In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the underlying. Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets.

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, business organizations, or their operating units are transferred to or consolidated with another company or business organization. This could happen through direct absorption, a merger, a tender offer or a hostile takeover. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position.

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments to the seller and, in exchange, may expect to receive a payoff if the asset defaults.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

Mark-to-market or fair value accounting is accounting for the "fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair" value. Fair value accounting has been a part of Generally Accepted Accounting Principles (GAAP) in the United States since the early 1990s. Failure to use it is viewed as the cause of the Orange County Bankruptcy, even though its use is considered to be one of the reasons for the Enron scandal and the eventual bankruptcy of the company, as well as the closure of the accounting firm Arthur Andersen.

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price.

A hire purchase (HP), also known as an installment plan, is an arrangement whereby a customer agrees to a contract to acquire an asset by paying an initial installment and repaying the balance of the price of the asset plus interest over a period of time. Other analogous practices are described as closed-end leasing or rent to own.

Rational pricing is the assumption in financial economics that asset prices – and hence asset pricing models – will reflect the arbitrage-free price of the asset as any deviation from this price will be "arbitraged away". This assumption is useful in pricing fixed income securities, particularly bonds, and is fundamental to the pricing of derivative instruments.

Market value or OMV is the price at which an asset would trade in a competitive auction setting. Market value is often used interchangeably with open market value, fair value or fair market value, although these terms have distinct definitions in different standards, and differ in some circumstances.

Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Here various valuation techniques are used by financial market participants to determine the price they are willing to pay or receive to effect a sale of the business. In addition to estimating the selling price of a business, the same valuation tools are often used by business appraisers to resolve disputes related to estate and gift taxation, divorce litigation, allocate business purchase price among business assets, establish a formula for estimating the value of partners' ownership interest for buy-sell agreements, and many other business and legal purposes such as in shareholders deadlock, divorce litigation and estate contest.

In economics, a price mechanism is the manner in which the profits of goods or services affects the supply and demand of goods and services, principally by the price elasticity of demand. A price mechanism affects both buyer and seller who negotiate prices. A price mechanism, part of a market system, comprises various ways to match up buyers and sellers.

The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle. They both determine the accounting period in which revenues and expenses are recognized. According to the principle, revenues are recognized when they are realized or realizable, and are earned, no matter when cash is received. In cash accounting—in contrast—revenues are recognized when cash is received no matter when goods or services are sold.

Murabaḥah, murabaḥa, or murâbaḥah was originally a term of fiqh for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments. Murabaha financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and sukuk that use murabahah contracts.

The term asset swap has a number of different meanings:

The Livestock Mandatory Reporting Act of 1999 requires large packers and importers to report to USDA the details of all transactions involving purchases of livestock and imported boxed lamb cuts, and the details of all transactions involving domestic and export sales of boxed beef cuts, sales of domestic and imported boxed lamb cuts, and sales of lamb carcasses. Additional provisions impose, in turn, new data reporting requirements on USDA, including more frequent price reports along with new monthly information on retail prices for meat and poultry products.

Feeder cattle, in some countries or regions called store cattle, are young cattle mature enough either to undergo backgrounding or to be fattened in preparation for slaughter. They may be steers or heifers. The term often implicitly reflects an intent to sell to other owners for fattening (finishing). Backgrounding occurs at backgrounding operations, and fattening occurs at a feedlot. Feeder calves are less than 1 year old; feeder yearlings are between 1 and 2 years old. Both types are often produced in a cow-calf operation. After attaining a desirable weight, feeder cattle become finished cattle that are sold to a packer. Packers slaughter the cattle and sell the meat in carcass boxed form.

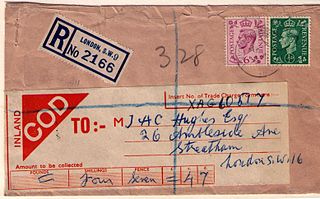

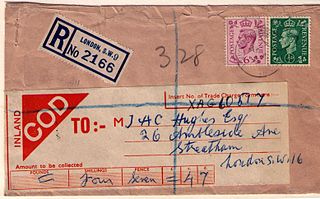

Cash on delivery (COD), sometimes called payment on delivery, cash on demand, payment on demand or collect on delivery is the sale of goods by mail order where payment is made on delivery rather than in advance. If the goods are not paid for, they are returned to the retailer. Originally, the term applied only to payment by cash but as other forms of payment have become more common, the word "cash" has sometimes been replaced with the word "collect" to include transactions by checks, money orders, credit cards or debit cards.

Live cattle is a type of futures contract that can be used to hedge and to speculate on fed cattle prices. Cattle producers, feedlot operators, and merchant exporters can hedge future selling prices for cattle through trading live cattle futures, and such trading is a common part of a producer's price risk management program. Conversely, meat packers, and merchant importers can hedge future buying prices for cattle. Producers and buyers of live cattle can also enter into production and marketing contracts for delivering live cattle in cash or spot markets that include futures prices as part of a reference price formula. Businesses that purchase beef as an input could also hedge beef price risk by purchasing live cattle futures contracts.