Related Research Articles

Daniel Drew was an American businessman, steamship and railroad developer, and financier. Summarizing his life, Henry Clews wrote: "Of all the great operators of Wall Street ... Daniel Drew furnishes the most remarkable instance of immense and long-continued success, followed by utter failure and hopeless bankruptcy".

Jay Cooke was an American financier who helped finance the Union war effort during the American Civil War and the postwar development of railroads in the northwestern United States. He is generally acknowledged as the first major investment banker in the United States and creator of the first wire house firm.

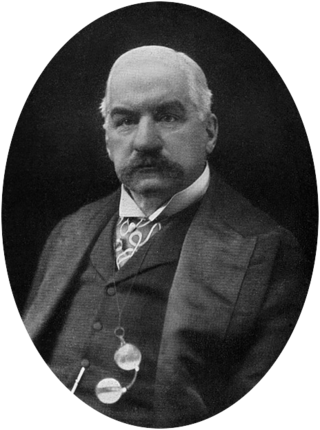

John Pierpont Morgan was an American financier and investment banker who dominated corporate finance on Wall Street throughout the Gilded Age and Progressive Era. As the head of the banking firm that ultimately became known as J.P. Morgan and Co., he was a driving personal force behind the wave of industrial consolidations in the United States at the turn of the twentieth century.

The Erie Railroad was a railroad that operated in the Northeastern United States, originally connecting Pavonia Terminal in Jersey City, New Jersey, with Lake Erie at Dunkirk, New York. The railroad expanded west to Chicago following its 1865 merger with the former Atlantic and Great Western Railroad, also known as the New York, Pennsylvania and Ohio Railroad. Its mainline route proved influential in the development and economic growth of the Southern Tier of New York state, including the cities of Binghamton, Elmira, and Hornell. The Erie Railroad repair shops were located in Hornell and was Hornell's largest employer. Hornell was also where Erie's mainline split into two routes with one proceeding northwest to Buffalo and the other west to Chicago.

Junius Spencer Morgan I was an American banker and financier, as well as the father of John Pierpont "J.P." Morgan and patriarch to the Morgan banking house.

Lehman Brothers Inc. was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York City. It was one of the five largest investment banking enterprises in the United States and the most profitable firm on Wall Street during the 1980s and 1990s. Its CEO and chairman at that time, John Gutfreund, was nicknamed "the King of Wall Street".

Drexel Burnham Lambert Inc. was an American multinational investment bank that was forced into bankruptcy in 1990 due to its involvement in illegal activities in the junk bond market, driven by senior executive Michael Milken. At its height, it was a Bulge Bracket bank, as the fifth-largest investment bank in the United States.

Moody's Investors Service, often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Investors Service provides international financial research on bonds issued by commercial and government entities. Moody's, along with Standard & Poor's and Fitch Group, is considered one of the Big Three credit rating agencies. It is also included in the Fortune 500 list of 2021.

J. & W. Seligman & Co., founded in 1864, was a prominent U.S. investment bank from the 1860s to the 1920s, until the divestiture of its investment banking arm in the aftermath of the Glass–Steagall Act. The firm was involved in the financing of several major U.S. railroads in the 1870s and the construction of the Panama Canal in the early 1900s. Seligman was also involved in the formation of Standard Oil and General Motors.

Hiram Bond was born May 10, 1838, in Farmersville, Cattaraugus County, New York and died in Seattle March 29, 1906. He was a corporate lawyer, investment banker and an investor in various businesses including gold mining. His family are descended from William Bond an early 17th-century immigrant from Bury St. Edmunds in East Anglia. He was the son of Hiram Bond M.D. and Almeda Slusser and was married to Laura Ann Higgins. He had two children- Louis Whitford Bond born in New York City, New York in 1865 and Marshall Latham Bond born in Orange, Virginia, in 1867. He attended Rushford Academy, Rushford, New York, and earned a bachelor's degree from Hamilton College. He earned much of the money for his own education as a distributor of maps and atlases. Among his successes were becoming a publisher, and taking over the rights to a map of the United States which had been prepared by Matthew Fontaine Maury, a Southerner who was a United States cartography officer. Maury, who decided to join the Confederacy, had left the work unpaid for in New York. He matriculated at Harvard Law School, but before graduation he was hired as a law clerk by Chauncey Depew, a friend and neighbor of his father in law Michael Dunning Higgins of Peekskill.

