.

The United States Tax Court is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides that the Congress has the power to "constitute Tribunals inferior to the supreme Court". The Tax Court specializes in adjudicating disputes over federal income tax, generally prior to the time at which formal tax assessments are made by the Internal Revenue Service.

John Andrew Koskinen is an American businessman and public official. He served as the non-executive chairman of Freddie Mac from September 2008 to December 2011, retiring from the board in February 2012. On December 20, 2013, Koskinen was confirmed by the U.S. Senate to head the Internal Revenue Service (IRS) as Commissioner of Internal Revenue. On December 23, 2013, Koskinen was sworn in as the 48th IRS Commissioner after being nominated by President Barack Obama. His term ended on November 12, 2017, with David Kautter becoming his interim replacement, followed by Charles P. Rettig as his permanent replacement.

The Joint Committee on Taxation (JCT) is a Committee of the U.S. Congress established under the Internal Revenue Code at 26 U.S.C. § 8001.

Congressional oversight is oversight by the United States Congress over the executive branch, including the numerous U.S. federal agencies. Congressional oversight includes the review, monitoring, and supervision of federal agencies, programs, activities, and policy implementation. Congress exercises this power largely through its congressional committee system. Oversight also occurs in a wide variety of congressional activities and contexts. These include authorization, appropriations, investigative, and legislative hearings by standing committees; which is specialized investigations by select committees; and reviews and studies by congressional support agencies and staff.

The Global Warming Solutions Act of 2006, or Assembly Bill (AB) 32, is a California State Law that fights global warming by establishing a comprehensive program to reduce greenhouse gas emissions from all sources throughout the state. AB32 was co-authored by then-Assemblymember Fran Pavley and then-Speaker of the California Assembly Fabian Nunez and signed into law by Governor Arnold Schwarzenegger on September 27, 2006.

The Office of the Taxpayer Advocate, also called the Taxpayer Advocate Service (TAS), is an office within the Internal Revenue Service (IRS) of the U.S. Department of the Treasury, reporting directly to the Commissioner of Internal Revenue. The office is under the supervision and direction of the National Taxpayer Advocate, who is appointed by the Secretary of Treasury.

Tax Analysts is a nonprofit publisher offering the Tax Notes portfolio of products, including weekly magazines featuring commentary, daily online journals featuring news and analysis, and research tools, all focused on tax policy and administration. Tax Analysts also promotes transparency in tax policymaking and holds regular conferences on key tax issues.

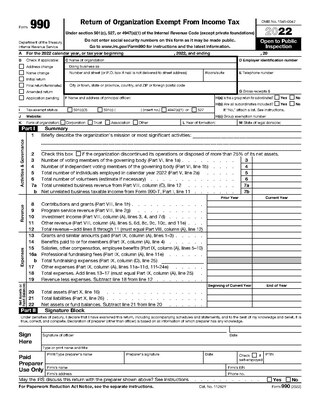

Form 990 is a United States Internal Revenue Service (IRS) form that provides the public with financial information about a nonprofit organization. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Certain nonprofits have more comprehensive reporting requirements, such as hospitals and other healthcare organizations.

Customer Account Data Engine (CADE) is the name of two Internal Revenue Service (IRS) tax processing systems, used for filing United States income tax returns. Work on the original CADE, designed to replace the Individual Master File (IMF) system, was begun in 2000 and stopped in 2009. The original CADE is in active use; for instance, in 2009, it was used to process over 40 million tax returns.

The American Payroll Association (APA) is a professional association for individuals responsible for processing company payrolls. The Association conducts payroll training courses and seminars on a yearly basis and publishes a library of payroll resource texts and newsletters. APA has approximately 21,000 members, 121 APA-affiliated local chapters, and registered lobbyists based in Washington, D.C.

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

The Treasury Inspector General for Tax Administration (TIGTA) is an office in the United States Federal government. It was established in January 1999 in accordance with the Internal Revenue Service Restructuring and Reform Act of 1998 (RRA 98) to provide independent oversight of Internal Revenue Service (IRS) activities. As mandated by RRA 98, TIGTA assumed most of the responsibilities of the IRS' former Inspection Service.

The IRS Return Preparer Initiative was an effort by the Internal Revenue Service (IRS) to regulate the tax return preparation industry in the United States. The purpose of the initiative is to improve taxpayer compliance and service by setting professional standards for and providing support to the tax preparation industry. Starting January 1, 2011 and, until the program was suspended in January 2013, the initiative required all paid federal tax return preparers to register with the IRS and to obtain an identification number, called a Preparer Tax Identification Number (PTIN). The multi-year phase-in effort called for certain paid tax return preparers to pass a competency test and to take annual continuing education courses. The ethics provisions found in Treasury Department's Circular 230 were extended to all paid tax return preparers. Preparers who have their PTINs, pass the test and complete education credits were to have a new designation: Registered Tax Return Preparer.

In 2013, the United States Internal Revenue Service (IRS), under the Obama administration, revealed that it had selected political groups applying for tax-exempt status for intensive scrutiny based on their names or political themes. This led to wide condemnation of the agency and triggered several investigations, including a Federal Bureau of Investigation (FBI) criminal probe ordered by United States Attorney General Eric Holder. Conservatives claimed that they were specifically targeted by the IRS, but an exhaustive report released by the Treasury Department's Inspector General in 2017 found that from 2004 to 2013, the IRS used both conservative and liberal keywords to choose targets for further scrutiny.

The Individual Master File (IMF) is the system currently used by the United States Internal Revenue Service (IRS) to store and process tax submissions and used as the main data input to process the IRS's transactions. It is a running record of all of a person's individual tax events including refunds, payments, penalties and tax payer status. It is a batch-driven application that uses VSAM files.

Charles Paul Rettig is an American attorney who served as the United States Commissioner of Internal Revenue, the head of the U.S. Internal Revenue Service (IRS). On September 12, 2018, the United States Senate confirmed Rettig's nomination to be Commissioner for the term expiring November 12, 2022. Rettig was sworn in on October 1, 2018.

The Taxpayer First Act is a law that makes significant reforms to the Internal Revenue Service (IRS).

Donald Cyril Lubick was an American attorney and tax policy expert. He served every Democratic President—from John F. Kennedy to Barack Obama—and was the Assistant Secretary for Tax Policy at the Department of the Treasury under both President Carter and President Clinton.

The IRS Oversight Board is a nine-member board established by the Internal Revenue Service Restructuring and Reform Act of 1998 to oversee the Internal Revenue Service. It usually meets four times a year.