A thin client is a lightweight computer that has been optimized for establishing a remote connection with a server-based computing environment. The server does most of the work, which can include launching software programs, performing calculations, and storing data. This contrasts with a fat client or a conventional personal computer; the former is also intended for working in a client–server model but has significant local processing power, while the latter aims to perform its function mostly locally.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts; that is, a contract to buy specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. These types of contracts fall into the category of derivatives. A counterpart to the futures market is the spot market, where trades occur immediately after a transaction agreement has been made, rather than at a predetermined time in the future. Futures instruments are priced according to the movement of the underlying asset. The aforementioned category is named "derivatives" because the value of these instruments are derived from another asset class.

An application service provider (ASP) is a business providing computer-based services to customers over a network; such as access to a particular software application using a standard protocol.

A credit risk is the risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased collection costs. The loss may be complete or partial. In an efficient market, higher levels of credit risk will be associated with higher borrowing costs. Because of this, measures of borrowing costs such as yield spreads can be used to infer credit risk levels based on assessments by market participants.

A laboratory information management system (LIMS), sometimes referred to as a laboratory information system (LIS) or laboratory management system (LMS), is a software-based solution with features that support a modern laboratory's operations. Key features include—but are not limited to—workflow and data tracking support, flexible architecture, and data exchange interfaces, which fully "support its use in regulated environments". The features and uses of a LIMS have evolved over the years from simple sample tracking to an enterprise resource planning tool that manages multiple aspects of laboratory informatics.

Microsoft Dynamics GP is a mid-market business accounting software or ERP software package marketed in North and South America, UK and Ireland, the Middle East, Singapore, Australia and New Zealand. It is used in many additional countries with partner supported localizations. It uses either Microsoft SQL Server 2005, 2008, 2012, 2014 or 2016 to store data. It is one of four accounting packages acquired by Microsoft that now share the Microsoft Dynamics Business Solutions brand. Dynamics GP is written in a language called Dexterity.

In finance, a contract for difference (CFD) is a contract between two parties, typically described as "buyer" and "seller", stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time.

A remote, online, or managed backup service, sometimes marketed as cloud backup or backup-as-a-service, is a service that provides users with a system for the backup, storage, and recovery of computer files. Online backup providers are companies that provide this type of service to end users. Such backup services are considered a form of cloud computing.

BitTorrent is an ad-supported BitTorrent client developed by Bram Cohen and BitTorrent, Inc. used for uploading and downloading files via the BitTorrent protocol. BitTorrent was the first client written for the protocol. It is often nicknamed Mainline by developers denoting its official origins. Since version 6.0 the BitTorrent client has been a rebranded version of μTorrent. As a result, it is no longer open source. It is currently available for Microsoft Windows, Mac, Linux, iOS and Android.

In finance, market data is price and trade-related data for a financial instrument reported by a trading venue such as a stock exchange. Market data allows traders and investors to know the latest price and see historical trends for instruments such as equities, fixed-income products, derivatives, and currencies.

Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. Usually, a project financing structure involves a number of equity investors, known as 'sponsors', a 'syndicate' of banks or other lending institutions that provide loans to the operation. They are most commonly non-recourse loans, which are secured by the project assets and paid entirely from project cash flow, rather than from the general assets or creditworthiness of the project sponsors, a decision in part supported by financial modeling; see Project finance model. The financing is typically secured by all of the project assets, including the revenue-producing contracts. Project lenders are given a lien on all of these assets and are able to assume control of a project if the project company has difficulties complying with the loan terms.

A trading room gathers traders operating on financial markets. The trading room is also often called the front office. The terms "dealing room" and "trading floor" are also used, the latter being inspired from that of an open outcry stock exchange. As open outcry is gradually replaced by electronic trading, the trading room gets the only living place that is emblematic of the financial market. It is also the likeliest place within the financial institution where the most recent technologies are implemented before being disseminated in its other businesses.

Asset and liability management is the practice of managing financial risks that arise due to mismatches between the assets and liabilities as part of an investment strategy in financial accounting.

Information FrameWork (IFW) is an enterprise architecture framework, populated with a comprehensive set of banking specific business models. It was developed as an alternative to the Zachman Framework by Roger Evernden.

Collateral has been used for hundreds of years to provide security against the possibility of payment default by the opposing party in a trade. Collateral management began in the 1980s, with Bankers Trust and Salomon Brothers taking collateral against credit exposure. There were no legal standards, and most calculations were performed manually on spreadsheets. Collateralisation of derivatives exposures became widespread in the early 1990s. Standardisation began in 1994 via the first ISDA documentation.

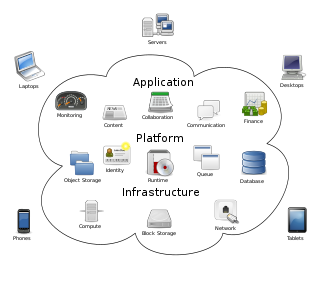

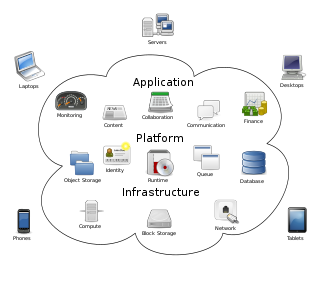

Cloud computing is the on-demand availability of computer system resources, especially data storage and computing power, without direct active management by the user. The term is generally used to describe data centers available to many users over the Internet. Large clouds, predominant today, often have functions distributed over multiple locations from central servers. If the connection to the user is relatively close, it may be designated an edge server.

In securities trading, same-day affirmation (SDA) also known as T0 refers to completing the entire trade verification process on the same day that the actual trade took place, and was invented in the early '90s by James Karat, the inventor of straight-through processing, in London. Trade verification is carried out on the institutional side of the market between the investment manager and the broker/dealer. This process ensures that the parties are in agreement about the essential trade details.

SIX is a financial service provider that operates the infrastructure of Switzerland's financial center. The abbreviation SIX stands for Swiss Infrastructure and Exchange. SIX develops and maintains securities trading and post-trading platforms, provides financial information and sells cashless payment systems. SIX operates worldwide and is headquartered in Zürich.

Numerix is an American financial technology limited liability company. It develops multi-asset class analytics and scalable software for risk management, trading, valuations and pricing for both sell-side and buyside market participants. The company is headquartered in New York City with nineteen offices worldwide.

Computer Age Management Services (CAMS) is a Mutual Fund Transfer Agency to the Indian Asset Management Companies with a share of 69.6% of the assets under management (AuM). The company was incorporated in year 1988. CAMS is co-owned by - NSE Investments Limited, HDFC Bank group, Warburg Pincus LLC and Acsys Investments Private Limited headquartered in Chennai, India.