Ex parte Gutta (BPAI 2009) is a precedential decision from the Board of Patent Appeals and Interferences (BPAI) of the United States Patent and Trademark Office (USPTO) concerning the patentability of mathematical formulae and/or algorithms. The BPAI rejected Gutta as failing a two-prong test to determine if a machine or "manufacture" involving a mathematical algorithm complies with 35 U.S.C. § 101. The patentability of processes was previously addressed in a closely related case, In re Bilski .

For a claimed machine (or article of manufacture) involving a mathematical algorithm

If the machine (or article of manufacture) fails either prong of the two-part inquiry, then the claim is not directed to patent eligible subject matter.

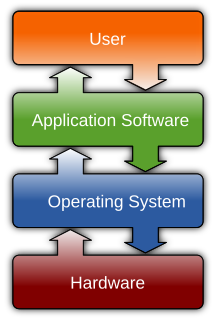

Software is a collection of instructions that tell a computer how to work. This is in contrast to hardware, from which the system is built and actually performs the work.

The software patent debate is the argument about the extent to which, as a matter of public policy, it should be possible to patent software and computer-implemented inventions. Policy debate on software patents has been active for years. The opponents to software patents have gained more visibility with fewer resources through the years than their pro-patent opponents. Arguments and critiques have been focused mostly on the economic consequences of software patents.

Neither software nor computer programs are explicitly mentioned in statutory United States patent law. Patent law has changed to address new technologies, and decisions of the United States Supreme Court and United States Court of Appeals for the Federal Circuit (CAFC) beginning in the latter part of the 20th century have sought to clarify the boundary between patent-eligible and patent-ineligible subject matter for a number of new technologies including computers and software. The first computer software case in the Supreme Court was Gottschalk v. Benson in 1972. Since then, the Supreme Court has decided about a half dozen cases touching on the patent eligibility of software-related inventions.

State Street Bank and Trust Company v. Signature Financial Group, Inc., 149 F.3d 1368, also referred to as State Street or State Street Bank, was a 1998 decision of the United States Court of Appeals for the Federal Circuit concerning the patentability of business methods. State Street for a time established the principle that a claimed invention was eligible for protection by a patent in the United States if it involved some practical application and, in the words of the State Street opinion, "it produces a useful, concrete and tangible result."

Business method patents are a class of patents which disclose and claim new methods of doing business. This includes new types of e-commerce, insurance, banking and tax compliance etc. Business method patents are a relatively new species of patent and there have been several reviews investigating the appropriateness of patenting business methods. Nonetheless, they have become important assets for both independent inventors and major corporations.

Diamond v. Diehr, 450 U.S. 175 (1981), was a United States Supreme Court decision which held that controlling the execution of a physical process, by running a computer program did not preclude patentability of the invention as a whole. The high court reiterated its earlier holdings that mathematical formulas in the abstract could not be patented, but it held that the mere presence of a software element did not make an otherwise patent-eligible machine or process patent ineligible. Diehr was the third member of a trilogy of Supreme Court decisions on the patent-eligibility of computer software related inventions.

Patentable, statutory or patent-eligible subject matter is subject matter which is susceptible of patent protection. The laws or patent practices of many countries provide that certain subject-matter is excluded from patentability, even if the invention is novel and non-obvious. Together with criteria such as novelty, inventive step or nonobviousness, utility, and industrial applicability, which differ from country to country, the question of whether a particular subject matter is patentable is one of the substantive requirements for patentability.

Parker v. Flook, 437 U.S. 584 (1978), was a 1978 United States Supreme Court decision that ruled that an invention that departs from the prior art only in its use of a mathematical algorithm is patent eligible only if there is some other "inventive concept in its application." The algorithm itself must be considered as if it were part of the prior art, and the claim must be considered as a whole. The case was argued on April 25, 1978 and was decided June 22, 1978. This case is the second member of the Supreme Court's patent-eligibility trilogy.

Gottschalk v. Benson, 409 U.S. 63 (1972), was a United States Supreme Court case in which the Court ruled that a process claim directed to a numerical algorithm, as such, was not patentable because "the patent would wholly pre-empt the mathematical formula and in practical effect would be a patent on the algorithm itself." That would be tantamount to allowing a patent on an abstract idea, contrary to precedent dating back to the middle of the 19th century. The ruling stated "Direct attempts to patent programs have been rejected [and] indirect attempts to obtain patents and avoid the rejection ... have confused the issue further and should not be permitted." The case was argued on October 16, 1972, and was decided November 20, 1972.

