Australian Securities Exchange Ltd or ASX, is an Australian public company that operates Australia's primary securities exchange, the Australian Securities Exchange. The ASX was formed on 1 April 1987, through incorporation under legislation of the Australian Parliament as an amalgamation of the six state securities exchanges, and merged with the Sydney Futures Exchange in 2006.

NYSE Chicago, formerly known as the Chicago Stock Exchange (CHX), is a stock exchange in Chicago, Illinois, US. The exchange is a national securities exchange and self-regulatory organization, which operates under the oversight of the U.S. Securities and Exchange Commission (SEC). Intercontinental Exchange (ICE) acquired CHX in July 2018 and the exchange rebranded as NYSE Chicago in February 2019.

Real-time gross settlement (RTGS) systems are specialist funds transfer systems where the transfer of money or securities takes place from one bank to any other bank on a "real-time" and on a "gross" basis. Settlement in "real time" means a payment transaction is not subjected to any waiting period, with transactions being settled as soon as they are processed. "Gross settlement" means the transaction is settled on a one-to-one basis, without bundling or netting with any other transaction. "Settlement" means that once processed, payments are final and irrevocable.

SIX Swiss Exchange, based in Zurich, is Switzerland's principal stock exchange. SIX Swiss Exchange also trades other securities such as Swiss government bonds and derivatives such as stock options.

The Depository Trust & Clearing Corporation (DTCC) is an American post-trade financial services company providing clearing and settlement services to the financial markets. It performs the exchange of securities on behalf of buyers and sellers and functions as a central securities depository by providing central custody of securities.

New Zealand's Exchange, known commonly as the NZX, is the national stock exchange for New Zealand and a publicly owned company. NZX is the parent company of Smartshares, and Wealth Technologies.

The Australian financial system consists of the arrangements covering the borrowing and lending of funds and the transfer of ownership of financial claims in Australia, comprising:

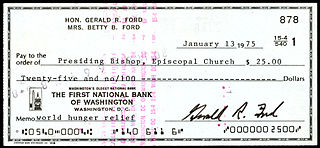

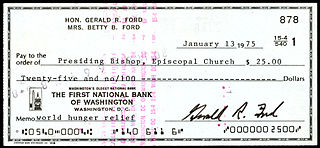

A cheque, or check is a document that orders a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks.

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, instruments, people, rules, procedures, standards, and technologies that make its exchange possible. A common type of payment system, called an operational network, links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment.

The Nairobi Securities Exchange (NSE) was established in 1954 as the Nairobi Stock Exchange, based in Nairobi the capital of Kenya. It was a voluntary association of stockbrokers in the European community registered under the Societies Act in British Kenya.

The Stock Exchange of Mauritius (SEM) ; is an organization responsible for the operation of Mauritius's primary stock exchange located at Port Louis. The SEM operates two markets: the Official Market and the Development & Enterprise Market (DEM). There are 40 companies listed on the Official Market representing a Market Capitalization of nearly US$5.3 billion, the DEM presently has 48 companies listed with a market capitalisation of nearly US$1.5 billion as at 31 July 2012. SEM is one of the leading Exchanges in Africa and a member of the World Federation of Exchanges.

The Uganda Securities Exchange (USE) is the principal stock exchange of Uganda. It was founded in June 1997. The USE is operated under the jurisdiction of Uganda's Capital Markets Authority, which in turn reports to the Bank of Uganda, Uganda's central bank.

The Palestine Exchange (PEX) is a stock exchange based in Nablus in the Palestinian territories. The PEX was established in 1995, and currently operates under the supervision of the Palestinian Capital Market Authority (CMA). In 2015, the CEO of the PEX was Ahmed Aweidah. The PEX aims to provide an environment for trading that is characterized by equity, transparency and competence, serving and maintaining the interest of investors.

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

Koscom is a Korean financial IT company launched by the Ministry of Finance (MOSF) and the Korea Exchange (KRX) in 1977. It has five corporate divisions with providing IT infrastructure to the Korean financial securities and futures market. Koscom also offers online stock trading systems that enable users to access to financial database and place trades by Home Trading System or using a customized terminal for professional traders in securities as well as other electronic financial services. Major Korean financial firms have subscription to the Koscom's online trading services including market news, price quotes and financial market data.

The Clearing House is a banking association and payments company owned by the largest commercial banks in the United States. The Clearing House is the parent organization of The Clearing House Payments Company L.L.C., which owns and operates core payments system infrastructure in the United States, including ACH, wire payments, check image clearing, and real-time payments through the RTP network, a modern real-time payment system for the U.S.

Vocalink is a payment systems company headquartered in the United Kingdom, created in 2007 from the merger between Voca and LINK. It designs, builds and operates the UK payments infrastructure, which underpins the provision of the Bacs payment system and the UK ATM LINK switching platform covering 65,000 ATMs and the UK Faster Payments systems.

Interactive Brokers LLC (IB) is an American multinational brokerage firm. It operates the largest electronic trading platform in the U.S. by number of daily average revenue trades. The company brokers stocks, options, futures, EFPs, futures options, forex, bonds, funds, and some cryptocurrencies.

A clearing house is a financial institution formed to facilitate the exchange of payments, securities, or derivatives transactions. The clearing house stands between two clearing firms. Its purpose is to reduce the risk of a member firm failing to honor its trade settlement obligations.