The Erie War was a 19th-century conflict between American financiers for control of the Erie Railway Company, which owned and operated the Erie Railroad. Built with public funds raised by taxation and on land donated by public officials and private developers, by the middle of the 1850s the railroad was mismanaged and heavily in debt. A cattle drover turned Wall Street banker and broker, Daniel Drew, at first loaned $2 million to the railroad, and then acquired control over it. He amassed a fortune by skillfully manipulating the Erie railroad shares on the New York Stock Exchange. Cornelius Vanderbilt, who set his mind on building a railroad empire, saw multiple business and financial opportunities in railways and decided in 1866 to corner the market on Erie by silently scooping-up the Erie railroad stock. After succeeding, Vanderbilt permitted Drew to stay on the board of directors in his former capacity as treasurer.

Jay Cooke & Company was a U.S. bank that operated from 1861 to 1873. Headquartered in Philadelphia, Pennsylvania, with branches in New York City and Washington, D.C., the bank helped underwrite the Union Civil War effort. It was the first "wire" brokerage house, pioneering the use of telegraph messages to confirm securities transactions with clients. The bank became overextended in the building of the Northern Pacific Railway and failed, contributing to the Panic of 1873.

The Buffalo and Susquehanna Railroad was a railroad company that formerly operated in western and north central Pennsylvania and western New York. It was created in 1893 by the merger and consolidation of several smaller logging railroads. It operated independently until 1929, when a majority of its capital stock was purchased by the Baltimore and Ohio Railroad. At the same time, the B&O also purchased control of the neighboring Buffalo, Rochester, and Pittsburgh Railway. The Baltimore and Ohio officially took over operations of both roads in 1932.

Harvey Edward Fisk was an American banker and financial writer. At the time of his death he was the only surviving son of Harvey Fisk, who founded the banking house of Fisk & Hatch in 1862 and helped the Union finance the Civil War. He was associated with his brother Pliny Fisk, who was an outstanding investment banker before the first World War, in the management of their father's firm.

Fisk & Hatch was an American finance and insurance company formed in 1862. They had offices at 5 Nassau St in New York City. During the Civil War the firm floated many millions of dollars' worth of government bonds, reviving the public credit and confidence beyond all anticipation, and aiding greatly in placing the national finances upon a firm foundation.

Harvey Fisk & Sons was formed in 1885 from the firm Fisk & Hatch that dated back to 1862. The firm was prominent in railroad financing and financed the American Locomotive Company and the Hudson & Manhattan Railroad.

Charles Waterhouse Goodyear was an American lawyer, businessman, lumberman, and member of the prominent Goodyear family of New York. Based in Buffalo, New York, along with his brother, Frank, Charles was the founder and president of several companies, including the Buffalo and Susquehanna Railroad, Great Southern Lumber Company, Goodyear Lumber Company, Buffalo & Susquehanna Coal & Coke Company, and the New Orleans Great Northern Railroad Company.

Alfrederick Smith Hatch was an American investment banker who founded Fisk & Hatch along with Harvey Fisk. Hatch was the President of the New York Stock Exchange from 1883 to 1884.

Harvey Fisk was an American investment banker who founded Fisk & Hatch along with Alfrederick Smith Hatch.

References

- 1 2 3 4 5 6 "Fisk & Robinson, Bond House, Fail" (PDF). The New York Times. February 2, 1910. Retrieved December 30, 2011.

- 1 2 Trust companies, Volume 2, Part 2. Trust Companies Pub. Association. 1905. Retrieved December 30, 2011.

- ↑ Memoranda concerning United States bonds: prepared for the information of national banks and others. Fisk & Robinson. 1901. Retrieved December 30, 2011.

- ↑ "The Making of Iron" (PDF). The New York Times. January 22, 1903. Retrieved December 30, 2011.

- ↑ The New York supplement, Volume 162. West Publishing Company. 1917. Retrieved December 30, 2011.

- ↑ "Fisk & Robinson Resume Business" (PDF). The New York Times. December 2, 1910. Retrieved December 30, 2011.

- ↑ Financial world, Volume 24. Guenther Pub. Co. 1915. Retrieved December 30, 2011.

- ↑ The national monthly municipal bond summary. National Quotation Bureau. 1917. Retrieved December 30, 2011.