Freeman-Walter-Abele is a now outdated judicial test in United States patent law. It came from three decisions of the United States Court of Customs and Patent Appeals—In re Freeman, 573 F.2d 1237, In re Walter, 618 F.2d 758 ; and In re Abele, 684 F.2d 902 —which attempted to comply with then-recent decisions of the Supreme Court concerning software-related patent claims.

In re Bilski, 545 F.3d 943, 88 U.S.P.Q.2d 1385, was an en banc decision of the United States Court of Appeals for the Federal Circuit (CAFC) on the patenting of method claims, particularly business methods. The Federal Circuit court affirmed the rejection of the patent claims involving a method of hedging risks in commodities trading. The court also reiterated the machine-or-transformation test as the applicable test for patent-eligible subject matter, and stated that the test in State Street Bank v. Signature Financial Group should no longer be relied upon.

In United States patent law, the machine-or-transformation test is a test of patent eligibility under which a claim to a process qualifies for consideration if it (1) is implemented by a particular machine in a non-conventional and non-trivial manner or (2) transforms an article from one state to another.

In re Ferguson, 558 F.3d 1359 is an early 2009 decision of the United States Court of Appeals for the Federal Circuit, affirming a rejection of business method claims by the United States Patent and Trademark Office (USPTO). One of the first post-Bilski decisions by a Federal Circuit panel, Ferguson confirms the breadth of the en banc Bilski opinion's rejection of the core holdings in State Street Bank & Trust Co. v. Signature Financial Group, Inc.

Bilski v. Kappos, 561 U.S. 593 (2010), was a case decided by the Supreme Court of the United States holding that the machine-or-transformation test is not the sole test for determining the patent eligibility of a process, but rather "a useful and important clue, an investigative tool, for determining whether some claimed inventions are processes under § 101." In so doing, the Supreme Court affirmed the rejection of an application for a patent on a method of hedging losses in one segment of the energy industry by making investments in other segments of that industry, on the basis that the abstract investment strategy set forth in the application was not patentable subject matter.

AT&T Corp. v. Excel Communications, Inc., 172 F.3d 1352 was a case in which the United States Court of Appeals for the Federal Circuit reversed the decision of the United States District Court for the District of Delaware, which had granted summary judgment to Excel Communications, Inc. and decided that AT&T Corp. had failed to claim statutory subject matter with U.S. Patent No. 5,333,184 under 35 U.S.C. § 101. The United States Court of Appeals for the Federal Circuit remanded the case for further proceedings.

CyberSource Corp. v. Retail Decisions, Inc., 654 F.3d 1366, is a United States Court of Appeals for the Federal Circuit case that disputed patent eligibility for the '154 patent, which describes a method and system for detecting fraud of credit card transactions through the internet. This court affirmed the decision of United States District Court for the Northern District of California which ruled that the patent is actually unpatentable.

Alice Corp. v. CLS Bank International, 573 U.S. 208 (2014), was a 2014 United States Supreme Court decision about patent eligibility. The issue in the case was whether certain patent claims for a computer-implemented, electronic escrow service covered abstract ideas, which would make the claims ineligible for patent protection. The patents were held to be invalid because the claims were drawn to an abstract idea, and implementing those claims on a computer was not enough to transform that abstract idea into patentable subject matter.

In re Alappat, 33 F.3d 1526, along with In re Lowry and the State Street Bank case, form an important mid-to-late-1990s trilogy of Federal Circuit opinions because in these cases, that court changed course by abandoning the Freeman-Walter-Abele Test that it had previously used to determine patent eligibility of software patents and patent applications. The result was to open a floodgate of software and business-method patent applications, many or most of which later became invalid patents as a result of Supreme Court opinions in the early part of the following century in Bilski v. Kappos and Alice v. CLS Bank.

In re Schrader, 22 F.3d 290 is a 1994 decision of the United States Court of Appeals for the Federal Circuit in which the court summarized and synthesized its precedents under the Freeman-Walter-Abele Test of patent eligibility. Under this test a key element is that the claimed invention is implemented with some type of hardware—that is, a particular machine. This was one of the last Federal Circuit decisions using that test.